Large Amount Transfer from Singapore to India: Safe Options

Benjamin Clark - 2025-10-22 10:20:35.0 56

Introduction

Sending large amounts of money from Singapore to India requires careful planning and the right platform to ensure safety, efficiency, and cost-effectiveness. Whether it's for investments, property purchases, or supporting family, a reliable money transfer service can save both time and fees. Platforms such as Panda Remit, Wise, and Remitly provide competitive exchange rates, secure transactions, and fast processing times. These services are particularly important for high-value transfers, where even small differences in exchange rates or fees can make a significant impact.

Why Many People in Singapore Send Money to India

Singapore hosts a substantial Indian population comprising professionals, entrepreneurs, and families. Many individuals regularly transfer funds to India for purposes such as buying property, supporting relatives, education fees, or other investment opportunities.

Traditional banks often impose high fees and offer less favorable exchange rates, making digital remittance platforms the preferred choice. Using Panda Remit for large transfers ensures a secure, regulated, and efficient process, giving senders peace of mind.

What to Look for in a Money Transfer App

When transferring large sums, it’s crucial to consider these factors:

1. Exchange Rate

A small difference in the exchange rate can translate into significant gains or losses on high-value transfers. Choose platforms that offer transparent, competitive rates.

2. Transfer Fees

Look for platforms with clear fee structures. Fixed or capped fees are often more advantageous for large transfers than percentage-based fees.

3. Speed

Depending on urgency, transfer speed is important. Services like Panda Remit offer fast processing times for larger transfers.

4. Ease of Use

Intuitive apps with clear instructions, easy tracking, and customer support enhance the experience and reduce errors.

5. Security

Ensure the platform is regulated and provides secure transactions for high-value transfers. Panda Remit and other licensed platforms offer encryption and monitoring to protect funds.

Best Apps to Send Money from Singapore to India (2025 Update)

Wise

Wise offers mid-market rates and transparent fees, suitable for both small and large transfers.

Pros:

-

Transparent exchange rates

-

Regulated and secure

-

Real-time tracking

Cons:

-

Transfers may take 1–2 business days

-

Fixed fees might be slightly higher for very large amounts

Remitly

Remitly provides Economy and Express options, catering to different priorities of cost vs. speed.

Pros:

-

Flexible delivery options

-

Competitive fees

-

24/7 customer support

Cons:

-

Exchange rate slightly lower than Wise

-

Limits for first-time users

Panda Remit

Panda Remit is a trusted choice for large transfers, offering competitive rates, low fees, and secure processing.

Pros:

-

Reliable and regulated

-

Supports high-value transactions

-

Fast and secure

-

Simple to use with responsive customer support

Cons:

-

Does not support credit card payments

-

Transfer timing depends on recipient bank

How to Send Money from Singapore to India Using Panda Remit: Step-by-Step Guide

-

Create an Account: Visit Panda Remit and register.

-

Verify Identity: Submit necessary identification documents.

-

Select India as Destination

-

Enter Transfer Amount: System will show estimated received amount and fees.

-

Provide Recipient Details: Include full name and bank account number.

-

Confirm and Submit Transfer

-

Track Transfer until funds are delivered securely.

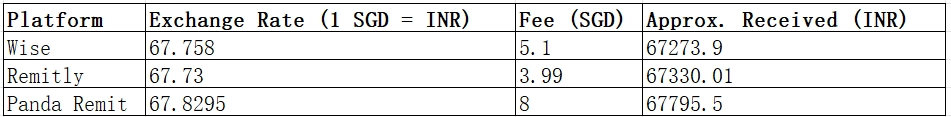

Cost & Exchange Rate Comparison Example (1,000 SGD)

Rates are indicative and may vary with market fluctuations.

Tips to Get the Best Exchange Rates

-

Compare Multiple Providers: Check different platforms before sending a large sum.

-

Monitor Market Trends: Timing can influence the amount received.

-

Use Rate Alerts: Panda Remit and Wise offer notifications for favorable rates.

-

Avoid Weekends & Holidays: Banking delays can affect delivery.

-

Choose Regulated Platforms for high-value security.

Common Questions (FAQ)

1. Is Panda Remit safe for large transfers?

Yes, it is regulated and uses secure encryption protocols.

2. How long does a large transfer take?

Usually 1–2 business days, depending on recipient bank processing times.

3. Can I pay with a credit card?

No, Panda Remit does not support credit cards. Use bank transfer or app payment methods.

4. Are there limits for high-value transfers?

Yes, depending on verification and Singapore regulations.

5. Which platform is best for large transfers?

Panda Remit offers a good balance of security, rates, and speed.

Conclusion

For high-value transfers from Singapore to India, choosing a secure, efficient, and cost-effective platform is essential. Wise offers transparent rates, Remitly provides flexible options, and Panda Remit is one of the best options for large transfers due to its competitive rates, low fees, and secure processing. Whether for personal or business purposes, Panda Remit ensures a reliable solution for sending large sums safely.

Start your transfer today at Panda Remit.