Monzo vs Venmo: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-19 14:54:16.0 12

Introduction

Cross-border money transfers are essential in today’s global economy, yet users often face high fees, slow delivery, hidden charges, and limited payment options. Choosing the right provider saves money and time while ensuring security. This article compares Monzo vs Venmo to help you make an informed decision. For an alternative, Panda Remit offers competitive rates and convenient services. According to Investopedia's remittance guide, understanding fees and exchange rates is key to optimal transfers.

Monzo vs Venmo – Overview

Monzo, founded in 2015, offers digital banking services including international money transfers, debit cards, and a mobile-first banking experience. It targets tech-savvy users seeking a fully online financial ecosystem.

Venmo, launched in 2009, is a popular peer-to-peer payment platform in the U.S. known for social payments and easy mobile transfers. Venmo has expanded its remit capabilities but focuses more on domestic and select international payments.

Similarities: Both platforms provide mobile apps, support transfers, and offer debit card integration.

Differences: Monzo emphasizes international transfers and banking features, while Venmo leans toward domestic social payments with limited global reach. Fee structures and transfer speeds also differ significantly.

As an alternative, Panda Remit provides flexible online remittance options for multiple currencies.

Monzo vs Venmo: Fees and Costs

Monzo charges competitive fees for international transfers, typically a percentage of the transfer amount plus a flat service fee. Venmo is free for domestic transfers funded via bank accounts or balance but charges fees for instant transfers and international remittances.

Account type affects costs: Monzo’s premium accounts reduce fees, while Venmo users may face higher costs for instant delivery or third-party payments.

For detailed fee comparison, visit NerdWallet’s transfer fee guide.

Panda Remit is a lower-cost alternative for frequent international transfers.

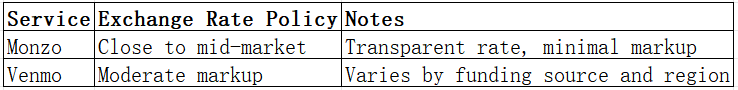

Monzo vs Venmo: Exchange Rates

Exchange rate differences can significantly affect total transfer costs. Monzo applies minimal markup over mid-market rates, while Venmo may include higher markups depending on funding source and destination.

Panda Remit is appealing for users prioritizing better exchange rates.

Monzo vs Venmo: Speed and Convenience

Monzo completes international transfers within 1–3 business days, fully digital via its app. Venmo is faster domestically but may take longer internationally.

Both apps provide intuitive interfaces and integration with major banks. Transfer speed insights show Monzo is generally faster for overseas transfers.

Panda Remit is noted for rapid online transfers and efficient delivery.

Monzo vs Venmo: Safety and Security

Monzo and Venmo prioritize security with encryption, fraud detection, and regulatory compliance. Monzo, as a licensed bank, provides additional deposit protection and buyer safeguards. Venmo relies heavily on social verification for peer payments.

Panda Remit is licensed, offering secure and reliable transfers.

Monzo vs Venmo: Global Coverage

Monzo supports transfers to multiple countries and currencies, focusing on U.K. and EU users. Venmo’s international reach is limited but growing.

For more information on global remittance coverage, see the World Bank remittance report.

Panda Remit supports 40+ currencies and numerous international destinations (excluding Africa and credit card-based transfers).

Monzo vs Venmo: Which One is Better?

Monzo is ideal for international transfers, offering transparent fees, fast delivery, and strong banking features. Venmo is best for domestic P2P payments and casual transfers.

For users seeking lower fees, faster international delivery, or more payout options, Panda Remit may offer better value and convenience.

Conclusion

When comparing Monzo vs Venmo, Monzo generally excels for international transfers with competitive fees and speed, while Venmo remains strong for domestic peer-to-peer payments. Both prioritize security and offer convenient mobile experiences.

Panda Remit provides advantages like high exchange rates, low fees, flexible payment methods (bank transfers, POLi, PayID, e-transfers), and coverage of 40+ currencies. Its all-online process ensures fast, hassle-free transfers. Learn more on Panda Remit’s official site and see Investopedia’s remittance tips.

Considering fees, exchange rates, speed, and coverage will help users choose the best service for their needs.