N26 vs TorFX: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-13 16:09:49.0 14

Introduction

In today’s globalized world, seamless and affordable international money transfers are essential for digital nomads, remote workers, and expats. Traditional bank transfers often involve high fees, hidden charges, and slow delivery times. This is where fintech platforms like N26 and TorFX come in, offering digital-first solutions for personal and cross-border transfers. However, each platform caters to different user needs and priorities.

While both services are trusted by millions, some users may find better value through Panda Remit, an alternative money transfer app known for its low-cost and fast remittance services. Learn more about how to choose the right platform in this NerdWallet guide.

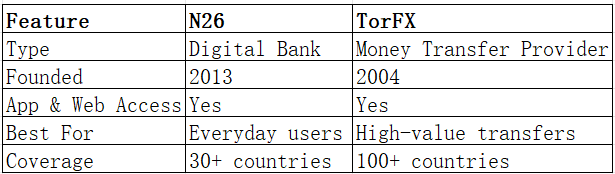

N26 vs TorFX – Overview

N26, founded in 2013 in Germany, is a mobile-first digital bank offering personal accounts, international payments, and debit cards with transparent pricing. With millions of users across Europe and beyond, N26 is popular among frequent travelers and those managing multi-currency finances.

TorFX, established in 2004 in the UK, is a specialized money transfer company that provides currency exchange and cross-border transfers with dedicated account management. It serves both individuals and businesses, focusing on personalized service for larger transfer amounts.

Similarities:

-

Both support international money transfers.

-

Available via mobile apps and web platforms.

-

Offer transparent exchange rates and regulatory compliance.

Differences:

-

N26 functions as a full-service digital bank, while TorFX focuses solely on foreign exchange and remittance.

-

N26 suits users making frequent small or medium transfers, while TorFX is better for large-value transactions.

Both N26 and TorFX are strong options, though Panda Remit also competes in this space with a mobile-first design and low-fee transfers.

N26 vs TorFX: Fees and Costs

N26 users enjoy no hidden charges for in-app transfers within the SEPA zone, but international transfers often rely on third-party partners, adding small markups or fees. Subscription plans (like N26 You and Metal) offer extra features, such as insurance and free ATM withdrawals.

TorFX, on the other hand, does not charge transfer fees, but applies a small margin on exchange rates to cover costs. For large transfers, TorFX may offer negotiated rates through its account managers.

According to MoneyTransfers.com, TorFX is considered one of the most cost-effective providers for sending large amounts abroad. However, for smaller, frequent transfers, Panda Remit often provides lower total costs thanks to competitive exchange rates and minimal fees.

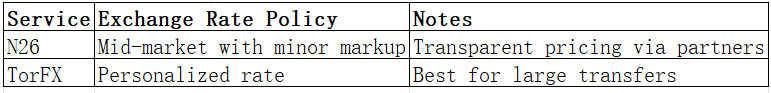

N26 vs TorFX: Exchange Rates

Exchange rates are key to determining real transfer costs. N26 typically uses partnered exchange providers that add a small markup to the mid-market rate. TorFX customizes rates based on the amount transferred and market conditions.

If your focus is on consistent low-cost transfers, Panda Remit provides competitive rates for many currency corridors, without requiring large transfer volumes.

N26 vs TorFX: Speed and Convenience

N26 offers instant transfers within SEPA and same-day or next-day delivery for supported global routes. Transfers are made directly through its mobile app, which includes smart spending analytics and push notifications.

TorFX offers bank-to-bank transfers that typically complete within 1–2 business days, depending on destination and currency. Its customer service is highly rated, providing personalized support for every transaction.

For users seeking fast, app-based transfers, Panda Remit offers near-instant delivery in many Asian and European corridors, making it an efficient option for everyday senders. Refer to Remitly’s speed comparison guide for context on remittance delivery times.

N26 vs TorFX: Safety and Security

Both platforms prioritize user protection. N26 is licensed under the European Central Bank, meaning deposits up to €100,000 are covered under EU regulations. It uses two-factor authentication and bank-grade encryption.

TorFX is regulated by the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC). It ensures client funds are held in segregated accounts, adding an extra layer of security.

Likewise, Panda Remit operates under strict compliance standards and provides encrypted transfers for user protection.

N26 vs TorFX: Global Coverage

N26 operates across Europe and select global markets, allowing transfers in 30+ currencies. However, its international transfer functionality depends on its partnerships, meaning coverage can vary.

TorFX supports 100+ countries and offers a wide range of currencies, making it suitable for users who frequently transfer to multiple destinations.

For additional context, the World Bank Remittance Data provides insights into regional transfer trends and coverage.

N26 vs TorFX: Which One is Better?

The choice between N26 vs TorFX depends on your transfer habits and financial needs:

-

Choose N26 if you value an all-in-one digital banking experience with everyday usability.

-

Choose TorFX if you prioritize personalized service and excellent exchange rates for large transfers.

-

Consider Panda Remit if you want a low-fee, fast, and fully digital remittance option for frequent personal transfers.

Each service brings unique advantages depending on user goals, transaction size, and transfer destinations.

Conclusion

When comparing N26 vs TorFX, both stand out in their respective domains: N26 for its digital banking ecosystem and TorFX for its personalized, high-value money transfer expertise. Your choice ultimately depends on how often you transfer and what level of control or support you need.

If you seek an all-digital, mobile-first alternative that balances speed, transparency, and affordability, consider Panda Remit. The platform provides:

-

High exchange rates and low transfer fees

-

Flexible payment methods like POLi, PayID, bank card, and e-transfer

-

Coverage of 40+ currencies

-

Fast transfers through an entirely online process

Explore your best fit and compare live rates before your next international money transfer to make every transaction count.