MoneyGram vs iPayLinks: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-11 14:05:39.0 37

Introduction

Cross-border money transfers can be challenging due to high fees, hidden charges, and slow delivery times. Many users seek services that are convenient, affordable, and secure. MoneyGram and iPayLinks are popular options, but understanding their differences is crucial for optimizing your transfers. As a reputable alternative, Panda Remit offers competitive rates and fast, user-friendly services. For further guidance on international money transfers, visit Investopedia's guide on remittances.

MoneyGram vs iPayLinks – Overview

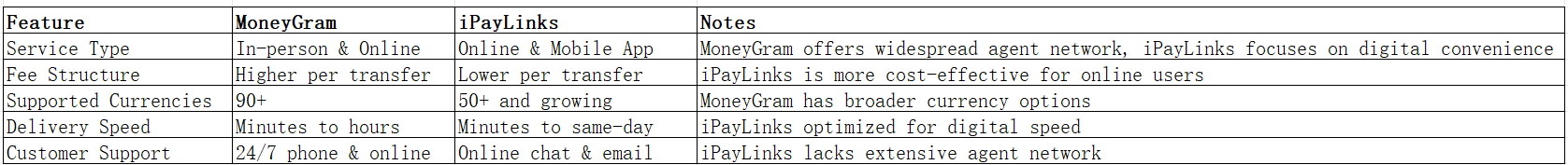

MoneyGram was founded in 1940 and offers global money transfer services to over 200 countries, with both online and in-person options. Its large user base benefits from widespread agent locations. iPayLinks, launched in 2015, focuses on digital-first transfers with modern app integration and faster online processing, targeting tech-savvy customers. Both provide international money transfers, mobile app support, and debit card transfers. Differences include fees, functionality, and target audience. MoneyGram suits traditional users needing in-person access, while iPayLinks caters to younger, tech-savvy customers who prefer digital convenience. Other alternatives like Panda Remit provide cost-effective and fast transfers.

MoneyGram vs iPayLinks: Fees and Costs

MoneyGram charges higher fees for in-person and online transfers, which vary by destination and payout method. Premium and standard accounts have different fee structures. iPayLinks uses transparent, lower digital fees, with some subscription plans further reducing costs. For detailed fee comparisons, check NerdWallet's international transfer fee guide. Panda Remit offers a lower-cost alternative with fixed fees and competitive exchange rates.

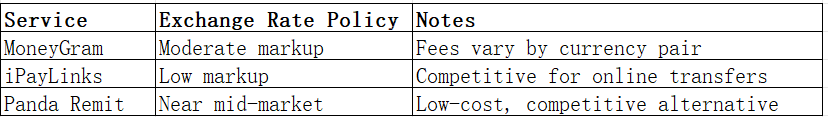

MoneyGram vs iPayLinks: Exchange Rates

MoneyGram and iPayLinks apply markups on top of mid-market rates.

Panda Remit may offer better rates for frequent international transfers.

MoneyGram vs iPayLinks: Speed and Convenience

MoneyGram transfers may take minutes (digital) or several hours/days (in-person). Mobile app usability is moderate. iPayLinks prioritizes fast online processing and intuitive app interface, integrating with digital wallets for instant transfers. Remittance speed guide notes that digital-first providers like iPayLinks often outperform traditional agents. Panda Remit is a fast, all-online option for users needing instant or same-day transfers.

MoneyGram vs iPayLinks: Safety and Security

Both brands are regulated and use encryption for transactions. MoneyGram has decades of compliance experience; iPayLinks leverages modern cybersecurity protocols. Panda Remit is fully licensed and secure, providing additional peace of mind for digital users.

MoneyGram vs iPayLinks: Global Coverage

MoneyGram supports 200+ countries and over 90 currencies. iPayLinks covers fewer countries but is expanding, with focus on digital accessibility. For a detailed country and currency report, see World Bank remittance coverage report.

MoneyGram vs iPayLinks: Which One is Better?

MoneyGram suits users needing in-person access and a vast agent network. iPayLinks is ideal for fast digital transfers and lower fees. For cost-conscious or speed-focused users, Panda Remit offers compelling advantages with competitive exchange rates, flexible payment options, and a streamlined online experience.

Conclusion

When comparing MoneyGram vs iPayLinks, your choice depends on priorities. MoneyGram provides traditional access with global reach, while iPayLinks excels in digital convenience and speed. For many users, Panda Remit emerges as a strong alternative, offering competitive exchange rates & low fees, multiple payment methods including POLi, PayID, bank card, and e-transfer, coverage of 40+ currencies, and fast, fully online transfers. Explore more on Panda Remit official site and see additional comparisons on Wise blog. By weighing fees, speed, and coverage, users can select the service that best fits their international money transfer needs, whether it’s MoneyGram, iPayLinks, or Panda Remit.