Payment methods in Malaysia: How to receive money in Malaysia

Benjamin Clark - 2025-09-26 09:46:04.0 15

Introduction

Malaysia is one of Southeast Asia’s most vibrant economies, with a diverse population and a rapidly digitizing financial sector. For locals and expatriates alike, having access to reliable payment methods is crucial for daily transactions. At the same time, many families rely on remittances from abroad, making it important to know the best ways to receive money securely.

This guide explores the most popular payment methods in Malaysia and highlights PandaRemit as a trusted solution for receiving international transfers.

Why Payment Methods Matter in Malaysia

Malaysia has a growing digital economy where e-commerce, tourism, and remittances all play a major role. While cash remains widely used, especially in rural areas, mobile wallets and online banking are becoming increasingly dominant. Having access to convenient and secure payment methods ensures smoother daily life and makes international financial connections easier.

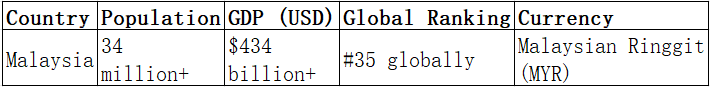

Country Overview

Main Local Payment Methods in Malaysia

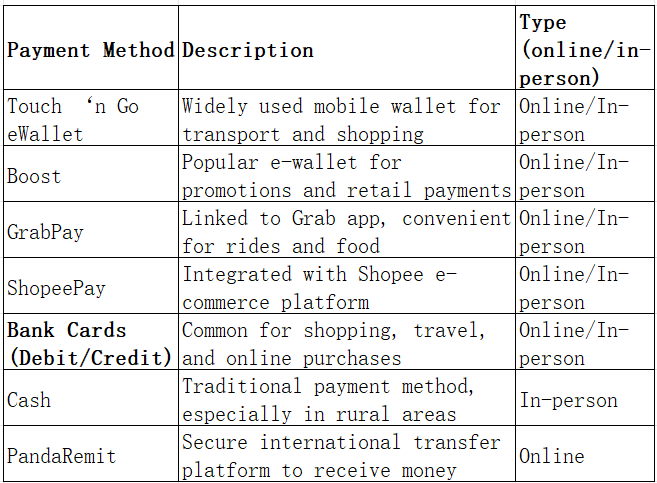

Malaysia’s domestic payment landscape includes both traditional and digital options:

-

Mobile Wallets (Touch ‘n Go eWallet, Boost, GrabPay, ShopeePay)

Popular among younger users and urban residents, these wallets are widely used for transport, shopping, and bill payments. -

Bank Cards (Debit and Credit Cards)

Debit cards are frequently used for everyday purchases and ATM withdrawals, while credit cards are more common for online shopping and travel. -

Cash

Still widely used, particularly in rural areas and small businesses, though urban areas are increasingly cashless.

Receiving International Transfers in Malaysia

There are several common ways to receive money from abroad:

-

Bank Wire Transfers: Secure but slow, with higher transaction fees.

-

Money Transfer Companies (Western Union, MoneyGram): Require cash pickup at agent locations, which may not always be convenient.

-

Digital Transfer Platforms: Faster, cheaper, and more user-friendly.

Among digital options, PandaRemit is highly recommended. It offers low fees, quick transfers, and 24/7 service, making it easy for users in Malaysia to securely receive international remittances directly into their bank accounts.

How to Pay and Receive in Malaysia (Table)

FAQ

1. Is PayPal available in Malaysia?

Yes, PayPal is available and often used for online shopping and cross-border e-commerce.

2. Are credit cards widely accepted in Malaysia?

Yes, especially in urban areas, shopping malls, and online platforms.

3. Do people in Malaysia still use cash?

Yes, cash is still common in small businesses and rural areas, though digital payments are increasing.

4. How can foreigners or family abroad send money to Malaysia?

They can use bank transfers, money transfer services, or digital platforms like PandaRemit for faster, lower-cost transfers.

5. How can I receive money via PandaRemit in Malaysia?

Register with PandaRemit, link your Malaysian bank account, share details with the sender, and receive money quickly and securely.

Conclusion

Malaysia’s payment methods are evolving rapidly, with mobile wallets and online banking gaining ground while cash remains in use.

For those who need to receive money from abroad, PandaRemit offers a secure, fast, and low-cost solution. It eliminates the hassle of traditional remittance services and ensures money reaches you efficiently.

👉 Try PandaRemit today and enjoy stress-free international transfers in Malaysia!