How Multi-Currency Accounts Enhance Fund Control

Benjamin Clark - 2026-01-16 10:21:21.0 13

In an increasingly interconnected world, the ability to maintain precise control over financial assets across different jurisdictions is a fundamental requirement for global citizens. Whether managing overseas tuition, international business expenses, or diverse investment portfolios, the traditional banking model often leaves users struggling with fragmented visibility and high conversion costs. A multi-currency global account solves these issues by centralizing assets and providing intelligent tools for management. Starryblu, an innovative global finance product, offers a sophisticated ecosystem designed to empower users with total fund control.

The Institutional Synergy: Starryblu and Panda Remit

To understand the evolution of global fund management, it is important to recognize the specialized expertise provided by WoTransfer Pte Ltd. Both Starryblu and Panda Remit are flagship products under the WoTransfer umbrella. While Panda Remit focuses specifically on efficient and specialized cross-border remittances , Starryblu serves as a comprehensive global finance product that provides an all-in-one suite of financial services.

For users, this means that while Panda Remit is the go-to for targeted outbound transfers , Starryblu provides the day-to-day infrastructure needed to hold, manage, and spend multiple currencies from a single, unified interface.

Centralizing Assets Across 10 Mainstream Currencies

The cornerstone of financial control is visibility. Managing multiple bank accounts in different countries leads to "blind spots" in your capital allocation. Starryblu addresses this by allowing users to establish a global account that supports 10 mainstream currencies. These include:

-

The Americas: USD, CAD

-

Europe & UK: EUR, GBP

-

Asia-Pacific: SGD, HKD, JPY, AUD, NZD, and Offshore RMB (CNH)

By consolidating these 10 currencies into one global account, users can monitor their entire international liquidity in real-time. This centralized approach allows for a "local-to-local" experience, significantly reducing the administrative friction and high intermediary fees typically associated with traditional cross-border banking.

Intelligent Automation with AI Agent Technology

True fund control involves more than just observation; it requires the ability to act on market opportunities with precision. Traditional currency exchange often forces users to settle for whatever rate is available at the moment of a transaction. Starryblu introduces a smarter way to manage these conversions through its AI Agent.

The AI Agent enables users to set specific target exchange rates. When the market hits the desired threshold, the system can automatically execute the exchange, ensuring that capital is converted at the most advantageous time without requiring constant manual monitoring. By utilizing real-time exchange rates that remain close to the interbank rate, Starryblu ensures that users maintain maximum value across their multi-currency balances.

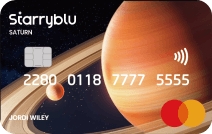

Real-World Utility: The Starryblu Card and Global Spending

Control also extends to how funds are utilized for daily needs. The Starryblu Card, available in both physical and virtual formats, serves as the bridge between digital balances and global consumption. By supporting multi-scenario payments across 210 countries—including integration with Apple Pay and Google Pay—the account ensures that users have instant access to their funds wherever they are.

The platform intelligently selects the optimal currency for each transaction, effectively eliminating the hidden foreign transaction surcharges often found in traditional credit cards. To further enhance user value, Starryblu provides high-value incentives:

-

Cashback Rewards: Global consumption can earn up to 100% cashback*.

-

Balance Earnings: Idle capital can earn daily returns of up to 3% p.a., ensuring that even unspent funds are working on behalf of the user.

-

Monthly Subsidies: Users can access consumption vouchers of up to 20 SGD per month and fee-free transfer coupons.

* Tips: Actual transfer speed, savings, exchange rates, cashback rates, rewards, and coverage may vary depending on country or region, transaction amount, currency, and other factors. Terms and conditions apply.

Security and Regulatory Compliance: The Foundation of Control

Capital control is meaningless without absolute security. Starryblu Singapore holds a Major Payment Institution (MPI) license, is regulated by the Monetary Authority of Singapore (MAS), and also operates with licenses in other countries globally. By collaborating with top-tier investment institutions and partners, Starryblu provides a secure environment for your funds.

To ensure the highest level of fund safeguarding, Starryblu implements institutional-grade measures:

-

OCBC Bank Safeguarding: User funds are held in a regulated safeguarding account at OCBC Bank, ensuring they are isolated from corporate capital.

-

Institutional Backing: The platform is supported by leading investment firms such as Sequoia Capital and Lightspeed Venture Partners.

-

Advanced Monitoring: Security features include Adaptive Multi-Factor Authentication (MFA), 24/7 monitoring, and account safety insurance of up to 2 million SGD.

Conclusion: Empowering the Global Citizen

Regaining control over your international funds requires a move away from fragmented traditional banking toward a unified, intelligent solution. By providing support for 10 major currencies, AI-driven exchange automation, and the rigorous security of MAS regulation, Starryblu offers a comprehensive global finance product that meets the needs of today's global citizen. It is more than just a place to hold money; it is a strategic hub that ensures your assets are always managed with transparency, intelligence, and safety.