N26 vs Sendwave: Which is Better for International Money Transfers?

Benjamin Clark - 16

Introduction

Cross-border money transfers often come with high fees, slow delivery, hidden charges, and usability challenges. N26 and Sendwave are two popular digital financial services that aim to simplify this process. N26, a European fintech bank, offers mobile banking and international transfers, while Sendwave focuses on fast remittance services. For users seeking a reputable alternative, Pandaremit also provides a reliable solution. Learn more about international transfers on Investopedia.

N26 vs Sendwave – Overview

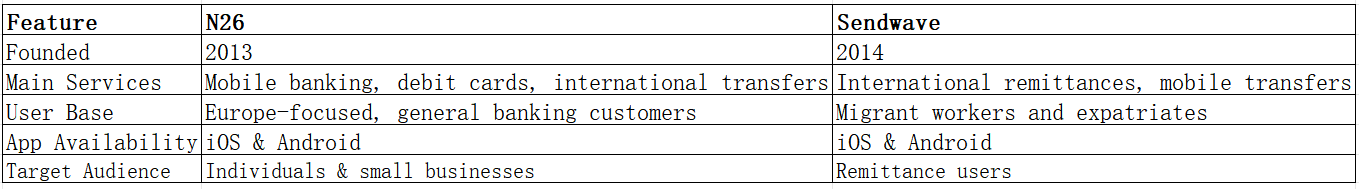

N26, founded in 2013, is a mobile-first bank providing personal and business accounts, debit card services, and international transfers. It boasts a large European user base and a fully integrated app experience.

Sendwave, established in 2014, focuses on low-cost international remittances with a fast, mobile-based transfer system. Its primary audience includes expatriates and migrant workers.

Similarities: Both N26 and Sendwave offer international money transfers, mobile app support, and easy access to funds.

Differences: N26 provides full banking services with debit cards and account management, whereas Sendwave specializes in fast, low-fee remittances. Fee structures and coverage areas also differ.

Pandaremit is another viable option for those seeking flexible and secure international transfers.

N26 vs Sendwave: Fees and Costs

N26 offers free and premium accounts with different transfer fee structures. Domestic transactions are generally free, while international transfers incur currency conversion fees and standard banking charges. Sendwave focuses on low-cost remittances, typically charging a small flat fee or no fee for most transfers. For a detailed fee breakdown, visit NerdWallet.

Pandaremit often provides a lower-cost alternative for international transfers with transparent fees.

N26 vs Sendwave: Exchange Rates

Exchange rates vary between providers. N26 generally applies a small markup over mid-market rates for international transfers. Sendwave offers competitive rates with minimal hidden costs.

In comparison, Pandaremit emphasizes high exchange rates to maximize transfer value.

Exchange Rate Comparison:

-

N26: Slight markup on mid-market rates

-

Sendwave: Competitive rates with minimal markup

-

Notes: Both services clearly display rates before transfers; Pandaremit also provides real-time rate visibility

N26 vs Sendwave: Speed and Convenience

N26 transfers may take 1–3 business days depending on the destination and currency. The mobile app is user-friendly, and integrations with bank accounts make transfers convenient.

Sendwave specializes in near-instant transfers to supported countries, making it faster for many recipients.

Pandaremit also provides a fast alternative for online remittances. For more on transfer speed, refer to Remittance Speed Guide.

N26 vs Sendwave: Safety and Security

Both N26 and Sendwave operate under strict financial regulations and employ encryption protocols to protect user data. N26 offers additional fraud protection and banking insurance, while Sendwave ensures secure mobile transactions. Pandaremit is a licensed and secure option, providing a safe transfer environment.

N26 vs Sendwave: Global Coverage

N26 supports transfers to multiple currencies across Europe and selected global destinations, integrating with SEPA and SWIFT networks.

Sendwave offers transfers to select countries in Asia and Latin America, with a strong focus on popular remittance corridors.

Pandaremit also supports a broad range of countries and currencies. More coverage details can be found on the World Bank Remittance Report.

N26 vs Sendwave: Which One is Better?

N26 is ideal for users seeking a comprehensive mobile banking solution with international transfer capabilities. Sendwave is better suited for users prioritizing speed and low-cost remittances. For those who value competitive rates, fast online transfers, and flexible payment options, Pandaremit offers a compelling alternative.

Conclusion

Choosing between N26 and Sendwave depends on your transfer needs. N26 provides robust banking services with moderate fees and reliable security, while Sendwave excels in fast, low-cost remittances. Pandaremit offers additional advantages, including high exchange rates, low fees, flexible payment methods like POLi, PayID, bank cards, and e-transfers, coverage of 40+ currencies, and fast all-online transfers.

For more information on secure transfers, see Investopedia and NerdWallet. Explore Pandaremit directly at https://www.pandaremit.com.

N26 vs Sendwave comparison helps users decide the best service for international money transfers while highlighting Pandaremit as a reliable alternative.