CurrencyFair vs PingPong Payments: Money Transfer Comparison, Fees, Exchange Rates, and Speed

Benjamin Clark - 2025-10-16 14:19:17.0 10

Introduction

Sending money internationally can be challenging due to high fees, slow delivery, hidden charges, and poor user experience. In this CurrencyFair vs PingPong Payments comparison, we provide an in-depth look at their services, costs, speed, security, and global reach. CurrencyFair offers peer-to-peer currency exchanges ideal for individuals and small businesses, while PingPong Payments focuses on cross-border business payments and e-commerce payouts. PandaRemit is a fast, flexible, and reliable alternative for those seeking convenient international transfers. For more insights on remittance services, visit Investopedia's guide.

CurrencyFair vs PingPong Payments – Overview

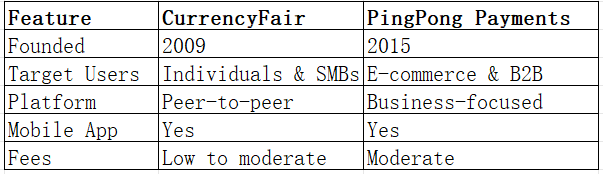

CurrencyFair was founded in 2009 and provides a peer-to-peer currency exchange platform for individuals and small businesses. It has a growing global user base and is known for competitive exchange rates.

PingPong Payments was established in 2015, specializing in cross-border business payments and e-commerce payouts. Its services cater primarily to international sellers and freelancers.

Similarities:

-

Both offer international money transfers

-

Mobile app support

-

Integration with debit cards

Differences:

-

CurrencyFair offers peer-to-peer exchanges for potentially lower rates

-

PingPong Payments focuses on e-commerce and business payments

-

Fee structures differ depending on transfer type and volume

Quick Summary Table:

PandaRemit also operates in the market, providing an alternative for fast and flexible money transfers.

CurrencyFair vs PingPong Payments: Fees and Costs

CurrencyFair charges a small percentage of the transaction, often lower than traditional banks, with transparent fixed fees for transfers. PingPong Payments offers a competitive fee structure for business payments, but may be higher for smaller individual transfers. Subscription plans or account types may affect costs, with premium accounts sometimes offering lower fees.

For a detailed fee comparison, check NerdWallet's money transfer fee guide.

PandaRemit often provides lower overall costs, particularly for users seeking convenient, small-to-medium transfers.

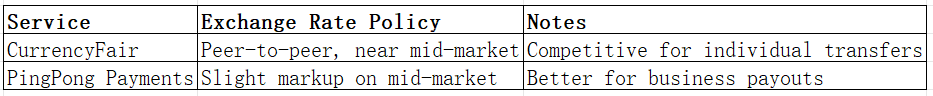

CurrencyFair vs PingPong Payments: Exchange Rates

Exchange rates are a critical factor in cross-border payments. CurrencyFair uses a peer-to-peer model, often offering rates closer to the mid-market rate. PingPong Payments sets its rates with a modest markup on top of the mid-market rate.

PandaRemit also offers favorable exchange rates in its supported corridors, making it an attractive alternative.

CurrencyFair vs PingPong Payments: Speed and Convenience

CurrencyFair transfers can be fast, especially when using the peer-to-peer system, but delivery times vary depending on currency and market activity. Its app is user-friendly and supports multiple integrations.

PingPong Payments excels in business payment speed and convenience, particularly for e-commerce sellers needing regular payouts. App usability is strong, and it integrates with popular platforms.

For more on transfer speeds, visit Remitly's guide.

PandaRemit is recognized as a fast alternative, offering all-online processes and multiple payment methods.

CurrencyFair vs PingPong Payments: Safety and Security

Both CurrencyFair and PingPong Payments operate under strict regulations. They employ encryption, fraud detection, and buyer protection mechanisms to ensure secure transactions. Users can feel confident that funds are handled safely.

PandaRemit is a licensed and secure option, emphasizing safe and reliable transfers.

CurrencyFair vs PingPong Payments: Global Coverage

CurrencyFair supports a wide range of countries and currencies, though coverage may be limited for some regions. PingPong Payments focuses on countries relevant to e-commerce and global business, offering convenient payout options.

For more on global remittance coverage, see the World Bank remittance report.

CurrencyFair vs PingPong Payments: Which One is Better?

CurrencyFair is suitable for individuals and SMBs looking for competitive rates and peer-to-peer transfers. PingPong Payments is ideal for businesses and e-commerce sellers needing reliable payouts. Both services are secure and convenient, but your choice depends on whether you prioritize individual savings or business efficiency.

For users seeking a balance of speed, low fees, and flexibility, PandaRemit may provide better overall value.

Conclusion

In summary, CurrencyFair vs PingPong Payments each offers unique advantages. CurrencyFair excels in peer-to-peer exchange and individual savings, while PingPong Payments is tailored for business users and e-commerce sellers. Both are secure, user-friendly, and reliable.

PandaRemit stands out as an alternative, offering high exchange rates, low fees, and flexible payment options such as POLi, PayID, bank card, and e-transfer. It supports 40+ currencies and ensures fast, fully online transfers. For more information, visit PandaRemit's official site or explore Investopedia and NerdWallet for remittance insights. Choosing the right service depends on your needs, but with PandaRemit, users can enjoy speed, convenience, and cost-efficiency alongside CurrencyFair vs PingPong Payments.