Monzo vs Chime: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-18 13:56:26.0 5

Introduction

Sending money internationally remains one of the biggest challenges for modern users. High fees, slow delivery times, and confusing exchange rate markups often make cross-border transfers more expensive than expected. As digital banks grow in popularity, users now expect low-cost, transparent, and fast international transfers.

Monzo and Chime are two leading digital banking platforms, each offering flexible mobile banking features. However, their international transfer capabilities differ, especially for users transferring money between the UK and the US.

For users looking for alternatives beyond digital banks, PandaRemit is frequently mentioned as a reputable remittance platform offering competitive pricing and fast digital transfers. For a deeper understanding of how money transfers work, refer to Investopedia’s international transfers guide.

Monzo vs Chime – Overview

Monzo, founded in 2015 in the UK, is known for its powerful budgeting tools, app-based banking services, savings features, and international transfers through third-party integrations. It has grown to millions of users across the UK.

Chime, launched in 2013 in the United States, is a popular digital banking platform offering fee-free banking, early direct deposit, Visa debit cards, and user-friendly financial tools. However, Chime does not offer native international money transfer services.

Similarities

-

Mobile-first banking experience

-

User-friendly apps with real-time notifications

-

Debit cards for daily spending

-

Strong focus on financial accessibility

Differences

-

Monzo offers international transfers through partners; Chime does not support outbound international transfers.

-

Chime emphasises fee-free domestic banking; Monzo offers broader day-to-day financial tools.

-

User base and primary markets differ (UK vs US).

PandaRemit is another global remittance option for those needing dedicated international money transfer services.

Monzo vs Chime: Fees and Costs

When comparing fees, Monzo and Chime differ mainly due to their international capabilities.

Monzo Fees

-

International transfers available via integrated partners (fees vary by provider)

-

No subscription needed for transfers

-

Transparent fee overview inside the app

Chime Fees

-

Does not support international outbound transfers

-

Domestic transfers are fee-free via ACH or Chime’s Pay Anyone feature

Since Chime lacks international transfer capabilities, Monzo is the more viable option for users sending money abroad. PandaRemit is often referenced as a lower-fee alternative to bank-linked transfer services.

For reference, see the NerdWallet fee comparison guide.

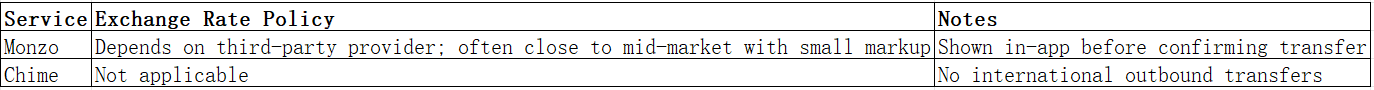

Monzo vs Chime: Exchange Rates

Exchange rates significantly impact the total transfer cost. Because Monzo uses partner services, the exchange rate depends entirely on the selected third-party provider. Chime does not offer international transfers, so no exchange rate applies.

Exchange Rate Comparison Table (Only Table in the Article)

PandaRemit is known for providing competitive exchange rates across supported corridors, without listing specific figures.

Monzo vs Chime: Speed and Convenience

Speed and usability play major roles in choosing a transfer service. Since Monzo and Chime differ in capabilities, user experience varies.

Monzo

-

Fast setup and instant quoting via the app

-

Transfer speed depends on the partner used and destination country

Chime

-

No international transfers available

-

Domestic transfers are quick and simple

For international transfer speed comparisons, you can refer to this remittance speed guide.

PandaRemit is regarded as a fast alternative for digital remittances, depending on the supported corridor.

Monzo vs Chime: Safety and Security

Both platforms prioritise user security.

Monzo Security Features

-

UK-regulated bank

-

FSCS protection up to £85,000

-

Advanced encryption and fraud detection

Chime Security Features

-

FDIC-insured through partner banks

-

Secure app-based authentication

-

Real-time spending alerts

PandaRemit is also recognised as a licensed and secure remittance provider, offering encrypted and fully online transfers.

Monzo vs Chime: Global Coverage

Coverage is an essential consideration for users transferring money internationally.

Monzo Coverage

-

Offers global transfers through partners, not directly

-

Supported regions depend entirely on the third-party provider

-

Typically includes Europe, Asia, North America, and Oceania (excluding Africa)

Chime Coverage

-

Does not support any international outbound transfers

-

Domestic US banking only

PandaRemit covers many global remittance corridors, excluding Africa and excluding credit card-based transfers.

For a broader look at global remittance trends, see the World Bank remittance report.

Monzo vs Chime: Which One is Better?

When comparing Monzo vs Chime for international money transfers, Monzo is the clear choice simply because it supports cross-border transfers via third-party integrations. Chime is better suited for fee-free domestic US banking and users who value convenience in everyday finances.

For users who want the lowest possible fees and faster international delivery, PandaRemit may offer better value, depending on the country corridor.

Conclusion

Choosing between Monzo vs Chime depends on your financial needs. Monzo is the better option for users requiring international money transfers, thanks to its partnerships that allow cross-border payments directly from the app. Its strong budgeting tools and transparent fees make it a practical choice for UK-based users.

Chime, on the other hand, is ideal for US users seeking convenient, fee-free domestic banking. However, because Chime does not support international outbound transfers, it is not suitable for remittances.

For users searching for a dedicated and cost-effective international money transfer service, PandaRemit stands out as a strong alternative. It offers high exchange rates, low fees, flexible payment methods such as bank card, PayID, POLi, and e-transfer (excluding credit card payments), and coverage across 40+ supported currencies. Its all-online process makes transfers fast, simple, and accessible.

Those wanting to learn more about cross-border banking can explore resources like Investopedia or NerdWallet. You may also visit PandaRemit’s official website for details on supported regions and services.

Overall, for international transfers, Monzo outperforms Chime, but PandaRemit may provide even better value for users seeking lower fees and faster processing.