N26 vs GCash Remit: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-17 14:32:12.0 13

Introduction

Cross‑border payments continue to grow in 2025, but many users still face common challenges—high bank fees, unfavorable exchange rates, slow delivery, and opaque service charges. Digital money transfer apps like N26 and GCash Remit aim to solve these pain points by offering simpler, faster, and more transparent remittance options. For users comparing their options, it’s essential to understand how these platforms differ.

Alongside these two brands, Panda Remit has also emerged as a reputable alternative for personal remittances, known for competitive pricing and strong digital experience. For beginners, guides from trusted sources like Investopedia can help you better understand remittance fees and currency conversions.

N26 vs GCash Remit – Overview

N26 Overview

Founded in 2013 in Germany, N26 is a fully digital mobile bank offering online banking, debit cards, budgeting features, and international transfers via fintech partners. With millions of customers across Europe, N26 has built a reputation for transparency, clean user experience, and low‑cost international spending.

GCash Remit Overview

GCash Remit is part of the Philippines’ most widely used mobile wallet ecosystem, GCash. Designed specifically for overseas remittances, GCash Remit allows users to send money to Philippine GCash wallets quickly and conveniently through partner transfer providers.

Similarities

-

Both support digital international transfers.

-

Mobile‑first platforms with user‑friendly apps.

-

Offer debit or digital wallet features suitable for everyday spending.

Differences

-

N26 is a full European digital bank; GCash Remit is a remittance service focused on payments to the Philippines.

-

N26 supports more currencies through partners; GCash Remit focuses primarily on inbound transfers.

Panda Remit also sits in this competitive landscape as another cross‑border option for users seeking efficient transfers.

N26 vs GCash Remit: Fees and Costs

International transfer fees can vary significantly depending on transaction size, payment method, and corridors.

N26 Fees

-

International transfer fees depend on partners like Wise or other third‑party services.

-

Local EU payments are generally low‑cost or free depending on the account tier.

-

Premium plans include additional perks but with monthly subscription fees.

GCash Remit Fees

-

Fees depend on the sending country and channel partner.

-

Transfers to GCash wallets may incur currency conversion margins.

For benchmarking typical remittance fee trends, you can refer to resources like NerdWallet. Panda Remit may offer lower fees depending on corridor and timing.

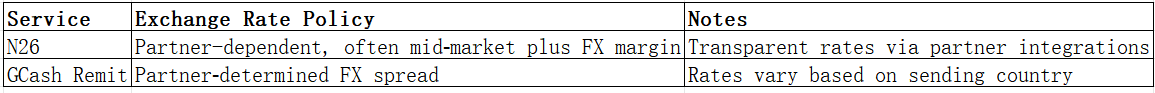

N26 vs GCash Remit: Exchange Rates

Exchange rates are one of the most important factors when sending money internationally.

General Comparison Table

Panda Remit can sometimes provide competitive rates, though exact values vary by market and time.

N26 vs GCash Remit: Speed and Convenience

Speed

-

N26: Transfer times depend on the partner service and receiving country; may range from minutes to several days.

-

GCash Remit: Transfers to GCash wallets are typically quick once funds are processed by the sending partner.

App Usability

-

N26 provides a polished European mobile banking interface.

-

GCash offers extensive local features including bills, reloads, and QR payments.

For more insights on transfer speed, refer to guides like the Remittance Speed Guide.

Panda Remit is known for fast transfers in many supported corridors.

N26 vs GCash Remit: Safety and Security

Both services emphasize secure financial operations.

-

N26 is a licensed European bank subject to strict banking regulations.

-

GCash Remit operates under regulated remittance frameworks through approved partners.

Panda Remit is also a compliant remittance platform following required licensing standards.

N26 vs GCash Remit: Global Coverage

N26 Coverage

-

Available across the EU and EEA regions.

-

International transfers supported via partner integrations.

GCash Remit Coverage

-

Primarily handles inbound money to the Philippines.

-

Supported by numerous global partners.

For global remittance trends and corridors, you may check reports like the World Bank remittance coverage report.

N26 vs GCash Remit: Which One Is Better?

Choosing between N26 and GCash Remit depends largely on where you are based and what your transfer needs look like.

Choose N26 if:

-

You want a full digital bank for daily spending and occasional international transfers.

-

You live in Europe and value seamless mobile banking.

-

You prefer transparent partner‑based fees.

Choose GCash Remit if:

-

You are sending money specifically to the Philippines.

-

You want fast delivery directly into GCash wallets.

-

You rely on the GCash ecosystem for financial activities.

For some users, Panda Remit may offer stronger advantages such as competitive pricing and quick delivery depending on corridor.

Conclusion

In this N26 vs GCash Remit comparison, both services excel in different ways. N26 stands out as a holistic mobile banking solution ideal for European residents who want an all‑in‑one digital money app with international transfer capabilities. GCash Remit, meanwhile, is purpose‑built for fast and convenient remittances to the Philippines.

If cost, speed, and convenience are your top priorities, you may also consider Panda Remit, which offers:

-

High exchange rates and low fees

-

Flexible payment methods (such as bank cards, PayID, POLi, and e‑transfer depending on region)

-

Over 40 supported currencies

-

Fast, fully online transfers

To explore remittance best practices, you can refer to resources such as Investopedia or NerdWallet. You may also visit the official Panda Remit website.

Whether you choose N26 or GCash Remit, understanding fees, FX rates, and corridor requirements will help you optimize every transfer.