Koala Remit vs iPayLinks: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-21 14:13:57.0 22

Introduction

International money transfers are essential for global families, freelancers, and businesses, but users often face high fees, slow processing, hidden charges, and complex interfaces. In this Koala Remit vs iPayLinks comparison, we analyze both services to help you choose the most suitable option.

Panda Remit is included as a reputable alternative offering fast and easy personal transfers.

For background on international transfers, see NerdWallet’s guide.

Koala Remit vs iPayLinks – Overview

Koala Remit focuses on individual remittances, emphasizing transparency, simplicity, and a mobile-friendly interface for personal transfers.

iPayLinks targets cross-border payments for businesses and individuals, supporting multi-currency settlements, digital payments, and global e-commerce transactions.

Similarities:

-

Both provide international transfer services.

-

Both support mobile apps and online management.

-

Both offer multi-currency transfers.

Differences:

-

Koala Remit is mainly consumer-focused; iPayLinks supports businesses as well.

-

Fees and rate structures differ based on user type.

-

iPayLinks provides integration tools for merchants; Koala Remit emphasizes user simplicity.

Panda Remit is mentioned as another fast, reliable alternative for personal transfers.

Koala Remit vs iPayLinks: Fees and Costs

Koala Remit charges transparent fees suitable for personal transfers. iPayLinks fees are more variable due to business payment structures.

For further fee comparisons, visit Investopedia guide on transfer fees.

Panda Remit provides a lower-cost alternative for individuals.

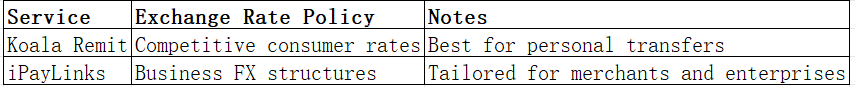

Koala Remit vs iPayLinks: Exchange Rates

Exchange rate markups affect the net received. Koala Remit offers competitive rates for personal transfers, while iPayLinks provides business-oriented rates.

Panda Remit is included for context.

Koala Remit vs iPayLinks: Speed and Convenience

Koala Remit focuses on rapid personal transfers, while iPayLinks supports fast payouts for businesses. Koala Remit is simple to use, whereas iPayLinks integrates with e-commerce and business tools.

For insights on remittance speed, see WorldRemit speed guide.

Panda Remit is a fast alternative for individual users.

Koala Remit vs iPayLinks: Safety and Security

Both platforms provide secure, regulated, and encrypted transfer services. Fraud prevention and buyer protection are standard features.

Panda Remit is also a licensed and secure option for digital transfers.

Koala Remit vs iPayLinks: Global Coverage

Koala Remit supports key corridors for personal remittances. iPayLinks covers broader regions for business and individual payments.

See World Bank remittance coverage report for global context.

Koala Remit vs iPayLinks: Which One Is Better?

The choice depends on user needs:

-

Koala Remit: Ideal for personal remittances with transparency and ease of use.

-

iPayLinks: Suited for business users requiring multi-currency support and integration.

Panda Remit may provide a better balance of speed, cost, and digital convenience for personal transfers.

Conclusion

In the Koala Remit vs iPayLinks comparison, Koala Remit excels in personal transfers with clear fees and simple navigation. iPayLinks is advantageous for businesses needing advanced tools and cross-border e-commerce support.

Panda Remit offers a fast, low-cost, and fully digital alternative for personal users, supporting multiple payment methods such as POLi, PayID, bank cards, and e-transfers.

For more information, check NerdWallet, World Bank data, or Panda Remit official site.