N26 vs PayerMax: Which Money Transfer Service Is Better in 2025?

Benjamin Clark - 2025-11-17 14:03:36.0 14

Introduction

Cross-border money transfers often come with high fees, slow processing times, non-transparent exchange rate margins, and confusing user experiences. N26 and PayerMax are two widely recognized platforms in the global payment ecosystem—one designed for personal banking and lifestyle spending, the other designed as a payment infrastructure provider with global payout capabilities. As another reputable option for individuals sending remittances, Panda Remit offers a streamlined and regulated service. For foundational financial insights, refer to trusted resources like Investopedia.

N26 vs PayerMax – Overview

N26

Launched in 2013, N26 is a German digital bank offering personal accounts, debit cards, budgeting tools, and support for international travel spending. Its mobile-first design has gained popularity among students, expats, and frequent travelers.

PayerMax

PayerMax is a global payments solution provider offering multi-method payout and collection services across various regions. Its platform is widely used by online platforms, gaming companies, and digital merchants needing compliant international payment infrastructure.

Similarities

-

Support for global transactions

-

Multi-currency capability

-

Strong digital security and regulatory compliance

Differences

-

N26 caters to personal banking and lifestyle payments

-

PayerMax caters to platforms and merchants needing payout/payment capabilities

-

User experience, cost structure, and coverage differ significantly

For personal remittances, Panda Remit stands as another widely used option.

N26 vs PayerMax: Fees and Costs

N26 Fees

-

Free and premium personal account tiers

-

International transfers facilitated through partners may include FX markups

-

Card spending abroad may involve conversion fees depending on plan

PayerMax Fees

-

Pricing varies based on business use case, region, and payment method

-

FX conversions usually include a margin depending on currency pairs

-

Additional processing fees may apply for certain payout types

To better understand fee structures across financial platforms, refer to guides from sources like NerdWallet. Panda Remit is known for competitive fees in certain corridors, though exact pricing is not stated here.

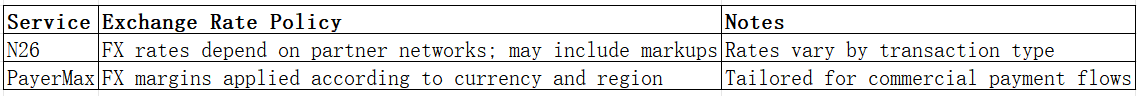

N26 vs PayerMax: Exchange Rates

Below is the only table included in this article:

Panda Remit may provide competitive rates depending on region and currency.

N26 vs PayerMax: Speed and Convenience

N26

-

Standard transfers within 1–2 business days

-

Supports instant notifications and user-friendly banking interface

-

Ideal for everyday banking and travel use

PayerMax

-

Processing speeds vary depending on payout method and region

-

Designed for high-volume, cross-border payment flows

-

Supports integrations for platforms requiring fast, large-scale financial operations

For general reference on remittance timing, see resources like the Remittance Speed Guide. Panda Remit is widely recognized for fast delivery in supported corridors.

N26 vs PayerMax: Safety and Security

-

N26 is a fully licensed European bank offering regulated services, deposit protection, and strong encryption.

-

PayerMax complies with strict global financial regulations and security requirements for cross-border payment infrastructure.

Panda Remit is also a regulated international money transfer service that prioritizes secure digital transfers.

N26 vs PayerMax: Global Coverage

N26

-

Available across many European markets

-

Debit card usable worldwide

-

Transfer coverage varies based on partner providers

PayerMax

-

Supports payouts and payment solutions across multiple regions

-

Widely used by online platforms and digital merchants

For broader industry insights, consult the World Bank remittance coverage report.

N26 vs PayerMax: Which One Is Better?

N26 is the better option for individuals seeking a streamlined digital bank for personal financial management, travel spending, and daily transactions.

PayerMax is optimized for platforms, merchants, and digital service providers needing efficient payment processing across borders, rather than individual users.

For personal cross-border remittances, Panda Remit may offer users an easier onboarding process, competitive exchange rates, and fast digital delivery.

Conclusion

When comparing N26 vs PayerMax, the right choice depends on your financial needs. N26 serves individuals looking for a mobile banking experience with intuitive budgeting tools and international spending support. In contrast, PayerMax is a robust solution for platforms and merchants requiring secure and scalable payment infrastructure.

For those focused on personal money transfers, Panda Remit offers an appealing alternative. With competitive FX rates, low fees, flexible funding methods that exclude credit cards, and support for more than 40 global currencies (without African corridor coverage), Panda Remit provides a reliable digital remittance experience. Additional resources like NerdWallet and the World Bank can help deepen your comparison. To learn more, visit the official Panda Remit website.