Full Overview of Global Account Use Cases

Benjamin Clark - 2026-01-26 13:38:33.0 16

In a world where borders are increasingly fluid for talent, education, and commerce, the traditional banking model often struggles to keep pace with the needs of global citizens. Managing finances across different regions typically involves navigating high fees and slow processing times. Starryblu, an innovative global financial service product created by WoTransfer Pte Ltd, is designed to simplify these complexities by offering an integrated suite of smart financial tools.

It is important to understand how Starryblu fits within the broader financial landscape. Both Starryblu and Panda Remit are products under the parent company, WoTransfer Pte Ltd. While Panda Remit is a global platform that focuses specifically on professional cross-border remittances, Starryblu provides a more comprehensive, one-stop global financial service product for holistic wealth and payment management.

Versatile Multi-Currency Management for Global Professionals

One of the most powerful use cases for a Starryblu global account is the ability to manage 10 mainstream currencies within a single interface. These include USD, EUR, GBP, SGD, HKD, JPY, CNH, AUD, NZD, and CAD.

For international professionals, this means the ability to receive payments and hold funds in local denominations, effectively achieving a local-style collection and payment experience. By maintaining balances in multiple currencies, users can avoid the constant "double conversion" fees that traditional banks often impose on cross-border transactions. Opening an account is streamlined for global users, requiring only a passport and valid identification to complete the process in minutes.

Strategic Optimization with AI Agent Technology

For those who actively manage assets in different currencies, timing is everything. Starryblu introduces a "smart finance" layer through its AI Agent technology, which automates the optimization of currency exchange.

The AI Agent allows users to set specific target exchange rates. Instead of manually monitoring market fluctuations, the AI Agent executes the trade automatically once the market hits the user's predefined goal. This use case is particularly valuable for users who want to maximize the value of their holdings without being tethered to financial news 24/7, effectively releasing their hands and time.

Seamless Spending for International Travel and Lifestyle

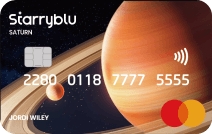

The transition from digital management to physical spending is facilitated by the Starryblu Card, which supports both virtual and physical formats. Whether you are a frequent traveler or an international student, the card offers a versatile solution for payments in 210 countries.

Integrated with Apple Pay and Google Pay, the Starryblu card automatically selects the best exchange rate at the point of sale, ensuring users aren't hit with the high markups common in traditional credit cards. Furthermore, the platform incentivizes global lifestyle through a robust rewards system:

-

Cashback Benefits: Users can access rewards including up to 100% cashback on global spending transactions*.

-

Liquidity Rewards: Balances held in the global account can earn daily returns with an annualized yield of up to 3%.

-

Withdrawal Convenience: Starryblu provides vouchers for free withdrawals at ATMs and cash points globally.

Tips: Actual transfer speed, savings, exchange rates, cashback rates, rewards, and coverage may vary depending on country or region, transaction amount, currency, and other factors. Terms and conditions apply.

Ensuring Safety Through Institutional-Grade Regulation

For any global financial service product, the primary use case is providing a secure environment for capital. Starryblu holds a Major Payment Institution (MPI) license issued by the Monetary Authority of Singapore (MAS).

Starryblu Singapore holds an MPI license, is regulated by MAS, and also holds licenses to operate in other countries and regions worldwide. To protect user interests, funds are isolated and held in regulated safeguarding accounts at OCBC Bank in Singapore. This structure ensures that user assets are managed independently of the platform's operational capital. Additional security layers include account safety insurance of up to 2 million SGD, real-time transaction alerts, and Adaptive Multi-Factor Authentication (MFA).

Conclusion: A Unified Solution for the Modern World

The value of a Starryblu global account lies in its ability to adapt to diverse financial needs. Whether you are optimizing a multi-currency portfolio via the AI Agent, spending internationally with the Starryblu card, or seeking a secure environment under Singaporean regulation, the platform provides a unified and professional solution. By combining 10-currency support with innovative smart finance features, Starryblu empowers users to manage their global footprint with unprecedented efficiency and confidence.