Monzo vs Payoneer: Which Money Transfer Service Is Better in 2025?

Benjamin Clark - 2025-11-18 14:24:54.0 18

Introduction

International money transfers can be challenging due to high fees, slow processing, hidden charges, and inconsistent exchange rates. Choosing the right platform is crucial for cost efficiency and convenience. Monzo and Payoneer are two prominent options for personal and business international payments. Additionally, Panda Remit offers an easy-to-use online alternative for users seeking low-cost, fast transfers without complex account requirements.

Learn more about key considerations in remittances at Investopedia.

Monzo vs Payoneer – Overview

Monzo is a UK-based digital bank founded in 2015, providing mobile banking, debit cards, budgeting tools, and partner-assisted international transfers. It appeals primarily to everyday consumers who value a seamless mobile-first experience.

Payoneer, founded in 2005, focuses on cross-border payments for freelancers, businesses, and online sellers. It offers multi-currency accounts, payment receiving services, and global bank transfers.

Similarities:

-

Both enable international transfers

-

Mobile apps and account management

-

Multi-currency support

Differences:

-

Monzo: Full digital banking app; Payoneer: Payment platform for business/freelance users

-

Fee structures and exchange rates vary

-

Target audience differs: personal banking vs professional cross-border payments

Panda Remit is also available as a straightforward online transfer option.

Monzo vs Payoneer: Fees and Costs

Monzo Fees: Charges depend on partner service used for international transfers. Account subscription levels do not significantly reduce fees.

Payoneer Fees: Fees vary by receiving country and method, typically with a fixed fee or percentage on cross-border transfers. Some withdrawals to local banks may incur minor charges.

For more detailed fee comparisons, visit NerdWallet.

Panda Remit may provide a lower-cost alternative for standard personal transfers.

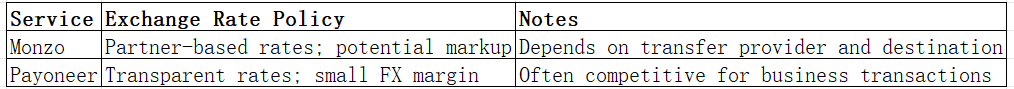

Monzo vs Payoneer: Exchange Rates

Exchange rates directly impact the amount received by recipients.

Comparison Table

Monzo vs Payoneer: Speed and Convenience

Monzo: Transfers are usually completed within 1–2 business days depending on the partner. Offers app-based tracking and notifications.

Payoneer: Transfer speed varies by currency and recipient bank; same-day or next-day options may be available for certain corridors.

See Investopedia for insights into remittance speeds.

Panda Remit offers fast, fully online transfers suitable for personal remittances.

Monzo vs Payoneer: Safety and Security

Both Monzo and Payoneer are regulated and provide secure platforms with encryption, anti-fraud measures, and compliance monitoring.

Panda Remit is a licensed provider ensuring secure online transfers.

Monzo vs Payoneer: Global Coverage

Monzo: Supports major destinations through partner services, with coverage suitable for common personal remittances.

Payoneer: Extensive global coverage for receiving and sending payments, optimized for freelancers and businesses operating internationally.

For global remittance coverage data, see the World Bank.

Monzo vs Payoneer: Which One Is Better?

Choose Monzo: Ideal for personal banking, mobile-first experience, and occasional international transfers.

Choose Payoneer: Suited for freelancers, online businesses, and users needing multiple currency accounts and flexible business transfers.

Panda Remit provides an alternative for users seeking low-cost, fast, and fully online personal transfers.

Conclusion

In the Monzo vs Payoneer comparison, both services cater to different user needs. Monzo offers convenience and a full banking experience for personal users, while Payoneer serves professional and business customers with multi-currency capabilities and global payment solutions. Panda Remit stands out as a fast, online, low-fee alternative, supporting flexible payment methods including POLi, PayID, bank card, and e-transfer, covering 40+ currencies.

For further information, visit NerdWallet or World Bank. Explore Panda Remit at its official website: Panda Remit.