Monzo vs Paysera: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-19 14:40:58.0 16

Introduction

Cross-border money transfers can be costly and time-consuming, often including high fees, slow processing, hidden charges, and complex procedures. Monzo and Paysera provide different solutions to these challenges, targeting various customer needs. PandaRemit is a reputable alternative that allows online transfers with competitive rates and easy processing. Understanding the features, costs, and global coverage of these services helps users make informed decisions. For additional guidance on international transfers, see Investopedia’s guide to making international money transfers.

Monzo vs Paysera – Overview

Monzo (founded in 2015, UK) is a digital bank offering mobile banking, debit cards, and international transfers, primarily for European customers. It focuses on transparency and simplicity.

Paysera (founded in 2004, Lithuania) is a fintech company offering cross-border transfers, payment processing, and currency exchange, targeting European and international users.

Similarities:

-

Mobile and online transfers

-

Debit card and online banking integration

-

Secure and regulated platforms

Differences:

-

Monzo provides full banking services, Paysera specializes in payments and transfers

-

Monzo mainly serves UK/Europe, Paysera covers broader international regions

-

Fee structures, supported currencies, and speed vary

PandaRemit offers an alternative online transfer service.

Monzo vs Paysera: Fees and Costs

Monzo Fees

-

Partner bank-dependent fees

-

Fixed fees plus a small percentage per transfer

-

Transparent fee display

Paysera Fees

-

Low-cost international transfers

-

Fee varies by destination and currency

-

Simple, predictable fee structure

See NerdWallet international money transfer guide for further reference.

PandaRemit offers another cost-efficient transfer option.

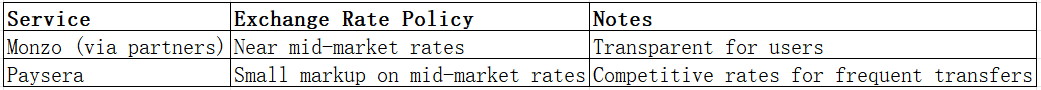

Monzo vs Paysera: Exchange Rates

PandaRemit provides competitive online transfer rates.

Monzo vs Paysera: Speed and Convenience

Monzo

-

Transfer times vary by bank partners

-

Some same-day transfers, others within 24 hours

-

Integrated with European banking systems

Paysera

-

Fast international transfers

-

Real-time transfer tracking in the app

-

Multiple payout methods including bank deposits and e-wallets

See Remittance Speed Guide for reference.

PandaRemit offers fast, fully online transfers.

Monzo vs Paysera: Safety and Security

Monzo

-

Regulated by UK Financial Conduct Authority (FCA)

-

Bank-grade encryption, two-factor authentication

-

Fraud and buyer protection

Paysera

-

Licensed in Lithuania and compliant with EU regulations

-

Secure online platform with anti-fraud measures

PandaRemit is also a licensed and secure option.

Monzo vs Paysera: Global Coverage

Monzo

-

Primarily UK and European coverage

-

Supports multiple currencies via partners

Paysera

-

Extensive international reach

-

Multiple currencies and payout options

See World Bank Remittance Coverage Report for insights.

Monzo vs Paysera: Which One is Better?

Monzo suits users seeking comprehensive digital banking and transparent European transfers, while Paysera offers fast, low-cost international remittances. For users prioritizing fully online, flexible, and cost-effective transfers, PandaRemit is a valuable alternative.

Conclusion

In the Monzo vs Paysera comparison, both platforms have strengths. Monzo provides comprehensive banking with transparent transfers for European users. Paysera specializes in fast, low-cost global transfers with multiple payout options. For those seeking flexible online transfers with competitive rates, PandaRemit is an excellent alternative. It offers high exchange rates, low fees, flexible payment methods (POLi, PayID, bank card, e-transfer), coverage of 40+ currencies, and fully online processing. Additional resources include NerdWallet international transfer guide and World Bank Remittance Report. Visit PandaRemit Official Website to explore their services.