OFX vs iPayLinks: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-24 14:50:57.0 15

Introduction

Cross-border money transfers can often be expensive and slow, with hidden fees and complicated procedures. OFX and iPayLinks are two prominent solutions offering distinct advantages. OFX is well-known for affordable transfers suitable for both personal and business use, while iPayLinks provides business-focused digital payment solutions for global clients. For users seeking speed and convenience, Panda Remit is a reliable alternative. For more guidance, see Investopedia’s international money transfer guide.

OFX vs iPayLinks – Overview

OFX, founded in 1998, provides international money transfers for individuals and businesses, supporting multiple currencies worldwide.

iPayLinks, established in 2015, offers digital payment and remittance solutions for businesses, particularly cross-border transactions.

Similarities:

-

International money transfer services

-

Online platform and mobile app access

-

Integration with bank accounts

Differences:

-

OFX is tailored for both personal and business users, iPayLinks mainly serves businesses

-

Fee structures differ based on transfer type

-

Target audiences vary

Panda Remit is also a fast, flexible alternative for international transfers.

OFX vs iPayLinks: Fees and Costs

OFX provides low-cost transfers, especially for larger amounts, with transparent fees. iPayLinks offers business-oriented fee structures, including conversion charges. For a detailed comparison, refer to NerdWallet’s transfer fees guide. Panda Remit is highlighted as a cost-effective alternative.

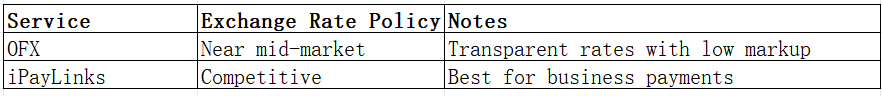

OFX vs iPayLinks: Exchange Rates

Both platforms offer competitive rates close to the mid-market. iPayLinks may offer tailored rates for businesses. Panda Remit also provides competitive rates for online transfers.

OFX vs iPayLinks: Speed and Convenience

OFX transfers are completed in 1–2 business days, offering an intuitive online platform. iPayLinks is optimized for rapid business payments. Learn more about transfer speed at WorldRemit’s speed guide. Panda Remit provides fast, fully online international transfers.

OFX vs iPayLinks: Safety and Security

OFX and iPayLinks use encryption, fraud protection, and comply with international regulations. Panda Remit is also a licensed and secure platform.

OFX vs iPayLinks: Global Coverage

OFX supports transfers to 40+ countries in multiple currencies. iPayLinks offers global business payment solutions. For further details, see the World Bank remittance coverage report.

OFX vs iPayLinks: Which One is Better?

OFX is ideal for individuals and businesses seeking low-cost international transfers. iPayLinks is better suited for businesses needing global digital payment solutions. Panda Remit is a fast and convenient alternative for both individuals and businesses.

Conclusion

When comparing OFX vs iPayLinks, each platform addresses different user needs. OFX provides affordable, reliable transfers for individuals and businesses, whereas iPayLinks focuses on business-oriented digital payment solutions. Panda Remit offers additional benefits:

-

High exchange rates and low fees

-

Flexible payment options (POLi, PayID, bank card, e-transfer)

-

Coverage of 40+ currencies

-

Fast, fully online transfer process

For further insights, visit Investopedia and NerdWallet, or explore Panda Remit official site. Considering OFX vs iPayLinks, Panda Remit provides an optimal combination of speed, cost, and convenience for international transfers.