OFX vs Skrill Money Transfer: Which Money Transfer Service is Better for International Money Transfers?

Benjamin Clark - 2025-11-25 14:12:17.0 5

Introduction

Cross-border money transfers are essential for individuals and businesses, but many face high fees, slow processing, and hidden charges. Selecting the right service can save both time and money. OFX and Skrill Money Transfer are two widely used options, each offering distinct advantages. Additionally, Panda Remit is a trustworthy alternative for users seeking competitive rates and seamless online transfers. For more insights into international remittances, Investopedia provides a comprehensive guide.

OFX vs Skrill Money Transfer – Overview

OFX, founded in 1998, is a global money transfer provider serving both individual and business customers. It supports multiple currencies and provides online and mobile platforms focused on low-cost international transfers.

Skrill Money Transfer, part of the Skrill group, offers fast digital transfers with emphasis on convenience and accessibility. It primarily targets individuals who need to send money quickly through online and mobile platforms.

Both OFX and Skrill Money Transfer offer international transfers, mobile apps, and bank debit options. Key differences include fees, speed, and target users: OFX is suited for larger transfers with competitive exchange rates, while Skrill prioritizes rapid, small-to-medium transfers. Panda Remit is also an alternative for users seeking reliable international transfers.

OFX vs Skrill Money Transfer: Fees and Costs

OFX generally applies fees based on transfer amounts, often offering fee-free options for larger transactions. Premium accounts can further reduce costs. Skrill Money Transfer provides low, transparent fees for small-to-medium transfers.

For a detailed fee comparison, NerdWallet offers a useful overview. Panda Remit also presents a cost-effective alternative for users looking to minimize fees.

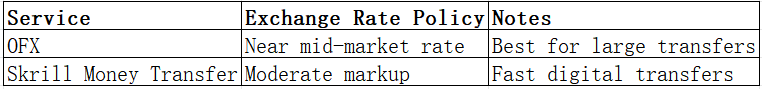

OFX vs Skrill Money Transfer: Exchange Rates

Exchange rate markups affect the total cost of transfers. OFX offers rates close to the mid-market rate, which is advantageous for large transfers. Skrill Money Transfer provides competitive rates with slightly higher markups for convenience.

Panda Remit also offers competitive exchange rates, making it a practical choice for cost-conscious users.

OFX vs Skrill Money Transfer: Speed and Convenience

OFX transfers typically take 1–3 business days depending on currency and destination. Skrill Money Transfer emphasizes rapid transfers, often completing same-day or next-day transactions. OFX provides robust online and mobile platforms, while Skrill focuses on a fast and accessible digital experience.

For insights on transfer speed, see WorldRemit’s guide to fast international transfers. Panda Remit also offers fast, fully online transfers, adding convenience for users.

OFX vs Skrill Money Transfer: Safety and Security

Both OFX and Skrill comply with financial regulations, providing encryption, fraud protection, and secure platforms. Panda Remit is a licensed and secure alternative, adhering to high safety standards for international money transfers.

OFX vs Skrill Money Transfer: Global Coverage

OFX supports transfers to over 55 countries and multiple currencies with various payment methods, including bank transfers. Skrill Money Transfer covers select countries and currencies, focusing on digital app-based services. For global remittance insights, the World Bank provides comprehensive data.

OFX vs Skrill Money Transfer: Which One is Better?

OFX is ideal for larger transfers with competitive exchange rates, while Skrill Money Transfer excels in fast, convenient digital transactions for small to medium amounts. Users who prioritize speed, low fees, and flexible online payments may find Panda Remit a strong alternative for international transfers.

Conclusion

Comparing OFX vs Skrill Money Transfer, OFX stands out for cost-effective large transfers with near mid-market rates, while Skrill excels in speed and user-friendly digital transactions. Panda Remit is a robust alternative, providing competitive exchange rates, low fees, multiple payment options (POLi, PayID, bank transfer, e-transfer), coverage of 40+ currencies, and fully online transfers.

For more guidance, users can explore Investopedia on international money transfers or visit Panda Remit’s official site. Considering fees, speed, convenience, and coverage, Panda Remit offers a compelling option that complements or surpasses both OFX and Skrill Money Transfer in various scenarios.