N26 vs iPayLinks: Which Money Transfer Service Is Better in 2025?

Benjamin Clark - 28

Introduction

Cross‑border money transfers continue to grow in 2025, yet users still face several recurring challenges—high service fees, slow delivery speeds, hidden FX markups, complex onboarding, and inconsistent customer support. As digital financial services expand, individuals compare more options to find the most cost‑effective and user‑friendly way to move money internationally.

In this article, we examine N26 vs iPayLinks, two platforms that serve different types of users. We also briefly introduce Panda Remit, a reputable remittance service known for competitive rates and fast delivery—appearing as an alternative worth considering.

For more background on remittances and digital transfers, see this guide from Investopedia.

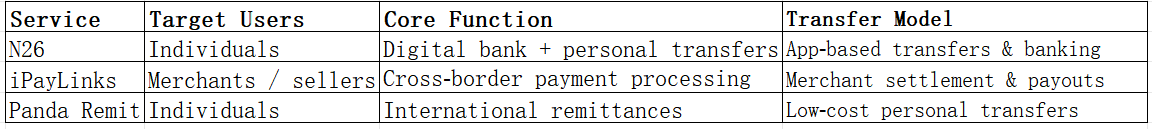

N26 vs iPayLinks – Overview

N26

Founded in 2013 in Germany, N26 is a fully digital bank providing personal accounts, debit cards, EUR payment services, and multi‑currency spending. It is widely used in Europe and valued for transparent pricing, strong mobile experience, and regulated operations.

iPayLinks

iPayLinks, founded in 2015, focuses on cross‑border acquiring, merchant payments, and settlement services. Its platform is commonly used by e‑commerce sellers and online businesses needing multi‑currency collection and international payouts.

Similarities

-

Both enable international transfers.

-

Both offer mobile‑accessible services.

-

Both support multi‑currency functions.

Differences

-

N26 targets individual users, offering personal accounts and everyday banking tools.

-

iPayLinks serves mainly merchants, with settlement and cross‑border payout services.

-

Transfer fees and structures differ significantly due to their different user bases.

-

N26 provides consumer‑oriented mobile banking, while iPayLinks offers business APIs and payment infrastructure.

Panda Remit stands as another option in the market for individuals seeking straightforward low‑cost remittances.

Quick Summary Table

N26 vs iPayLinks: Fees and Costs

N26’s fee structure is transparent for personal users, typically offering low‑cost or free EUR transfers within SEPA and competitive pricing for international transfers through partners. Subscription tiers may include additional features such as travel insurance or better FX terms.

iPayLinks fees vary according to business type, settlement currency, payout corridor, and payment volume. Its pricing is designed for merchants rather than personal users, meaning individual remittances are not the focus.

For more details on how fee structures generally compare across providers, see this overview on NerdWallet.

Panda Remit may provide lower‑cost transfers for personal use cases depending on corridor and payment method.

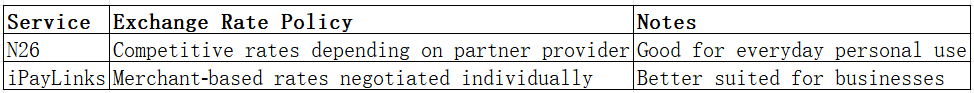

N26 vs iPayLinks: Exchange Rates

N26 typically offers competitive FX rates depending on the transfer provider used within the app. Some transfers may follow mid‑market rates with small markups.

iPayLinks applies FX conversions according to merchant settlement needs and commercial agreements. Rates vary by currency pair and business volume.

Exchange Rate Comparison Table

N26 vs iPayLinks: Speed and Convenience

N26 provides intuitive app‑based transfers, fast internal payments, and smooth integrations with mobile wallets in supported regions. International transfers depend on third‑party partners, usually completing within 1–2 business days.

iPayLinks specializes in merchant settlement, which can be fast depending on corridor and payout arrangement, though it is not designed for ad‑hoc personal remittances.

For general expectations of transfer speed, reference this remittance speed guide.

Panda Remit is known for delivering fast transfers in many supported regions.

N26 vs iPayLinks: Safety and Security

N26 is a fully licensed bank in the EU, protected by strict regulatory standards, data encryption, and fraud monitoring. User funds are safeguarded under deposit protection schemes.

iPayLinks is also regulated within its operating jurisdictions, providing enterprise‑grade security, compliance tools, and anti‑fraud systems for merchants.

Panda Remit is a licensed, compliant remittance provider following standard security and data‑protection practices.

N26 vs iPayLinks: Global Coverage

N26 operates across multiple European countries, providing IBAN accounts and card services. Currency support varies, with EUR as its core operating currency.

iPayLinks focuses on merchant coverage in Asia‑Pacific, Europe, and selected international markets, offering payout and settlement in multiple currencies based on commercial frameworks.

For broader insights into global remittance trends, see the World Bank remittance coverage report.

N26 vs iPayLinks: Which One Is Better?

The decision between N26 and iPayLinks depends on your transfer needs:

Choose N26 if:

-

You need a personal account for daily spending.

-

You want simple international transfers.

-

You prefer a modern digital bank with strong app usability.

Choose iPayLinks if:

-

You operate an online business.

-

You require merchant settlement or multi‑currency payout services.

-

You need API‑based cross‑border payment integration.

For individuals sending money to family or covering personal expenses abroad, Panda Remit may offer a smoother, lower‑cost, and fast alternative.

Conclusion

When comparing N26 vs iPayLinks, the best choice comes down to your user profile. N26 excels as a digital bank for individuals, offering transparent pricing, app‑based transfers, and a regulated banking environment. iPayLinks is designed for merchants, providing cross‑border payout capabilities and scalable settlement infrastructure.

For personal remittances, Panda Remit can be an excellent alternative—offering high exchange rates, low fees, flexible payment options like PayID, POLi, bank card and e‑transfer (excluding credit cards), and support for 40+ currencies across multiple regions. Transfers are fast and fully online, making it convenient for individuals seeking reliable overseas payments.

To explore more about digital transfers, you can refer to trusted financial resources such as Investopedia or NerdWallet. To learn about Panda Remit, visit the official website: https://www.pandaremit.com.