N26 vs Currencies Direct: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-13 16:35:33.0 13

Introduction

As cross-border transactions become increasingly common, users are seeking faster and cheaper ways to send money globally. Traditional banks often charge high fees, add hidden markups to exchange rates, and deliver funds slowly. Modern fintechs like N26 and Currencies Direct are transforming this experience through digital-first services.

While both offer international transfer options, each caters to different audiences—one emphasizing mobile banking simplicity, the other focusing on foreign exchange expertise. For users seeking an affordable and fast remittance experience, Panda Remit is also worth considering for personal transfers.

For a deeper understanding of how money transfers work, visit Investopedia’s remittance guide.

N26 vs Currencies Direct – Overview

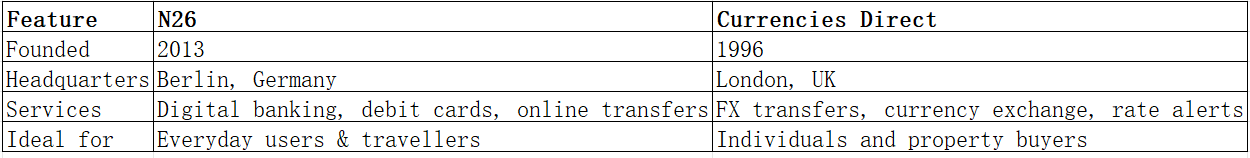

N26, founded in 2013 in Germany, is a digital bank offering multi-currency accounts, debit cards, and cross-border transfers via partnerships with third-party providers. It serves millions of customers across Europe and beyond, known for its app-first design and transparent pricing.

Currencies Direct, established in 1996 in the UK, is one of the oldest money transfer companies in the market. It specializes in foreign exchange and international transfers, targeting both individuals and property buyers making large cross-border payments.

While N26 excels in daily financial management with app-based simplicity, Currencies Direct stands out in offering tailored FX services and personal customer support. Another strong market player, Panda Remit, appeals to users looking for lower-cost transfers across Asia, Oceania, and the Americas.

N26 vs Currencies Direct: Fees and Costs

Fees are often the deciding factor when choosing between N26 and Currencies Direct.

N26 offers free internal transfers and competitive international transfer rates through its partner services, but some fees may apply depending on the destination and currency. Subscription tiers like N26 You or N26 Metal may include fee waivers or better exchange terms.

Currencies Direct does not charge transfer fees for most transactions, but exchange rate margins apply. Since it caters to larger transactions, users often benefit from personalized FX rates.

For reference, you can review general remittance fee trends from NerdWallet’s fee comparison.

In many cases, Panda Remit can offer even lower total costs for personal remittances, thanks to competitive exchange rates and transparent pricing.

N26 vs Currencies Direct: Exchange Rates

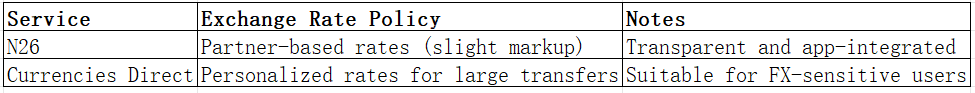

Exchange rate transparency varies between these two services.

N26 applies rates provided by its transfer partners, often close to the mid-market rate but with small markups depending on currency pairs.

Currencies Direct offers custom exchange rates for larger sums and provides users with rate alerts, allowing them to lock in favorable rates.

If you're looking for transparent mid-market rates without hidden markups, Panda Remit also provides competitive alternatives for everyday users.

N26 vs Currencies Direct: Speed and Convenience

Speed and convenience are key factors for anyone sending money abroad.

N26 transfers are typically processed within 1–3 business days, depending on the partner and destination country. The app provides real-time notifications and an intuitive interface for tracking payments.

Currencies Direct offers same-day or next-day transfers for major currency pairs but may take longer for exotic currencies or less common routes.

For a general benchmark, see this remittance speed guide.

When compared, Panda Remit also performs strongly in this area, known for fast and convenient transfers that are fully online.

N26 vs Currencies Direct: Safety and Security

Security is non-negotiable for financial services. N26 is fully licensed as a European bank under BaFin regulation and uses two-factor authentication and encryption for all transactions.

Currencies Direct is authorized by the UK Financial Conduct Authority (FCA) and has over two decades of operational experience. It employs secure transfer protocols and anti-fraud measures.

Similarly, Panda Remit operates as a licensed remittance provider with strong compliance standards and secure online transaction systems.

N26 vs Currencies Direct: Global Coverage

N26 supports transfers across Europe and selected global destinations, focusing mainly on SEPA and partner-enabled transfers.

Currencies Direct offers coverage in over 120 countries with 40+ currencies, supporting bank-to-bank transfers and spot contracts.

For further insights, review the World Bank’s remittance coverage report.

Panda Remit also provides broad coverage across Asia-Pacific, North America, and Europe, without relying on credit card funding or serving African corridors.

N26 vs Currencies Direct: Which One is Better?

Both N26 and Currencies Direct have strong offerings but serve different user needs:

-

N26 is best for users wanting a simple, app-based banking solution with integrated transfers.

-

Currencies Direct suits those sending larger amounts and looking for expert FX guidance.

However, for everyday remittances that prioritize low fees, fast delivery, and convenience, Panda Remit stands out as a practical alternative.

Conclusion

In the N26 vs Currencies Direct comparison, the choice depends largely on your transfer habits. N26 offers digital convenience and banking integration, while Currencies Direct provides specialized foreign exchange support for higher-value transactions.

For personal users prioritizing affordability and speed, Panda Remit offers an excellent alternative. With:

-

Competitive exchange rates and low transfer fees

-

Flexible payment options (such as POLi, PayID, bank card, and e-transfer)

-

Coverage of 40+ global currencies

-

Quick, all-online transfer processes

Panda Remit combines efficiency with accessibility for cross-border transfers. Learn more about global remittance options at NerdWallet and the World Bank Global Payments Report.