PayerMax vs PandaRemit: Fees, Speed, Security & Coverage Compared

Benjamin Clark - 2025-09-29 09:24:23.0 39

Introduction

International remittances are a vital part of today’s financial ecosystem. According to Wikipedia, remittances involve transferring money across borders, often by migrant workers, international students, or businesses. Both PayerMax and PandaRemit are recognized players in this field. In this article, we will break down PayerMax vs PandaRemit across key factors such as fees, exchange rates, speed, security, and global coverage to help you determine which service suits your situation best.

Fees and Costs

When choosing a remittance platform, transfer fees and hidden charges are often the first concern.

-

PayerMax: Primarily focused on enterprise payments and digital wallet solutions. Fee structures vary by country, partner banks, and transaction type, making them less transparent for individual users.

-

PandaRemit: Tailored for personal transfers, offering clear and transparent fees. In many regions, it even supports zero-fee transfers, making it more affordable for individuals and families.

Exchange Rates

Exchange rates directly determine how much the recipient receives.

-

PayerMax: Relies on partner banks and settlement channels for exchange rates, which can fluctuate and lack full transparency.

-

PandaRemit: Provides near real-time mid-market rates and offers a calculator on its official site https://www.pandaremit.com to show users exactly how much will arrive before making a transfer.

Speed and Convenience

Transfer speed is a critical factor in user experience.

-

PayerMax: Designed mainly for enterprise settlements, personal transfers may take 1–3 business days depending on banking partners and compliance checks.

-

PandaRemit: Known for its fast transfers, with some corridors delivering funds in minutes and most transactions completing within 24 hours—ideal for personal or family remittances.

Safety and Security

Security and compliance are non-negotiable in cross-border payments.

-

PayerMax: Holds multiple regulatory licenses across regions, with a strong focus on enterprise payment security.

-

PandaRemit: Licensed in multiple countries, using bank-level encryption to protect transactions for individual users. For more about financial safety in transfers, check ConsumerFinance.gov.

Global Coverage (Countries and Payment Methods)

Coverage and flexibility in payment methods are essential considerations.

-

PayerMax: Strong presence in Asia, the Middle East, and Africa, primarily serving businesses.

-

PandaRemit: Supports 40+ countries worldwide with flexible payment options including bank transfers, e-wallets, and mobile payments, making it more accessible for personal users.

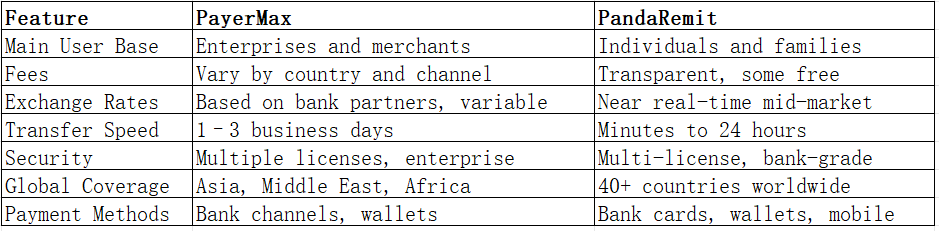

Comparison Table

For more details, visit:

-

PayerMax official site: https://www.payermax.com

-

PandaRemit official site: https://www.pandaremit.com

Which One Is Better?

The choice between PayerMax vs PandaRemit depends largely on your needs:

-

For businesses handling enterprise-level settlements, PayerMax provides robust infrastructure.

-

For individuals such as students, overseas workers, or families needing fast and affordable remittances, PandaRemit stands out with its transparent fees, fast transfers, and user-friendly services.

Conclusion

Overall, PayerMax vs PandaRemit shows a clear difference in target audiences and service focus. PayerMax is better suited for enterprises and merchants managing complex payment networks, while PandaRemit caters to individuals and families seeking a simple, affordable, and secure way to send money across borders.

If you’re looking for a safe and efficient personal remittance platform, you can explore PandaRemit directly at:

https://www.pandaremit.com