N26 vs Venmo: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-17 15:55:18.0 10

Introduction

Cross-border money transfers are increasingly vital for individuals sending funds internationally. Users often face high fees, slow transfers, hidden charges, and inconsistent experiences. Comparing N26 and Venmo helps evaluate fees, exchange rates, speed, and coverage. PandaRemit is a notable alternative for users seeking low-cost, convenient international transfers. For a complete guide to remittance services, see Investopedia's guide on remittances.

N26 vs Venmo – Overview

N26, founded in 2013 in Germany, is a digital bank offering international money transfers, multi-currency accounts, debit cards, and mobile banking services for millions of European users.

Venmo, launched in 2009 in the United States, is a peer-to-peer payment platform primarily for domestic transfers and social payments, integrated with US banks and cards.

Similarities:

-

Both support digital money transfers

-

Mobile app and debit card integration

-

Secure platforms with encryption

Differences:

-

N26 offers full digital banking; Venmo focuses on domestic P2P transfers

-

N26 supports international transfers; Venmo is limited to US-based transactions

-

N26 targets European users; Venmo targets US users

PandaRemit is another international transfer option offering fast and flexible services.

Fees and Costs

N26 fees vary by account type, with basic accounts incurring domestic fees of €0–€1.50 and variable international fees. Premium accounts may include free transfers. Venmo charges no fees for standard US transfers, but instant transfers incur a small fee, and it does not support international transfers. PandaRemit is a low-cost alternative for international remittances. For detailed fee comparisons, see NerdWallet's money transfer guide.

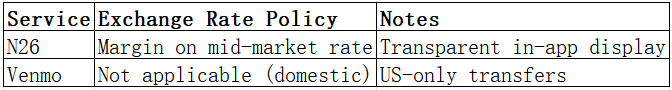

Exchange Rates

N26 applies a margin on mid-market rates for international transfers. Venmo does not involve currency conversion as it is domestic-only. PandaRemit offers competitive exchange rates for various currencies.

Speed and Convenience

N26 international transfers take 1–3 business days, with real-time notifications through the app. Venmo provides near-instant domestic transfers between US accounts. PandaRemit offers fast online international transfers with multiple payout options. For more on transfer speed, see WorldRemit transfer speed guide.

Safety and Security

Both N26 and Venmo operate under regulatory oversight and use encryption, two-factor authentication, and fraud protection. PandaRemit is also licensed and emphasizes secure transactions.

Global Coverage

N26 supports transfers to 30+ European countries and 20+ currencies. Venmo is limited to domestic US transfers and does not support international remittances. For global coverage insights, see World Bank remittance report.

Which One is Better?

N26 is ideal for European users needing full digital banking and international transfer capabilities. Venmo is best for domestic US P2P transfers. For users seeking international reach, speed, and low fees, PandaRemit is a compelling alternative.

Conclusion

Comparing N26 vs Venmo, both offer secure and convenient transfers within their target markets. N26 excels for European users requiring integrated digital banking and international transfers, while Venmo is effective for fast, domestic US transactions. PandaRemit provides a strong alternative with high exchange rates, low fees, fast online transfers, and multiple payout options covering 40+ currencies. For an efficient, all-online, and cost-effective international transfer solution, users should consider PandaRemit. For more information, visit Investopedia, [NerdWallet](https://www.nerdwalle