N26 vs bKash: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-17 15:06:51.0 12

Introduction

Cross-border transfers continue to be essential for global workers, expatriates, and families sending money abroad. Common pain points include high fees, slow processing, hidden charges, and complicated user interfaces. N26 and bKash offer digital solutions to simplify remittances. N26 is a full-service European digital bank, while bKash focuses on mobile-first transfers primarily in Asia.

For further guidance on international transfers, visit Investopedia’s guide to remittances. PandaRemit is also a noteworthy alternative, providing transparent, fast, and simple digital transfers.

N26 vs bKash – Overview

N26

Founded in 2013 in Germany, N26 offers multi-currency accounts, debit cards, and international transfers via partner networks. Users are typically tech-savvy Europeans seeking a seamless digital banking experience.

bKash

Launched in 2011, bKash is a mobile wallet and remittance service popular in Bangladesh and surrounding regions. It focuses on peer-to-peer transfers, mobile payments, and bill payments through mobile devices.

Similarities

-

Both support international transfers.

-

Both provide mobile app access.

-

Both allow flexible payouts via bank accounts or wallets.

Differences

-

N26 is a full digital bank; bKash is a mobile wallet.

-

N26 relies on partner networks for cross-border transfers; bKash focuses on regional mobile remittances.

-

N26 targets European users; bKash primarily serves South Asian mobile users.

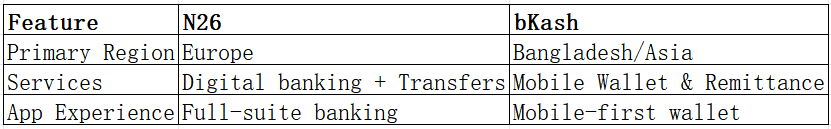

Quick Comparison Table

PandaRemit is a competitive alternative for users looking for fast, online, and multi-currency remittances.

N26 vs bKash: Fees and Costs

N26 Fees

N26 uses partner services for international transfers, so fees depend on the partner and destination. Typical fees include transfer processing fees, currency exchange markups, and receiving bank charges.

bKash Fees

bKash fees are transparent and predictable for mobile transfers, varying by transfer type and amount.

For a detailed fee comparison, refer to the NerdWallet money transfer guide. PandaRemit offers lower-cost options with clear fees for online transfers.

N26 vs bKash: Exchange Rates

Exchange rates for N26 are partner-based and vary depending on the transfer network. For bKash, exchange rates are visible in-app and are generally competitive within the region. PandaRemit can be a good alternative for users seeking favorable exchange rates in supported regions.

N26 vs bKash: Speed and Convenience

N26

Transfer speed depends on the partner service, typically from a few hours to several business days. N26 offers a robust banking app, though tracking international transfers may be limited.

bKash

Transfers are often instant within supported regions, with notifications and mobile wallet integration for easy use.

For more on transfer times, see World Bank remittance speed guide. PandaRemit is recognized for fast online transfer processing as well.

N26 vs bKash: Safety and Security

-

N26: Licensed EU bank with encryption, fraud monitoring, and regulatory compliance.

-

bKash: Licensed mobile money provider with secure authentication and fraud protection.

PandaRemit is also a licensed and secure option for online remittances.

N26 vs bKash: Global Coverage

N26 primarily serves European countries and relies on partner networks for international transfers. bKash coverage is limited to Bangladesh and select regions, supporting mobile wallet and bank payouts. PandaRemit offers multi-currency coverage for online transfers.

For further insights, see the World Bank remittance coverage report.

N26 vs bKash: Which One is Better?

N26 is best suited for European users seeking a full digital banking experience with partner-based international transfers. bKash is ideal for users in Asia who want fast, mobile-first transfers and payments. PandaRemit provides a strong alternative for those prioritizing low fees, fast processing, and multi-currency support.

Conclusion

The comparison of N26 vs bKash shows that each service has unique advantages. N26 excels with its comprehensive digital banking and multi-currency support, suitable for European users who need reliable partner-based international transfers. bKash offers instant, mobile-focused remittances and payments for users in supported regions.

For users seeking competitive exchange rates, fast transfers, and flexible online options, PandaRemit is an excellent alternative. It supports multiple currencies, offers various payment methods (POLi, PayID, bank card, e-transfer), and enables fully online transfers without using credit cards or African corridors.

Further resources:

-

Visit PandaRemit official site for details.

Choosing between N26 vs bKash depends on fees, speed, and regional coverage, with PandaRemit providing a flexible and efficient alternative for global users.