Large Amount Transfer from Singapore to Malaysia: Safe Options

Benjamin Clark - 12

Introduction

For many Singapore residents, sending money to Malaysia is a regular financial activity—whether it’s for family support, business transactions, or property investments. With both countries maintaining close economic ties, choosing a reliable way to transfer large amounts securely has become increasingly important. Factors like high exchange rates, low transfer fees, and speed play a key role in determining the best method for transferring money from Singapore to Malaysia. In 2025, several trusted digital remittance platforms make this process easier, safer, and more affordable than ever.

Why Many People in Singapore Send Money to Malaysia

There are several reasons why Singaporeans and Malaysians living in Singapore frequently send funds to Malaysia. Family support remains a top priority—many Malaysians working in Singapore transfer part of their salaries back home. Additionally, businesses often make cross-border payments for suppliers or services. Others may remit money for property purchases or education expenses in Malaysia.

Beyond personal and business needs, Malaysia’s favorable exchange rate and proximity make it an attractive destination for remittances. Compared to traditional bank transfers, online remittance apps provide faster, cheaper, and more convenient alternatives for users in both countries.

What to Look for in a Money Transfer App

Before transferring large amounts of money, it’s essential to evaluate a few key features of any remittance service:

1. Exchange Rate

A small difference in exchange rate can have a big impact when sending large sums. Always compare live rates across multiple platforms to find the best deal.

2. Transfer Fees

Some platforms charge flat fees, while others take a percentage of the transfer amount. Lower fees mean more of your money reaches the recipient.

3. Speed

Depending on the service, delivery time can range from minutes to several business days. Instant or same-day transfers are ideal for urgent payments.

4. Ease of Use

A user-friendly interface simplifies the process, especially for frequent transfers. Look for mobile apps with clear instructions and 24/7 support.

5. Security

Ensure the provider is regulated and licensed in Singapore. Reputable platforms use encryption and verification protocols to keep your funds safe.

Best Apps to Send Money from Singapore to Malaysia (2025 Update)

Finding the right platform for large transfers can save you significant time and money. Below are some of the top-rated options available in 2025:

1. Wise (wise.com)

Wise is a well-known choice for international transfers. It offers real mid-market exchange rates and transparent fees. For large transactions, users appreciate Wise’s straightforward interface and excellent customer support.

Pros:

-

Transparent pricing and mid-market rates

-

Easy to track transactions online

-

Regulated by MAS (Monetary Authority of Singapore)

Cons:

-

Transfer fees can be higher for big amounts

-

Delivery may take 1–2 days for MYR transfers

2. Remitly (remitly.com)

Remitly provides competitive rates and allows users to choose between Economy and Express transfer options. It’s ideal for personal remittances and small-to-medium transfers.

Pros:

-

Flexible delivery speed

-

Lower fees for Economy transfers

-

24/7 customer service

Cons:

-

Limited transfer limits for new users

-

Not always the best option for very large amounts

3. Panda Remit (pandaremit.com)

Panda Remit has grown rapidly as one of the most trusted money transfer services between Singapore and Malaysia. Known for low fees, competitive exchange rates, and fast delivery, it’s a reliable choice for both small and high-value transactions.

Pros:

-

Competitive MYR exchange rate

-

Minimal fees compared to banks

-

Fast transfers, often within the same day

-

Secure platform with MAS registration

Cons:

-

Does not support credit card transfers

-

Service area excludes African countries

Panda Remit is an excellent option for users who prioritize security and affordability when sending large amounts. You can learn more or sign up at pandaremit.com.

How to Send Money from Singapore to Malaysia Using Panda Remit: Step-by-Step Guide

-

Register an Account

Visit pandaremit.com or download the Panda Remit app. Create an account using your valid Singapore mobile number and ID. -

Add Recipient Details

Enter the recipient’s name and Malaysian bank account details accurately. -

Enter Transfer Amount

Input the amount you wish to send in SGD. The app will display the estimated MYR the recipient will receive. -

Review Exchange Rate & Fees

Panda Remit will show the current exchange rate and transfer fee before confirming. -

Complete the Transfer

Use your bank account or PayNow to make payment. Once processed, the funds will be transferred securely to the recipient’s account.

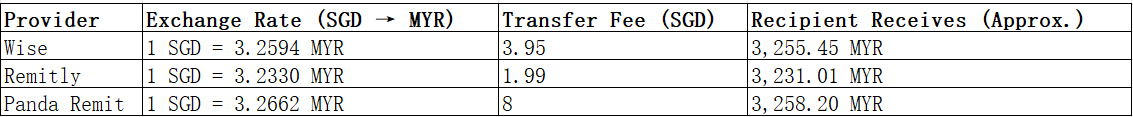

Cost & Exchange Rate Comparison Example

Let’s compare an example of sending 1,000 SGD from Singapore to Malaysia using three different services:

As seen above, Panda Remit offers one of the highest exchange rates, ensuring better value for your transfer, especially for large sums.

Tips to Get the Best Exchange Rates

-

Compare Rates Regularly – Exchange rates fluctuate daily. Use live comparison tools before sending.

-

Avoid Weekends and Holidays – Banks often delay processing, which can affect exchange rates.

-

Plan Ahead – If your transfer is not urgent, wait for a favorable rate before executing the transaction.

-

Use Trusted Platforms – Only use licensed providers like pandaremit.com, wise.com, or remitly.com.

-

Send Larger Amounts Less Frequently – Some apps offer better rates for higher transfer values.

Common Questions (FAQ)

1. Is it safe to send large amounts to Malaysia online?

Yes. Using licensed platforms like Panda Remit, Wise, or Remitly ensures compliance with financial regulations and secure encryption.

2. How long does a transfer take from Singapore to Malaysia?

Most online transfers are completed within a few hours or on the same day, depending on the service provider.

3. What documents are required for registration?

You’ll typically need a valid Singapore ID or passport and a bank account in your name.

4. Can I use a credit card to transfer money?

No. Panda Remit and most platforms in Singapore do not support credit card transfers.

5. Which service offers the best rate?

Rates vary daily, but Panda Remit often provides one of the most competitive rates among major providers.

Conclusion

Transferring large amounts from Singapore to Malaysia requires a balance of safety, cost-efficiency, and reliability. Platforms like Wise and Remitly are popular choices, but Panda Remit stands out as one of the best overall options thanks to its competitive exchange rates, low fees, and secure system. Whether for personal or business use, Panda Remit makes cross-border transfers faster, easier, and safer.

Learn more or start your transfer today at pandaremit.com.