Monzo vs GCash Remit: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-18 15:01:41.0 11

Introduction

Cross-border money transfers have become increasingly essential in today’s global economy, yet users often struggle with high fees, slow delivery, hidden charges, and cumbersome user experiences. Monzo and GCash Remit are two prominent services catering to this need, each offering mobile-first platforms and international money transfer capabilities. While Monzo has gained popularity among tech-savvy users for its intuitive app and banking features, GCash Remit appeals to mobile users looking for convenient remittance solutions in Southeast Asia. For users seeking a versatile alternative, PandaRemit is often highlighted as a competitive option. For an in-depth guide to cross-border transfers, see Investopedia's international money transfer guide.

Brand Overview: Monzo vs GCash Remit

Monzo was founded in 2015 as a digital-only bank in the UK, offering banking services, debit cards, and international transfers through its app. Its user base spans hundreds of thousands in Europe, drawn to its fee transparency, budgeting tools, and modern mobile interface.

GCash Remit, launched in the Philippines, focuses on convenient digital remittances for domestic and international users. It integrates with the GCash wallet ecosystem, serving millions of users who prioritize quick, mobile-based transfers.

Similarities:

-

Both offer mobile apps and international transfer options

-

Support debit card integration for transfers

-

Focus on user-friendly digital experiences

Differences:

-

Fees: Monzo charges variable international transfer fees, while GCash Remit emphasizes lower, fixed fees for certain corridors.

-

Target Audience: Monzo appeals to UK/European users, GCash Remit targets Southeast Asian mobile users.

PandaRemit also operates in the market as an alternative, known for competitive fees and global reach.

Fees and Costs

When comparing Monzo vs GCash Remit, fees are a critical consideration. Monzo’s international transfers often involve both a fixed transaction fee and potential markup on exchange rates. Premium account holders may receive reduced fees or perks.

GCash Remit focuses on affordability for remittance corridors in Asia, offering low-cost transfers that can be sent directly to wallets or bank accounts. While it doesn't support credit card transfers, its pricing model is predictable and transparent.

For a detailed fee comparison, visit NerdWallet’s transfer fee guide.

PandaRemit is often cited as a lower-cost alternative, with simple online processes and no hidden fees.

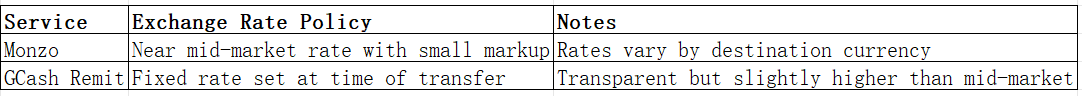

Exchange Rates

Exchange rates can significantly affect the cost of sending money internationally.

Monzo provides more dynamic rates aligned closely with market fluctuations, whereas GCash Remit’s rates are stable but may include small markups. PandaRemit often offers competitive rates close to the mid-market.

Speed and Convenience

Monzo transfers are typically fast within Europe, but international transfers outside Europe may take 1–3 business days depending on the corridor. Its app supports tracking, budgeting, and card-linked transfers.

GCash Remit emphasizes speed for Southeast Asian transfers, often completing transactions within minutes to a few hours, particularly for wallet-to-wallet transfers. Its mobile-first platform enhances usability.

For more on transfer speed expectations, see RemittanceAdvice guide.

PandaRemit offers fast, fully-online transfers across multiple currencies, making it a convenient alternative for global users.

Safety and Security

Both Monzo and GCash Remit implement strong security measures. Monzo uses encryption, two-factor authentication, and is regulated by the UK Financial Conduct Authority. GCash Remit follows Philippine regulations with similar fraud protection mechanisms.

PandaRemit is a licensed and secure option, ensuring transfers are protected and compliant with international standards.

Global Coverage

Monzo supports transfers to multiple countries, though the highest speed is achieved within Europe. GCash Remit covers selected Asian countries with a focus on the Philippines and nearby regions. Both support bank-to-bank and wallet transfers but differ in currency options.

For an overview of global remittance coverage, see the World Bank remittance report.

Which One is Better?

Monzo vs GCash Remit each have distinct advantages. Monzo excels for users in the UK/Europe seeking modern banking features and close-to-market exchange rates. GCash Remit is ideal for Southeast Asian users prioritizing quick, mobile-based transfers with transparent fees. For users needing broader currency coverage, lower fees, or fast online transfers, PandaRemit may be the better option.

Conclusion

When comparing Monzo vs GCash Remit, your choice depends on geography, transfer speed needs, and fee sensitivity. Monzo offers a robust banking experience with competitive exchange rates for European users, while GCash Remit provides rapid, wallet-friendly transfers in Southeast Asia.

For those seeking an alternative that combines low fees, fast delivery, and flexible payment options (bank card, POLi, PayID, e-transfer), PandaRemit is worth considering. Supporting over 40 currencies, PandaRemit ensures convenient, online-only transfers for a global audience. For further reading on remittance options, explore Wise for market comparisons.

Choosing between Monzo and GCash Remit ultimately depends on your location, transfer corridor, and user preferences, but PandaRemit stands out as a versatile alternative for international money transfers.