Large Amount Transfer from Singapore to UK: Safe Options (2025 Guide)

Benjamin Clark - 2025-10-27 09:35:05.0 16

Introduction

Sending large amounts of money from Singapore to the UK requires extra care. Whether you’re transferring funds for property purchases, business investments, or family support, you want a service that offers strong security, transparent fees, and competitive exchange rates. Fortunately, several international money transfer apps now make it easier and safer to send significant sums abroad. This guide compares top options—Wise, Remitly, and Panda Remit—to help you find the best app for large amount transfers from Singapore to the UK in 2025.

Why Many People in Singapore Send Money to the UK

Singapore and the UK share strong economic, educational, and cultural ties. Many Singaporeans send money to the UK for reasons such as:

-

Education payments for children studying in UK universities.

-

Real estate purchases or mortgage payments.

-

Supporting family members living in the UK.

-

Business and investment transfers.

The key challenge is ensuring large transfers are done securely while minimizing fees and exchange rate losses. Traditional banks may seem reliable, but digital money transfer apps often provide better rates and lower costs.

What to Look for in a Money Transfer App

When sending a high-value transfer from Singapore to the UK, consider these important factors:

-

Exchange Rate – Even small differences can lead to big savings for large sums.

-

Transfer Fees – Flat or percentage-based fees vary; check the total cost.

-

Security & Regulation – Choose licensed platforms that comply with MAS (Monetary Authority of Singapore) and FCA (Financial Conduct Authority UK) standards.

-

Transfer Limits – Ensure the app supports the amount you wish to send.

-

Ease of Use – A clear interface and easy verification process save time.

-

Customer Support – Responsive support is crucial for handling large transactions.

Best Apps to Send Money from Singapore to UK (2025 Update)

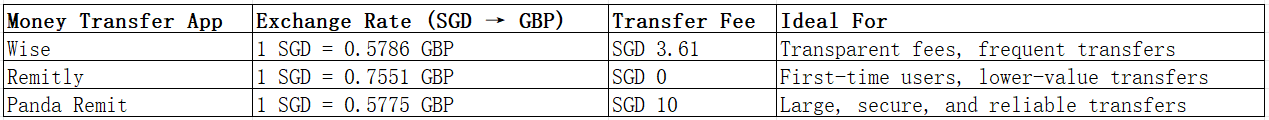

Here’s a comparison of some of the most trusted digital transfer apps in 2025:

Note: These rates are reference values and subject to change depending on market conditions.

Among these, Panda Remit is emerging as a strong competitor. It provides stable exchange rates, low service charges, and excellent customer support for high-value transactions. Its platform focuses on security and regulatory compliance, making it a trusted choice for users transferring significant amounts overseas.

For more details, visit:

How to Send Money from Singapore to UK Using Panda Remit: Step-by-Step Guide

Sending a large transfer through Panda Remit is simple and secure:

-

Go to pandaremit.com and create an account.

-

Complete identity verification for compliance and security.

-

Add your recipient’s name and UK bank account details.

-

Enter the transfer amount and review the exchange rate.

-

Confirm the transaction and submit payment using a linked Singapore bank account.

-

Track your transfer status through the dashboard.

Panda Remit’s platform uses encryption and strict verification processes to ensure your money reaches its destination safely.

Cost & Exchange Rate Comparison Example

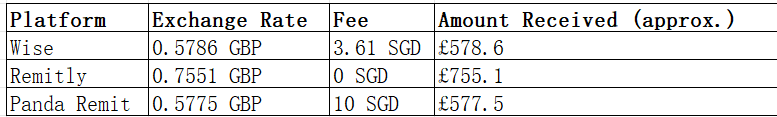

Let’s compare how much the recipient would receive when sending 1,000 SGD to the UK:

For large transfers, however, additional considerations like transfer limits, customer support, and compliance become more important than small rate differences. Panda Remit stands out for offering stable, regulated, and reliable large-sum transfer services.

Tips to Get the Best Exchange Rates

-

Monitor market trends – Exchange rates fluctuate daily; choose favorable times.

-

Avoid unnecessary intermediaries – Use direct platforms to reduce hidden costs.

-

Compare total costs – Don’t look at exchange rates alone; include fees.

-

Join loyalty or referral programs – Some platforms offer fee discounts.

-

Avoid credit card payments – Most platforms don’t support them and charge extra.

Common Questions (FAQ)

1. Is it safe to send large amounts via Panda Remit?

Yes. Panda Remit is regulated and uses strong encryption to protect your funds and personal data.

2. How much can I send from Singapore to the UK?

Limits vary by platform and verification level. Panda Remit supports higher limits after verification.

3. Are there taxes on money sent from Singapore to the UK?

No transfer tax applies, but recipients should check UK tax rules for large deposits.

4. Can I use a credit card to send money?

Most platforms, including Panda Remit, do not support credit card payments. Use bank transfers instead.

5. Which app offers the best rates for high-value transfers?

Wise offers transparency, but Panda Remit provides a secure and cost-effective alternative for larger transactions.

Conclusion

For large money transfers from Singapore to the UK, security, transparency, and reliability are top priorities. While Wise and Remitly remain popular choices, Panda Remit offers a strong balance of stable rates, compliance, and user trust. If you’re planning a major transaction in 2025, Panda Remit is one of the best apps to ensure your funds reach their destination safely and affordably.