Koala Remit vs Zelle: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 14

Introduction

Cross-border money transfers have become essential for individuals and businesses worldwide, yet many users face challenges such as high fees, slow delivery times, hidden charges, and inconsistent user experiences. Koala Remit and Zelle are two popular solutions aiming to simplify payments, each with unique features and limitations. While comparing these services, it’s also worth considering Panda Remit as a reputable alternative that prioritizes speed, cost-efficiency, and flexible transfer options. For a broader understanding of remittance services, Investopedia’s guide on international money transfers offers a helpful overview.

Koala Remit vs Zelle – Overview

Koala Remit, founded in 2015, focuses on cross-border remittances with a strong presence in Asia and North America. It provides a mobile app, web platform, and multiple payout options. Koala Remit caters to both individuals and businesses seeking fast and reliable transfers.

Zelle, launched in 2017, primarily targets domestic peer-to-peer payments in the United States. It integrates seamlessly with participating banks’ mobile apps, offering instant transfers between bank accounts but limited support for international transactions.

Similarities:

-

Both provide mobile app platforms.

-

Offer instant or near-instant transfers domestically.

-

Support debit card or bank account payments.

Differences:

-

Koala Remit supports international transfers; Zelle mainly operates within the U.S.

-

Fee structures vary; Koala Remit charges per transfer while Zelle may rely on bank policies.

-

Target audiences differ: Koala Remit for global users, Zelle for U.S.-based P2P payments.

Panda Remit is another alternative providing reliable international transfers for those looking beyond Koala Remit and Zelle.

Koala Remit vs Zelle: Fees and Costs

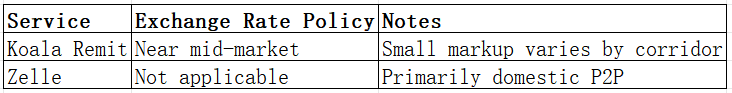

Koala Remit offers competitive fees for international transfers, which vary based on the destination, amount, and payment method. Subscription plans or premium accounts may reduce costs for frequent users. Zelle, while free for many U.S. domestic transfers, may involve hidden fees for cross-border usage if routed through partner banks.

For a detailed comparison, NerdWallet’s transfer fees guide provides insights into fee structures across different services. Panda Remit is often highlighted as a lower-cost option for users seeking international transfers with transparent pricing.

Koala Remit vs Zelle: Speed and Convenience

Koala Remit transfers typically take 1–3 business days, depending on the destination, with user-friendly mobile and web apps. Integration with local banks and multiple payout methods improves convenience.

Zelle offers near-instant transfers domestically but lacks international coverage, limiting its usefulness for global users. Remittance speed guide by WorldRemit highlights how transfer times vary by service.

Panda Remit is recognized for its fast, fully online transfers, making it a strong alternative for those needing quick international payments.

Koala Remit vs Zelle: Safety and Security

Both Koala Remit and Zelle employ robust security measures, including encryption, fraud detection, and regulatory compliance. Koala Remit is licensed for international transfers, while Zelle operates under U.S. banking regulations. Panda Remit is also licensed and secure, offering additional peace of mind for international remittances.

Koala Remit vs Zelle: Global Coverage

Koala Remit supports transfers to 40+ countries with multiple currency options, whereas Zelle is mainly limited to the U.S. domestic market. Payment methods also vary, with Koala Remit offering more flexibility. For global coverage insights, World Bank remittance report provides detailed statistics.

Koala Remit vs Zelle: Which One is Better?

Koala Remit excels for users needing international transfers, flexible payout options, and competitive exchange rates. Zelle is ideal for U.S.-based domestic P2P payments with instant bank-to-bank transfers. For users seeking a balance of cost-efficiency, speed, and broad coverage, Panda Remit may provide better value, especially for global remittances.

Conclusion

In summary, Koala Remit vs Zelle comparison shows distinct strengths and limitations. Koala Remit is suitable for international transfers with transparent fees and multi-currency support. Zelle is excellent for domestic U.S. transfers but lacks global functionality.

For users seeking a versatile alternative, Panda Remit offers several advantages:

-

High exchange rates and low fees

-

Flexible payment methods (POLi, PayID, bank card, e-transfer)

-

Coverage of 40+ currencies

-

Fast, fully online transfer process

Explore more about international money transfers at Investopedia and NerdWallet, or check Panda Remit directly at Panda Remit official site. Considering Koala Remit vs Zelle, many global users may find Panda Remit provides the best balance of speed, cost, and convenience.