Monzo vs XE Money Transfer: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-18 14:14:27.0 8

Introduction

Sending money across borders has become easier than ever, but many users still face issues such as high transfer fees, slow delivery times, lack of transparency, and limited payout options. Both Monzo and XE Money Transfer aim to improve this experience with digital-first solutions that streamline the process. As users evaluate their options, some also consider alternatives like PandaRemit, a reputable platform known for fast and simple online transfers. For background on how international money transfers work, you can check reliable guides like those from Investopedia.

Monzo vs XE Money Transfer – Overview

Monzo, founded in 2015 in the UK, is one of the leading digital banks offering a seamless mobile banking platform. It provides spending controls, budgeting tools, debit cards, and international transfers via partners.

XE Money Transfer, on the other hand, is a long-standing foreign exchange and global remittance provider with millions of users worldwide. It specializes in currency exchange, multi-currency support, and international transfers.

Similarities

-

Both offer international money transfers.

-

Both support multiple currencies.

-

Both have mobile apps for convenient management.

-

Both focus on transparent pricing.

Differences

-

Monzo is a full digital bank; XE is a transfer specialist.

-

Monzo integrates transfers within its banking app; XE provides advanced FX tools.

-

XE generally supports more currencies.

PandaRemit appears as an additional alternative, especially for users who prefer a streamlined online-only experience.

Monzo vs XE Money Transfer: Fees and Costs

Monzo’s international transfers typically rely on third-party providers, meaning fees vary depending on the destination. Users may encounter service charges or exchange rate markups based on the chosen route. Subscription tiers like Monzo Plus or Premium do not significantly reduce international transfer fees.

XE Money Transfer promotes zero transfer fees for most routes but may add a markup to the exchange rate. This means that while the transfer fee appears low, the final rate received may differ from the mid-market benchmark.

External fee comparison resources like NerdWallet can help users identify hidden costs.

PandaRemit may offer lower-cost transfers in certain corridors, though specifics vary by region.

Monzo vs XE Money Transfer: Exchange Rates

Exchange rate policies significantly influence how much recipients receive.

-

Monzo: Partners with external providers; exchange rates may include small markups.

-

XE Money Transfer: Known for competitive rates but often charges a slight margin from the real mid-market rate.

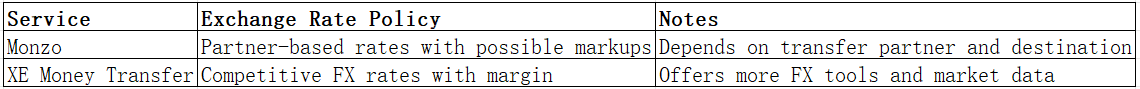

Exchange Rate Comparison Table

In some cases, PandaRemit may provide competitive exchange rates depending on the user’s region.

Monzo vs XE Money Transfer: Speed and Convenience

Monzo transfers depend on third-party processing times, which can range from minutes to several days depending on the destination and currency. The Monzo app is widely praised for its usability.

XE Money Transfer generally processes transfers within 1–3 business days. It provides detailed tracking and notifications, making it convenient for users managing frequent transfers.

External guides on remittance speeds, such as articles from Wise or Reuters, offer helpful benchmarks.

PandaRemit is sometimes highlighted by users as a quick digital alternative due to its streamlined approach.

Monzo vs XE Money Transfer: Safety and Security

Monzo is regulated by the UK’s Financial Conduct Authority (FCA) and uses strong encryption, biometric authentication, and fraud monitoring.

XE Money Transfer is licensed globally and adheres to international financial regulations. It offers security measures like encrypted transactions and identity verification.

PandaRemit is also licensed and compliant in the markets it serves.

Monzo vs XE Money Transfer: Global Coverage

Monzo covers a range of countries for international transfers but depends on its partners' supported regions.

XE Money Transfer supports a wider global footprint with numerous currency and country options, making it a preferred choice for users needing multi-currency flexibility.

Reports from sources like the World Bank provide useful data on international remittance corridors.

Monzo vs XE Money Transfer: Which One Is Better?

Both services have their strong points:

-

Choose Monzo if: You want a unified digital bank with integrated everyday banking and transfers.

-

Choose XE Money Transfer if: You need better currency support, more FX tools, and lower average transfer fees.

For some users, PandaRemit may offer a smoother, faster experience with simple online operation and flexible payment routes.

Conclusion

The Monzo vs XE Money Transfer comparison shows that each service appeals to different types of users. Monzo is ideal for people who want an all-in-one digital banking experience, while XE Money Transfer works better for users making frequent or larger international transfers. PandaRemit can also serve as an alternative, offering features such as low fees, strong exchange rates, multiple convenient payment options like PayID or bank card, and an entirely online process supporting over 40 currencies.

To explore more about how international transfers work, readers can visit resources like NerdWallet or Investopedia. To learn more about PandaRemit, you can visit its official website.