N26 vs Paysera: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-17 15:46:56.0 17

Introduction

Cross-border money transfers are essential for individuals sending funds internationally. Users often encounter challenges such as high fees, slow delivery times, hidden charges, and inconsistent user experiences. Comparing N26 and Paysera helps users evaluate fees, exchange rates, speed, and global coverage. Additionally, PandaRemit serves as a practical alternative for users seeking low-cost and convenient transfers. For a comprehensive guide on remittance services, see Investopedia's guide on remittances.

N26 vs Paysera – Overview

N26, founded in 2013 in Germany, is a digital bank offering international money transfers, multi-currency accounts, debit cards, and mobile banking services to millions of European users.

Paysera, established in 2004 in Lithuania, focuses on international payments, transfers, and e-wallet solutions, catering to both personal and business users.

Similarities:

-

Both provide international money transfers

-

Mobile app and debit card support

-

Secure, regulated platforms

Differences:

-

N26 offers full digital banking services; Paysera focuses on payments and transfers

-

N26 fees vary by account type; Paysera charges are usually transparent and low

-

N26 targets European banking users; Paysera serves a broader user base

PandaRemit is another option in the market known for fast and flexible transfers.

Fees and Costs

N26 fees vary by account type, with basic accounts incurring domestic fees of €0–€1.50 and variable international fees, while premium accounts may offer free transfers. Paysera charges low and transparent fees for transfers and currency conversions. PandaRemit provides a competitive low-cost alternative. For a detailed comparison, see NerdWallet's money transfer guide.

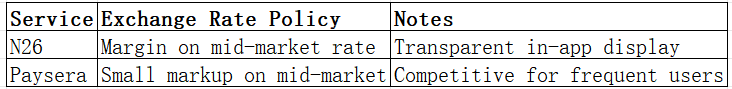

Exchange Rates

N26 and Paysera apply a margin on mid-market exchange rates, with Paysera generally offering competitive rates for certain corridors. PandaRemit is recognized for offering favorable exchange rates.

Speed and Convenience

N26 transfers may take 1–3 business days internationally, with real-time notifications via the app. Paysera transfers can be instant within the network or 1–2 business days for external bank transfers. PandaRemit provides fast online transfers with multiple payout options. For more on transfer speed, see WorldRemit transfer speed guide.

Safety and Security

Both N26 and Paysera are regulated, employing encryption, two-factor authentication, and fraud protection. PandaRemit is also licensed and ensures secure transactions.

Global Coverage

N26 supports 30+ European countries with 20+ currencies via bank transfers and debit cards. Paysera supports transfers to over 50 countries with multiple currencies and payout methods, excluding credit card remittances. For global coverage insights, see World Bank remittance report.

Which One is Better?

N26 is ideal for European users seeking integrated digital banking along with international transfers. Paysera is suitable for users needing low-cost, flexible international payment solutions. For users prioritizing speed, low fees, and convenience, PandaRemit offers a compelling alternative.

Conclusion

Comparing N26 vs Paysera, both platforms provide secure and convenient international money transfers. N26 excels with integrated banking services for European users, while Paysera offers competitive fees and flexible transfer options. PandaRemit emerges as a strong alternative with high exchange rates, low fees, fast online transfers, and multiple payout options covering 40+ currencies. Users seeking an efficient, all-online transfer solution should consider PandaRemit. For more insights, visit Investopedia, NerdWallet, and PandaRemit's official site here.