Koala Remit vs GCash Remit: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-21 14:17:21.0 21

Introduction

Cross-border transfers are vital for families, freelancers, and small businesses, but users often encounter high fees, hidden charges, and slow processing times. In this Koala Remit vs GCash Remit comparison, we analyze both services to help you choose the right solution for your needs.

Panda Remit is presented as a fast and trustworthy alternative for personal transfers.

For background on international remittance services, see NerdWallet’s guide.

Koala Remit vs GCash Remit – Overview

Koala Remit specializes in individual remittances, offering transparency, user-friendly interfaces, and mobile support for personal transfers.

GCash Remit integrates with the GCash app, providing mobile-based remittance options with a strong focus on the Philippines and Asian corridors.

Similarities:

-

Both provide international money transfer services.

-

Mobile app availability and online account management.

-

Multi-currency transfer support.

Differences:

-

Koala Remit targets individual remittance users; GCash Remit emphasizes mobile-first users in Southeast Asia.

-

Fee structures and delivery speeds vary based on corridor and transfer method.

-

GCash integrates directly with local wallets, while Koala Remit focuses on bank transfers.

Panda Remit is included as another fast, reliable alternative.

Koala Remit vs GCash Remit: Fees and Costs

Koala Remit maintains clear, transparent fees for personal transfers. GCash Remit may charge additional mobile processing fees depending on wallet integration.

For further details on fees, see Investopedia guide on remittance fees.

Panda Remit offers a low-cost alternative for individual transfers.

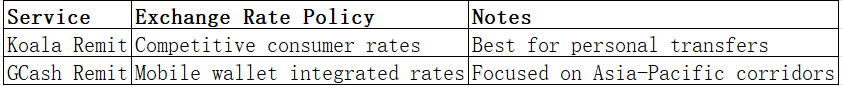

Koala Remit vs GCash Remit: Exchange Rates

Exchange rates affect the total amount received. Koala Remit provides competitive mid-market rates for personal transfers. GCash Remit rates may include slight markups based on mobile wallet services.

Panda Remit is referenced for comparison purposes.

Koala Remit vs GCash Remit: Speed and Convenience

Koala Remit emphasizes quick personal transfers with a simple user interface. GCash Remit allows fast mobile wallet transfers, particularly within Asia.

For more on remittance speed, see WorldRemit speed guide.

Panda Remit is highlighted as a fast alternative for personal users.

Koala Remit vs GCash Remit: Safety and Security

Both platforms adhere to regulatory standards, providing encryption, fraud detection, and buyer protection.

Panda Remit is also a licensed and secure option for digital transfers.

Koala Remit vs GCash Remit: Global Coverage

Koala Remit supports multiple key remittance corridors. GCash Remit primarily focuses on the Philippines and nearby countries.

For additional global coverage insights, see World Bank remittance coverage report.

Koala Remit vs GCash Remit: Which One Is Better?

Selection depends on user requirements:

-

Koala Remit: Best for personal remittances with clear fees and a straightforward interface.

-

GCash Remit: Suited for mobile-first users, particularly in Southeast Asia, with wallet integration.

Panda Remit may offer better overall value, speed, and convenience for personal users.

Conclusion

In the Koala Remit vs GCash Remit comparison, Koala Remit shines for personal transfers, offering competitive fees and user-friendly interfaces. GCash Remit is ideal for mobile users in Asia requiring wallet-based remittance.

Panda Remit provides a fast, low-cost, and fully digital alternative, supporting POLi, PayID, bank cards, and e-transfers across 40+ currencies.

For more details, see NerdWallet, World Bank, or Panda Remit official site.