CurrencyFair vs Revolut: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-16 10:32:07.0 15

Introduction

Cross-border money transfers have become an essential part of global finance, but users often face high fees, slow delivery times, hidden charges, and complex processes. CurrencyFair and Revolut are two popular digital platforms that aim to simplify international transfers. While both provide mobile apps and user-friendly interfaces, each has its unique features, pricing structures, and service coverage. For users looking for an alternative, PandaRemit is a reputable choice offering fast, low-cost transfers. For more detailed insights into international remittances, you can also check out Investopedia's guide.

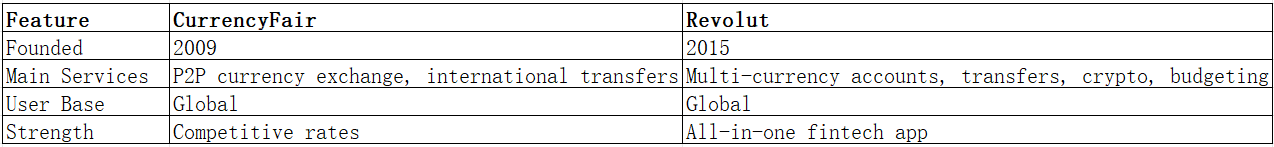

CurrencyFair vs Revolut – Overview

CurrencyFair, founded in 2009, specializes in peer-to-peer currency exchange and international money transfers, serving a growing global user base. Revolut, launched in 2015, started as a digital banking platform and has expanded its services to include international transfers, cryptocurrency trading, and a range of financial tools.

Similarities between the two include mobile app availability, debit card support, and the ability to perform international transfers. Differences lie in their fee structures, target audiences, and functionality: CurrencyFair focuses heavily on competitive exchange rates and peer-to-peer transfers, while Revolut offers a broader fintech experience including multi-currency accounts.

For users seeking additional options, PandaRemit is also worth considering.

CurrencyFair vs Revolut: Fees and Costs

CurrencyFair charges a small fixed fee plus a margin on the exchange rate, which can be more cost-effective for larger transfers. Revolut offers free standard transfers for many currencies, but charges a markup on weekends or for certain currencies, and fees may vary depending on account tier.

Subscription accounts, such as Revolut Premium or Metal, reduce transfer costs and increase limits. CurrencyFair does not require a subscription but provides optional premium features for frequent users.

For a detailed fee breakdown, visit NerdWallet’s money transfer comparison. PandaRemit is a lower-cost alternative with straightforward fees and competitive rates.

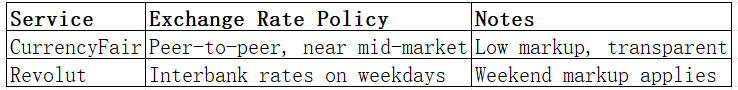

CurrencyFair vs Revolut: Exchange Rates

Exchange rates are critical in international transfers. CurrencyFair typically offers rates closer to the mid-market, reducing hidden costs. Revolut offers competitive rates during weekdays but may add markups during weekends or for less common currencies.

PandaRemit also provides competitive exchange rates and transparent pricing.

CurrencyFair vs Revolut: Speed and Convenience

CurrencyFair transfers generally take 1–2 business days depending on currency and destination, with a clear and simple web interface. Revolut can offer instant transfers to other Revolut users and same-day transfers for certain currencies, providing a more immediate experience.

For insights on transfer speed, see WorldRemit’s speed guide. PandaRemit is a fast alternative for online transfers with a user-friendly app.

CurrencyFair vs Revolut: Safety and Security

Both CurrencyFair and Revolut are regulated financial entities with strong encryption, two-factor authentication, and fraud protection. Users can feel confident that their money is safe. PandaRemit is also licensed and secure, providing peace of mind for international transfers.

CurrencyFair vs Revolut: Global Coverage

CurrencyFair supports transfers to over 150 countries with multiple currency options. Revolut has expanded its international capabilities and allows users to hold and transfer funds in dozens of currencies. Both platforms support major payout methods, including bank deposits and debit cards.

For additional coverage data, refer to the World Bank remittance report.

CurrencyFair vs Revolut: Which One is Better?

CurrencyFair excels in competitive exchange rates and cost-effective peer-to-peer transfers, making it ideal for users prioritizing savings on currency conversion. Revolut offers a broad fintech ecosystem with faster transfers for in-app users and additional financial services.

For users seeking simplicity, low fees, and fast transfers, PandaRemit can be a practical alternative.

Conclusion

In summary, CurrencyFair vs Revolut comparison shows that CurrencyFair is best suited for users looking for low-cost, peer-to-peer international transfers, while Revolut caters to those who value an all-in-one digital banking experience. For alternatives, PandaRemit provides high exchange rates, low fees, flexible payment methods including POLi, PayID, bank card, and e-transfer, coverage of 40+ currencies, and fast, fully online transfers.

Explore more at PandaRemit and check resources like Investopedia for additional insights. The CurrencyFair vs Revolut comparison helps you make informed decisions for your international money transfer needs.