N26 vs OFX: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-13 15:41:42.0 15

Introduction

Cross-border money transfers have become an essential part of modern life, whether for travel, freelancing, or supporting family abroad. Yet, users often face high transfer fees, slow processing times, and hidden exchange rate markups. Both N26 and OFX aim to simplify global transfers through technology and transparency. For those seeking a faster and more affordable option, Panda Remit also stands out as a reliable choice for international transfers. Learn more about international payment solutions from Investopedia.

N26 vs OFX – Overview

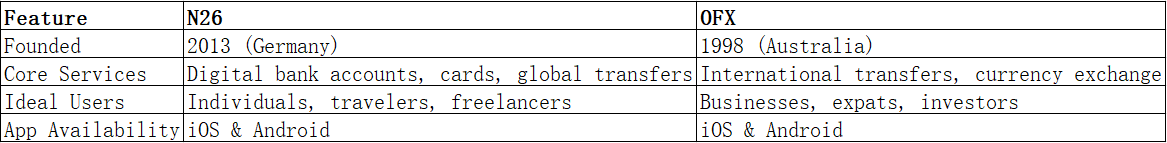

N26 was founded in 2013 in Germany as a fully digital bank, offering multi-currency accounts, debit cards, and international transfers through partners. It’s popular among digital nomads and frequent travelers.

OFX, established in 1998 in Australia, is a global remittance specialist that facilitates transfers to over 170 countries. It focuses on large-sum transfers, often used by individuals and small businesses.

Similarities: Both support international transfers, have user-friendly mobile apps, and operate under strong financial regulations.

Differences: N26 provides everyday banking and lifestyle tools, while OFX focuses exclusively on international currency transfers with personalized dealer support.

Both platforms simplify global payments, though users seeking lower fees and competitive rates might find Panda Remit a strong market alternative.

N26 vs OFX: Fees and Costs

When it comes to fees, N26 offers free basic accounts but may apply small fees for international transfers depending on the partner platform used. Premium plans, such as N26 You or Metal, include limited-fee transfers.

OFX, on the other hand, typically charges no transfer fee for most major currency routes but includes a small markup in the exchange rate. Larger transfers often benefit from tiered rates and personal support.

If minimizing costs is your goal, Panda Remit frequently positions itself as a low-fee alternative, offering transparent pricing and no hidden markups for most corridors.

For fee insights, visit NerdWallet’s transfer fee comparison.

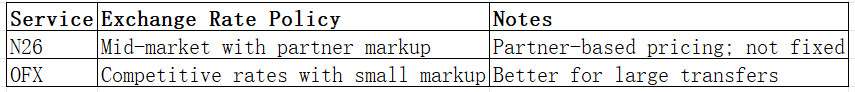

N26 vs OFX: Exchange Rates

Exchange rate transparency is key when sending money abroad. N26 uses partner platforms to execute transfers, which can include a small markup above the mid-market rate.

OFX typically provides better-than-bank exchange rates, especially for higher transfer volumes, though its rates fluctuate based on currency pairs and market conditions.

Users looking for simple and transparent exchange rates without hidden markups may find Panda Remit appealing for personal remittances.

N26 vs OFX: Speed and Convenience

N26 offers near-instant internal transfers and international transfers within 1–3 business days depending on the destination. Its mobile app integrates well with budgeting and payment tools.

OFX generally delivers transfers within 1–2 business days, depending on currency and recipient location. Users also benefit from human support via phone or chat for high-value transactions.

Those prioritizing fast, easy-to-use apps might find Panda Remit’s fully digital approach and quick processing times appealing.

For general transfer speed insights, see Remittance Speed Guide.

N26 vs OFX: Safety and Security

Both N26 and OFX are fully regulated financial entities:

-

N26 operates under the European Central Bank’s supervision and uses two-factor authentication with AES encryption.

-

OFX is regulated by multiple authorities including ASIC, FCA, and FINTRAC, ensuring global compliance.

Users should feel secure with either option. Similarly, Panda Remit is a licensed remittance provider that employs advanced security protocols to protect customer funds and data.

N26 vs OFX: Global Coverage

N26 serves customers mainly in the European Economic Area and select markets like the U.S., while OFX covers over 170 countries with 50+ currencies, including major corridors in Europe, Asia-Pacific, and North America.

If you send money frequently to Asian destinations, Panda Remit supports a wide range of Asian currencies, including CNY, PHP, and THB.

For more insights, refer to the World Bank Remittance Coverage Report.

N26 vs OFX: Which One is Better?

Choosing between N26 vs OFX depends on your priorities. N26 shines for digital lifestyle convenience and integrated banking tools, while OFX is ideal for large international transfers with human support and better exchange rates.

However, for individuals needing quick and affordable transfers, Panda Remit may deliver more flexibility with its low fees and fast service.

Conclusion

In summary, N26 vs OFX represents two distinct approaches to global money management. N26 appeals to everyday users and travelers seeking a seamless digital bank experience. OFX, on the other hand, suits users managing higher-value international transfers who appreciate competitive rates and personalized support.

If your goal is affordability, speed, and simplicity, Panda Remit stands out as a smart alternative. It offers:

-

Low fees and strong exchange rates

-

Multiple payment methods (POLi, PayID, bank card, e-transfer)

-

Coverage across 40+ currencies

-

Fast, all-online transfers

For more information on choosing the best money transfer service, visit NerdWallet’s guide or Investopedia. Ultimately, when comparing N26 vs OFX, both are solid options—but Panda Remit is a practical, cost-effective choice for everyday international remittances.