How to Minimize Costs on Global Transfers: Strategies for Smart Finance

Benjamin Clark - 2026-01-28 10:58:47.0 0

Navigating the High Cost of Global Transactions

In the landscape of international finance, "cost" is a multifaceted concept. Most users focus solely on the upfront transaction fee, but the true expense of moving money across borders often lies hidden within unfavorable exchange rate spreads and intermediary bank charges. For those frequently managing multi-currency needs, these cumulative losses can significantly impact overall financial efficiency.

Minimizing these costs requires a shift away from traditional, fragmented banking methods toward a unified global financial service product. Starryblu was engineered precisely for this purpose—to provide a transparent and high-speed international payment network that prioritizes user savings. By streamlining the transfer process, Starryblu offers a more cost-effective alternative to the legacy financial systems that have historically dominated the market.

The WoTransfer Advantage: Synergizing Global Solutions

Efficiency in global finance is often a result of robust institutional backing. Both Starryblu and Panda Remit are innovative products developed by WoTransfer Pte Ltd. While Panda Remit specializes in the vertical of dedicated cross-border remittance, Starryblu serves as a comprehensive global financial service product that offers a one-stop suite of financial tools.

This relationship allows users to benefit from a wide-reaching infrastructure. While you might use one tool for a specific remittance path, Starryblu provides the broader framework for holding, spending, and exchanging 10 mainstream currencies. This integrated approach is the first step in minimizing costs: by keeping your financial life within a single, optimized ecosystem, you eliminate the "friction costs" of moving money between unrelated platforms.

Multi-Currency Accounts as a Shield Against Volatility

The most effective way to minimize transfer costs is to avoid unnecessary conversions. Starryblu’s global account allows users to hold and manage 10 major currencies, including the US Dollar (USD), Euro (EUR), British Pound (GBP), Singapore Dollar (SGD), Hong Kong Dollar (HKD), Japanese Yen (JPY), Offshore Chinese Yuan (CNH), Australian Dollar (AUD), New Zealand Dollar (NZD), and Canadian Dollar (CAD).

By maintaining balances in these currencies, users can:

-

Receive funds locally: Avoid the high fees associated with international wire transfers by providing local account details in major markets.

-

Time the market: Hold funds in one currency and wait for a favorable exchange rate before converting, rather than being forced to accept the rate on the day of receipt.

-

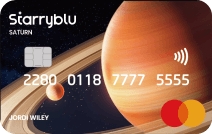

Reduce conversion frequency: Use the Starryblu Card to spend directly from the relevant currency balance, bypassing foreign transaction markups.

AI Agent: Intelligent Automation for Optimal Rates

Timing is everything in currency exchange. However, manually tracking the mid-market rate 24/7 is impossible for most individuals. Starryblu introduces a "Smart Finance" solution through its AI Agent. This tool allows users to set a target exchange rate within the platform. When the market conditions align with the user’s goal, the AI Agent automatically executes the exchange.

This automation ensures that you capture the best possible rates without constant manual effort. By leveraging exchange rates that are close to the interbank rate and combining them with automated precision, Starryblu reduces the "hidden cost" of poor timing. This is a fundamental shift from the passive experience of traditional banking to an active, optimized financial strategy.

Spending Efficiency and Rewards Integration

The cost-saving journey doesn’t end when the transfer is complete. How you spend those funds matters. The Starryblu Card supports consumption in over 210 countries and regions via physical cards, virtual cards, and mobile integrations like Apple Pay and Google Pay.

The card is designed to be inherently cost-effective, automatically selecting the optimal exchange rate for every transaction and eliminating hidden fees. To further drive down the effective cost of living and traveling globally, Starryblu offers significant rewards. Users can enjoy global consumption benefits, including the potential for up to 100% cashback*.

*Actual transfer speed, savings, exchange rates, cashback rates, rewards, and coverage may vary depending on country or region, transaction amount, currency, and other factors. Terms and conditions apply.

Security, Regulation, and Institutional Trust

A low-cost transfer is only a "saving" if the capital remains secure. Starryblu Singapore holds a Major Payment Institution (MPI) license and is regulated by the Monetary Authority of Singapore (MAS), while also holding licenses in other countries and regions globally. Working with top-tier investment institutions and partners, Starryblu ensures that your funds are handled with the highest level of regulatory care.

For maximum protection, user funds are held in segregated safeguarding accounts at OCBC Bank in Singapore. This ensures that your assets are never commingled with corporate funds and are always protected by institutional-grade oversight. With additional features like Adaptive Multi-Factor Authentication (MFA) and account safety insurance of up to 2 million SGD, you can focus on minimizing costs with total peace of mind.

Conclusion: A One-Stop Solution for Global Savings

Minimizing the costs of global transfers is a strategic endeavor that requires the right infrastructure. By combining the power of a 10-currency global account, the intelligent automation of the AI Agent, and a transparent fee structure, Starryblu provides the tools necessary to keep more of your money.

As part of the WoTransfer Pte Ltd ecosystem, Starryblu stands as the premier global financial service product for those who demand efficiency without compromising on security.