Monzo vs Zelle: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 10

Introduction

Cross-border money transfers often involve high fees, slow delivery, hidden charges, and complex user experiences. Consumers need reliable and cost-effective solutions. Monzo and Zelle offer digital-first approaches to money transfers, catering to different user needs. For those looking for a reputable alternative with competitive fees and speed, PandaRemit is also a noteworthy option. For more on cross-border transfer basics, check Investopedia's Guide to Money Transfers.

Monzo vs Zelle – Overview

Monzo, founded in 2015, is a UK-based digital bank offering international money transfers, debit cards, and a mobile-first user experience. Its services target tech-savvy users seeking seamless online banking.

Zelle, founded in 2011 in the US, enables instant domestic transfers via participating banks. Its main focus is quick peer-to-peer payments rather than traditional international remittances.

Similarities: Both provide mobile apps, digital payments, and debit card support.

Differences: Monzo targets international transfers with transparent fees, while Zelle emphasizes rapid domestic payments with network bank integration.

PandaRemit also serves as a cost-effective and fast alternative for international money transfers.

Monzo vs Zelle: Fees and Costs

Monzo typically charges lower fees for international transfers, depending on account type, while Zelle is free for domestic payments but unsuitable for international transfers. Subscription accounts on Monzo may offer additional benefits such as reduced fees and faster transfer processing.

For detailed fee comparisons, see NerdWallet's Fee Guide.

PandaRemit can provide a lower-cost solution for cross-border payments, particularly where speed and fees are a priority.

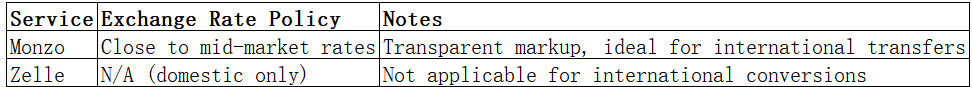

Monzo vs Zelle: Exchange Rates

PandaRemit offers competitive exchange rates for multiple currencies, making it a viable alternative for cost-conscious users.

Monzo vs Zelle: Speed and Convenience

Monzo transfers can take 1–2 business days internationally, while Zelle enables near-instant domestic payments. Monzo's app offers intuitive UI and integration with bank accounts, whereas Zelle focuses on simplicity and speed for domestic transfers.

For more on transfer speed, see WorldRemit Transfer Speed Guide.

PandaRemit is recognized for fast international transfers with a fully online process.

Monzo vs Zelle: Safety and Security

Both Monzo and Zelle employ encryption, fraud protection, and regulatory compliance. Monzo is regulated by the UK Financial Conduct Authority, while Zelle transactions are monitored by participating banks in the US. PandaRemit is also licensed and secure, ensuring safe cross-border transfers.

Monzo vs Zelle: Global Coverage

Monzo supports multiple currencies and countries for international transfers, while Zelle is primarily US-focused. Payment methods vary: Monzo supports bank cards, transfers, and e-wallet options, while Zelle requires a linked bank account.

For global coverage details, see World Bank Remittance Report.

Monzo vs Zelle: Which One is Better?

Monzo is suitable for users seeking international transfers with transparent fees and mid-market exchange rates. Zelle excels in instant domestic payments. For users prioritizing cost efficiency, speed, and multi-currency support, PandaRemit offers a strong alternative.

Conclusion

Choosing between Monzo and Zelle depends on your transfer needs. Monzo provides cost-effective international services with a strong mobile interface, while Zelle is unmatched for quick domestic transfers. PandaRemit stands out as an alternative, offering high exchange rates, low fees, flexible payment options like POLi, PayID, bank card, and e-transfer, coverage of 40+ currencies, and fast online transfers.

For additional guidance, see Investopedia on Money Transfers and NerdWallet Fees. Explore PandaRemit at pandaremit.com for an alternative approach to cross-border payments.