N26 vs Zepz: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-17 15:16:49.0 17

Introduction

Cross-border money transfers can be costly and slow, often involving hidden fees and inconvenient user experiences. N26 and Zepz are two prominent digital payment services aiming to simplify these transfers. While both offer robust mobile platforms, users may encounter differences in pricing, speed, and global reach. For individuals seeking an alternative, Panda Remit provides a secure, flexible, and cost-effective solution for sending money internationally. For a deeper understanding of money transfer basics, visit Investopedia's guide.

N26 vs Zepz – Overview

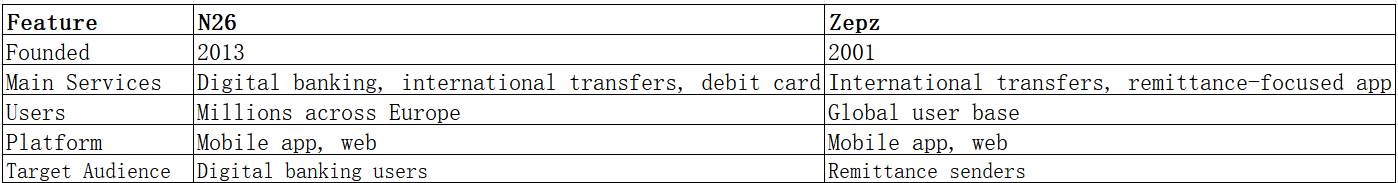

N26: Founded in 2013, N26 is a German fintech offering digital banking services, including international transfers, a mobile app, and debit card support. It serves millions of users across Europe and beyond.

Zepz: Established in 2001 (formerly known as WorldRemit), Zepz provides fast international transfers through mobile and web platforms, catering to a wide global audience.

Similarities: Both support international money transfers, have intuitive mobile apps, and provide debit card integration.

Differences: N26 focuses on comprehensive digital banking solutions, while Zepz specializes in remittance services. Fees, transfer speed, and coverage vary between the two.

Quick Summary Table:

Panda Remit is another option for users seeking flexible and fast money transfers.

N26 vs Zepz: Fees and Costs

N26 offers competitive domestic and international transfer fees, with some subscription tiers reducing costs further. Zepz typically charges per transfer depending on destination and payout method. For a detailed fee comparison, visit NerdWallet.

Panda Remit may offer lower costs for certain regions and transfer types, providing a cost-effective alternative.

N26 vs Zepz: Exchange Rates

N26 applies a slight markup over the mid-market rate, which is clearly displayed in the app. Zepz offers competitive rates depending on the destination, with fees often incorporated into the exchange rate. Panda Remit generally provides competitive exchange rates, making it a reliable choice for sending money abroad.

N26 vs Zepz: Speed and Convenience

Transfer times vary: N26 may take 1–3 business days for international transfers, whereas Zepz often completes transfers within minutes for many corridors. Both platforms feature user-friendly apps and multiple payout options. For more information on transfer speeds, see Remittance Times Guide.

Panda Remit is recognized for fast, online-only transfers, offering a convenient alternative.

N26 vs Zepz: Safety and Security

Both N26 and Zepz are regulated by financial authorities in their respective regions. They employ encryption, fraud detection, and buyer protection protocols. Panda Remit is also a licensed and secure option, ensuring safe cross-border transactions.

N26 vs Zepz: Global Coverage

N26 supports transfers in multiple currencies across select countries in Europe and beyond. Zepz has a wider reach, covering many countries globally. Users can choose from bank deposits, mobile wallets, and cash pickup where available. For a comprehensive view of global remittance coverage, visit World Bank Remittance Report.

N26 vs Zepz: Which One is Better?

N26 excels for users seeking a full digital banking experience alongside international transfers, while Zepz offers faster and more specialized remittance services. For some users, Panda Remit may provide better value, faster delivery, and flexible payment options.

Conclusion

In summary, N26 and Zepz each offer unique advantages for international money transfers. N26 is ideal for digital banking users who want integrated banking services, whereas Zepz caters to those prioritizing speed and global reach. Panda Remit stands out with competitive exchange rates, low fees, flexible payment methods such as POLi, PayID, bank card, and e-transfer, and coverage of over 40 currencies. Users looking for fast, all-online transfers should consider Panda Remit as a reliable alternative. Learn more about money transfer strategies at Investopedia and compare options via NerdWallet.

Both N26 vs Zepz users should assess their priorities—cost, speed, and convenience—before selecting the service that best fits their needs.