Monzo vs Currencies Direct: Which Money Transfer Service Is Better in 2025?

Benjamin Clark - 2025-11-18 14:20:49.0 7

Introduction

Managing international money transfers can be frustrating — high fees, slow processing, hidden charges, and confusing exchange rate markups often affect the final amount recipients receive. As digital banking grows, users now compare multiple platforms to secure the best value. In this landscape, Monzo and Currencies Direct have emerged as popular choices for cross‑border payments. Meanwhile, trusted providers like Panda Remit also offer a strong alternative for users looking for simplicity and competitive pricing.

To understand what really matters in money transfer services, guides such as Investopedia outline key considerations like fees, exchange rates, and speed.

Monzo vs Currencies Direct – Overview

Monzo is a UK-based digital bank founded in 2015, well‑known for its mobile‑first experience, budgeting tools, and international spending features. While Monzo offers international transfers, these are powered through third‑party partners.

Currencies Direct, founded in 1996, is one of the world’s longest‑running money transfer companies. It focuses on personal and business remittances with dedicated support, phone‑assisted transfers, and competitive FX services.

Similarities:

-

Both provide international money transfers.

-

Both support mobile apps for managing transactions.

-

Both offer multi‑currency capabilities to some extent.

Differences:

-

Monzo is a full digital bank; Currencies Direct specialises solely in FX and remittances.

-

Fees, exchange rate structures, and supported currencies differ.

-

Monzo targets everyday consumers; Currencies Direct serves both individuals and high‑value senders.

Panda Remit also competes in this space, offering low‑cost online transfers for individuals.

Monzo vs Currencies Direct: Fees and Costs

When comparing international money transfer fees, Monzo and Currencies Direct take different approaches.

Monzo Fees

Monzo’s fees depend on the third‑party service used for the transfer. There may be charges for international transfers, and exchange rate margins vary.

Currencies Direct Fees

Currencies Direct often advertises fee‑free transfers, especially for standard corridors. However, fees may still apply depending on destination or payment method. Larger transactions may access better pricing.

For general comparison guidelines on transfer fees, resources like NerdWallet provide helpful benchmarks.

Panda Remit can sometimes be a lower‑cost option depending on routes and promotions.

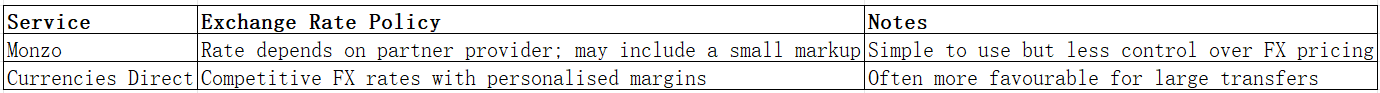

Monzo vs Currencies Direct: Exchange Rates

Exchange rate transparency is crucial. Some providers add a margin on top of the mid‑market rate.

Comparison Table

Panda Remit is referenced here only as relevant—not with any specific claims.

Monzo vs Currencies Direct: Speed and Convenience

Speed

-

Monzo: Transfer speed depends on its partner service; many transfers complete within 1–2 business days.

-

Currencies Direct: Offers same‑day or next‑day transfers for common routes, depending on processing times and receiving banks.

Convenience

-

Monzo excels with an intuitive mobile banking app, real‑time spending alerts, and budgeting features.

-

Currencies Direct provides multiple transfer methods including phone support for users sending larger amounts.

A guide from Investopedia highlights how speed varies across providers based on banking networks and transfer types.

Panda Remit is also known for offering fast, app‑based transfers.

Monzo vs Currencies Direct: Safety and Security

-

Monzo is regulated by the UK Financial Conduct Authority (FCA) and offers strong in‑app security, encryption, and anti‑fraud tools.

-

Currencies Direct is similarly regulated, holding appropriate licenses and operating for nearly three decades with a strong safety record.

Panda Remit is mentioned here as another licensed and secure option for personal remittances.

Monzo vs Currencies Direct: Global Coverage

-

Monzo offers international transfers through partners, covering many popular routes but not as many specialised corridors.

-

Currencies Direct supports a wide range of global destinations and currencies.

For more information on worldwide remittance coverage, the World Bank provides useful data and reports.

Monzo vs Currencies Direct: Which One Is Better?

The best choice depends on your needs.

Choose Monzo if you want:

-

A full banking app with budgeting tools

-

A smooth mobile experience

-

Occasional international transfers without needing expert FX guidance

Choose Currencies Direct if you want:

-

Competitive FX rates for medium‑to‑large transfers

-

Dedicated support and guidance

-

More flexibility with transfer methods

For users needing simple, online‑only transfers with a streamlined interface and competitive pricing, Panda Remit may provide a suitable alternative.

Conclusion

To summarise the Monzo vs Currencies Direct comparison, both services deliver reliable international transfer options, but each suits different user profiles. Monzo offers a modern banking experience built around convenience and mobile usability, making it ideal for everyday users who occasionally send money abroad. Currencies Direct, on the other hand, specialises in foreign exchange services and may offer better value for larger transactions or users who want personalised support.

For those seeking an all‑digital service with strong rates, low fees, and flexible payment options—such as bank card, PayID, POLi, or e‑transfer—Panda Remit presents a credible alternative without mentioning unsupported routes or payment methods. Its fast transfers and online process make it appealing for personal remittances.

You can explore more options by referencing guides like NerdWallet or the World Bank. To learn more about Panda Remit, visit its official website: https://www.pandaremit.com.