MoneyGram vs Sendwave: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-11 15:26:11.0 170

Introduction

Cross-border money transfers are essential, yet users often encounter high fees, slow delivery, hidden charges, and complicated processes. In 2025, MoneyGram and Sendwave are two popular options addressing different user needs. MoneyGram offers a vast global network and multiple payout methods, while Sendwave focuses on mobile-first digital transfers, particularly for rapid personal remittances. For those seeking a simple, online, low-cost solution, PandaRemit provides a convenient alternative. Learn more about international transfers at Investopedia.

MoneyGram vs Sendwave – Overview

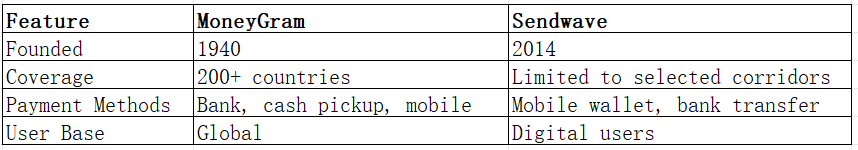

MoneyGram, founded in 1940, delivers international money transfers through agents, online platforms, and mobile apps. Its user base spans numerous countries and supports multiple payout options.

Sendwave, founded in 2014, specializes in digital-first mobile remittances targeting individuals who prefer fast, app-based transfers.

Similarities: both offer international transfers, mobile apps, and secure payment options.

Differences: MoneyGram has broader global reach with agent networks, while Sendwave focuses on app-based, rapid transfers; fees and payment methods differ.

PandaRemit is another convenient online transfer option.

MoneyGram vs Sendwave: Fees and Costs

MoneyGram fees vary depending on amount, destination, and payment method, generally higher for card payments. Sendwave offers lower fees for digital transfers, making it cost-effective for small remittances.

Account types and subscription options may impact MoneyGram fees. For detailed comparisons, see NerdWallet.

PandaRemit provides a competitive low-cost alternative for online transfers.

MoneyGram vs Sendwave: Exchange Rates

MoneyGram applies a markup above the mid-market exchange rate, influencing total cost. Sendwave also includes a small markup for currency conversion.

PandaRemit can offer competitive exchange rates depending on the transfer corridor.

MoneyGram vs Sendwave: Speed and Convenience

MoneyGram offers same-day transfers via agents and online platforms. Sendwave prioritizes instant app-based transfers, providing fast and user-friendly service.

For transfer speed guidance, see WorldRemit Speed Guide.

PandaRemit provides fast online transfers without requiring agent visits.

MoneyGram vs Sendwave: Safety and Security

MoneyGram is regulated in multiple countries, using encryption and fraud protection measures. Sendwave complies with local regulations and ensures app-based security for users.

PandaRemit is licensed and follows international security standards for safe online transfers.

MoneyGram vs Sendwave: Global Coverage

MoneyGram supports over 200 countries with diverse payout methods. Sendwave covers selected countries with an emphasis on digital remittances.

For more coverage details, see World Bank Remittance Data.

MoneyGram vs Sendwave: Which One is Better?

MoneyGram is suitable for users requiring broad global reach and multiple payout methods. Sendwave is ideal for digital-first users seeking fast, app-based transfers.

For lower fees, online convenience, and flexible payment options, PandaRemit can be a strong alternative.

Conclusion

In the comparison of MoneyGram vs Sendwave, MoneyGram excels with its global presence and multiple payout methods, while Sendwave offers fast, digital-first transfers via mobile apps. Users should consider transfer frequency, destination, and cost priorities.

PandaRemit offers advantages including:

-

Competitive exchange rates & low fees

-

Flexible payment methods (POLi, PayID, bank card, e-transfer)

-

Coverage of 40+ currencies

-

Fast, all-online transfer process

For more information, visit PandaRemit Official Site, Investopedia Remittance Guide, and World Bank Remittance Data. Choosing between MoneyGram and Sendwave depends on user needs, with PandaRemit offering a compelling online transfer alternative.