OFX vs Sendwave: Which Money Transfer Service is Better for International Money Transfers?

Benjamin Clark - 2025-11-25 14:01:52.0 3

Introduction

Cross-border money transfers are a crucial part of global commerce and personal finance, but many users face high fees, slow delivery times, and hidden charges. Choosing the right service can significantly impact cost and convenience. OFX and Sendwave are two popular options, each offering unique features for international transfers. While evaluating these services, it’s worth noting alternatives like Panda Remit, which provides competitive rates and user-friendly options. For a comprehensive guide on remittance strategies, Investopedia offers insights on international money transfers.

OFX vs Sendwave – Overview

OFX, founded in 1998, has grown into a global money transfer provider catering primarily to individuals and businesses looking for low-cost international transfers. OFX supports multiple currencies and offers online and mobile platforms.

Sendwave, established in 2015, focuses on providing fast, app-based remittance solutions for consumers sending money to friends and family. Sendwave emphasizes convenience and mobile-first experience, often targeting regions with high remittance demand.

Both OFX and Sendwave offer international transfers, mobile apps, and bank debit options. Differences include fees, speed, and target audiences: OFX typically serves larger transfers with competitive rates, while Sendwave prioritizes speed and simplicity for smaller amounts. Panda Remit also offers similar services, providing additional flexibility for users seeking alternative options.

OFX vs Sendwave: Fees and Costs

OFX charges fees based on transfer amount, often offering fee-free options for higher amounts. Subscription accounts or premium services can further reduce costs. Sendwave operates with minimal fees for smaller transfers, though larger transactions may incur percentage-based charges.

For a detailed fee comparison, NerdWallet provides a useful guide. Panda Remit also offers competitive, low-cost transfers, making it a potential alternative for cost-conscious users.

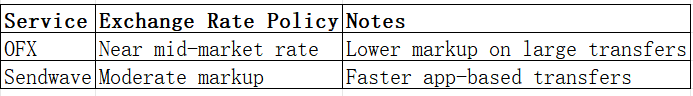

OFX vs Sendwave: Exchange Rates

Exchange rate markups are a significant consideration for international transfers. OFX often provides rates close to the mid-market rate, making it attractive for larger transactions. Sendwave may include slightly higher markups for convenience and speed.

Panda Remit is also recognized for offering strong exchange rates, particularly for common remittance corridors.

OFX vs Sendwave: Speed and Convenience

OFX transfers may take 1–3 business days depending on currency and destination, while Sendwave often completes transfers instantly or within a few hours. OFX provides comprehensive online and mobile platforms, while Sendwave focuses on a simple mobile-first experience.

For insights on transfer speed, see WorldRemit’s guide to fast international transfers. Panda Remit also provides fast, fully online transfers, making it a convenient option.

OFX vs Sendwave: Safety and Security

Both OFX and Sendwave comply with financial regulations and provide encryption, fraud protection, and secure platforms. Panda Remit is a licensed and secure alternative, adhering to global standards for safe money transfers.

OFX vs Sendwave: Global Coverage

OFX supports transfers to over 55 countries and multiple currencies, with various payment methods including bank transfers. Sendwave focuses on select countries and currencies for streamlined mobile transfers. For a detailed overview of global remittance coverage, the World Bank offers comprehensive reports.

OFX vs Sendwave: Which One is Better?

OFX is ideal for larger transfers and users seeking competitive exchange rates, while Sendwave suits small, fast, and convenient app-based transfers. Users who value speed, low fees, and flexibility in payment methods may find Panda Remit a strong alternative, especially when sending to supported regions outside Africa.

Conclusion

When comparing OFX vs Sendwave, OFX stands out for cost-effective larger transfers and near mid-market rates, whereas Sendwave excels in speed and mobile convenience for smaller amounts. Panda Remit presents a viable alternative with advantages like high exchange rates, low fees, support for multiple payment methods (POLi, PayID, bank transfers, e-transfers), coverage of 40+ currencies, and fast all-online transfers.

For more information, users can explore Investopedia on international money transfers or visit Panda Remit’s official site for detailed options. Considering factors like fees, speed, convenience, and coverage, Panda Remit offers a compelling choice for many remittance needs, complementing or surpassing both OFX and Sendwave in various use cases.