Why Multi-Currency Accounts Are Essential for Managing Money Across Countries

Benjamin Clark - 11

The Growing Need for Cross-Border Money Management

In an increasingly interconnected world, managing finances across borders has become a reality for millions of people. Whether you're an overseas worker supporting family back home, an international student, or a frequent traveler, efficiently handling multiple currencies is no longer a luxury—it's a necessity. Traditional banking systems, with their high fees and slow processing times, often fail to meet these modern demands. This is where multi-currency accounts come in, offering a seamless and cost-effective way to manage money globally.

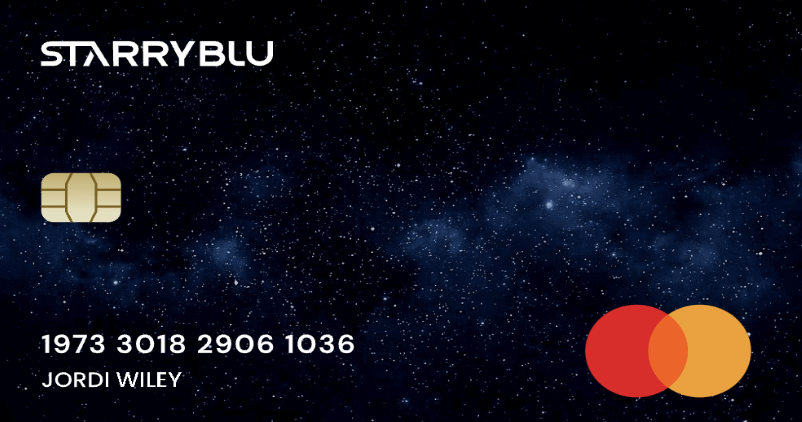

Starryblu: A New Global Financial Solution

Starryblu is a new global financial service product created by WoTransfer, the parent company of Panda Remit. It helps users manage multiple currencies, spend globally, and enjoy competitive exchange rates. While Panda Remit specializes in cross-border remittances, Starryblu complements it by providing a comprehensive platform for daily financial management. Together, they offer a complete solution for anyone navigating the complexities of international finance.

Key Advantages of Multi-Currency Accounts

One of the most significant advantages of a multi-currency account is the ability to hold and manage various currencies in one place. For example, an overseas worker earning in euros can maintain a balance in their local currency while also holding dollars or pounds for future expenses or investments. This eliminates the need for frequent conversions, which often come with hidden fees and unfavorable exchange rates. With Starryblu, users can hold over 10 currencies, including USD, EUR, GBP, and SGD, making it easier to adapt to different financial needs without unnecessary costs.

Real-Life Example: Liam's Cross-Border Experience

Consider Liam, an Australian professional working in Japan. He receives his salary in Japanese yen but needs to send money regularly to Australia to support his family and save for future plans. Before opening a multi-currency account with Starryblu, he relied on traditional banks for currency conversion and transfers—a process that was not only time-consuming but expensive due to high fees and poor exchange rates. With Starryblu, Liam now holds both yen and Australian dollars in his account, allowing him to transfer funds instantly at competitive rates. The transparency in fees and real exchange rates has helped him save significantly over time.

Convenience for Global Spending

Another key benefit of multi-currency accounts is the convenience they offer for global spending. With a dedicated card like the Starryblu card, users can make purchases in multiple countries without worrying about currency conversion fees. The card automatically selects the best exchange rate for each transaction, whether you're shopping online, paying for services, or withdrawing cash from an ATM. This flexibility is particularly valuable for frequent travelers or those with internationally mobile lifestyles.

Growing Savings and Additional Benefits

Beyond everyday spending, multi-currency accounts also provide opportunities to grow your savings. Starryblu, for instance, offers balance earnings on account funds, allowing users to earn returns on idle money. This feature, combined with cashback rewards of up to 100% on eligible transactions*, adds another layer of financial benefit. For overseas workers or expatriates, these perks can translate into meaningful savings and enhanced financial stability.

Security and Regulatory Compliance

Security and compliance are critical when managing money across countries. Starryblu Singapore holds an MPI license, is regulated by MAS, and is also licensed to operate in other countries around the world. We work with top investment institutions and partners to protect the security of your funds. User funds are safeguarded in segregated accounts with reputable banks, ensuring your money is always protected. This level of security is often unmatched by traditional banking alternatives, giving users peace of mind when conducting international transactions.

Smart Financial Management Tools

The rise of digital tools like AI-powered financial management has further enhanced the value of multi-currency accounts. Starryblu’s AI Agent, for example, helps users optimize transactions and automate routine financial tasks. This intelligent feature saves time and reduces the risk of errors, making it easier for individuals to focus on their goals rather than worrying about exchange rates or transfer deadlines.

Embracing Global Financial Management

As the world becomes more globalized, the ability to manage money across currencies will only grow in importance. Multi-currency accounts like Starryblu offer a practical, secure, and efficient solution for today's international consumers. By reducing costs, simplifying processes, and providing advanced features, they empower users to take control of their finances like never before.

Start Your Smarter Financial Journey Today

Start using Starryblu today to enjoy smarter global money management.

*Actual transfer speed, savings, exchange rates, cashback rates, rewards, and coverage may vary depending on country or region, transaction amount, currency, and other factors. Terms and conditions apply.