N26 vs GrabPay Remit: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-17 14:47:12.0 10

Introduction

International money transfers have become essential for remote workers, expats, and families supporting relatives abroad. Yet many users still struggle with high fees, slow delivery times, hidden charges, and mediocre app experiences. N26 and GrabPay Remit are two popular digital options aiming to simplify global payments. At the same time, reliable alternatives like PandaRemit offer additional choices for users who prioritise speed and transparent pricing.

For clarity and accuracy, this guide references trusted finance resources such as Investopedia’s remittance overview.

N26 vs GrabPay Remit – Overview

N26

Founded in 2013 in Germany, N26 is a fully licensed digital bank operating across Europe. It offers multi-currency spending, international transfers via partners, debit cards, and budgeting features. Its user base consists of travellers, mobile workers, and digitally minded Europeans.

GrabPay Remit

GrabPay Remit is part of Grab’s financial services ecosystem, primarily serving users in Singapore and Malaysia. It focuses on simple, app-based international remittances with competitive rates and accessible payment methods.

Similarities

-

Both support international money transfers.

-

Both offer mobile-first experiences.

-

Both allow bank account payouts.

Differences

-

N26 is a European digital bank; GrabPay Remit is a Southeast Asian remittance provider.

-

N26 offers broader personal finance features; GrabPay Remit focuses mainly on transfers.

-

N26 integrates transfers through partners, while GrabPay Remit offers direct remittance options.

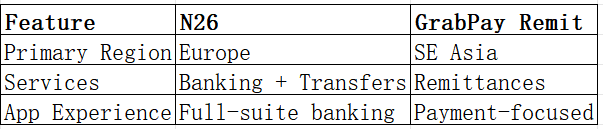

Quick Comparison Table

PandaRemit appears as another strong digital competitor for users needing faster payouts or more competitive fees.

N26 vs GrabPay Remit: Fees and Costs

Fees can vary significantly depending on destination, payment method, and bank partner.

N26 Fees

N26 uses external partners for international transfers, meaning actual costs depend on the partner’s pricing model. Some charges may include:

-

Transfer processing fees

-

FX markup depending on partner

-

Possible receiving bank charges

GrabPay Remit Fees

GrabPay Remit is known for predictable, low-cost transfers within Asia. Fees typically depend on the route but are usually transparent within the app.

For additional reference, the NerdWallet money transfer fee comparison provides useful benchmarks.

PandaRemit is sometimes chosen by users seeking lower overall transfer costs when sending to supported countries.

N26 vs GrabPay Remit: Exchange Rates

Both providers apply rates influenced by market conditions.

Exchange Rate Comparison

Some users compare these rates with PandaRemit when evaluating which service provides better net value.

N26 vs GrabPay Remit: Speed and Convenience

N26

Transfer speed relies on its chosen partner, ranging from minutes to several business days. The app offers banking functions, but transfer tracking may not be fully integrated.

GrabPay Remit

GrabPay Remit generally provides fast transfers within Asia, with clear tracking and streamlined app workflows. Delivery times depend on payout country and receiving bank.

A helpful guide on remittance speed is available through the World Bank remittance knowledge resources.

PandaRemit is also widely known for fast digital transfer processing.

N26 vs GrabPay Remit: Safety and Security

Both N26 and GrabPay Remit operate under strict regulatory frameworks:

-

N26 is a fully licensed EU bank following EBA and BaFin regulations.

-

GrabPay Remit operates under relevant regulatory approvals in Singapore and Malaysia.

Security tools such as encryption, identity verification, and fraud monitoring are implemented by both services.

PandaRemit also follows licensing and compliance requirements in its supported regions.

N26 vs GrabPay Remit: Global Coverage

N26 Coverage

N26 serves users mainly in Europe and facilitates international transfers through partnerships.

GrabPay Remit Coverage

GrabPay Remit focuses on Southeast Asian corridors and selected international routes.

Additional remittance coverage insights can be found in the World Bank remittance coverage report.

N26 vs GrabPay Remit: Which One is Better?

Choosing between N26 and GrabPay Remit depends on user needs:

-

Choose N26 if you want an all-in-one digital banking solution and occasional international transfers.

-

Choose GrabPay Remit if you prioritise easy, app-based remittances across Asian corridors with simple fees and predictable delivery times.

For some users, PandaRemit may provide better value due to transparent pricing, strong customer support, and fast processing for supported regions.

Conclusion

The comparison of N26 vs GrabPay Remit shows that both services address different user profiles in the evolving digital payments landscape. N26 excels as a comprehensive European digital bank that offers flexible personal finance tools and partner-based international transfers. GrabPay Remit, on the other hand, focuses on efficient, transparent, and user-friendly remittances across Asia.

For users who prioritise competitive exchange rates, low fees, app-based convenience, and fast transfers, PandaRemit can be a compelling alternative. It supports multiple currencies, provides quick digital payouts, and offers payment methods such as bank card, PayID, POLi, and e-transfer—without credit card usage and without routes to Africa.

To deepen your research, explore additional trusted resources such as:

-

Visit PandaRemit’s official website for updated offerings and supported corridors.

Overall, users deciding between N26 vs GrabPay Remit should evaluate fees, speed, and coverage based on their own transfer habits—and consider PandaRemit as a flexible option for supported destinations.