Payment methods in the Philippines: How to receive money in the Philippines

Benjamin Clark - 2025-09-26 09:51:12.0 11

Introduction

The Philippines is a fast-growing economy in Southeast Asia, with millions of citizens working overseas and sending money back home. For Filipinos, both domestic payment convenience and reliable ways to receive international remittances are essential to everyday life.

This guide explores the most popular payment methods in the Philippines, and shows how PandaRemit offers a secure and cost-effective way to receive international transfers.

Why Payment Methods Matter in the Philippines

The Philippines has a highly cash-driven economy, but digital adoption is accelerating. With a large population relying on remittances—accounting for nearly 10% of the country’s GDP—efficient payment systems are critical. Payment methods impact daily transactions, e-commerce growth, and the ability of families to access funds sent from abroad.

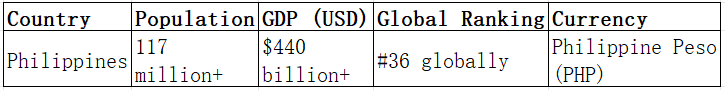

Country Overview

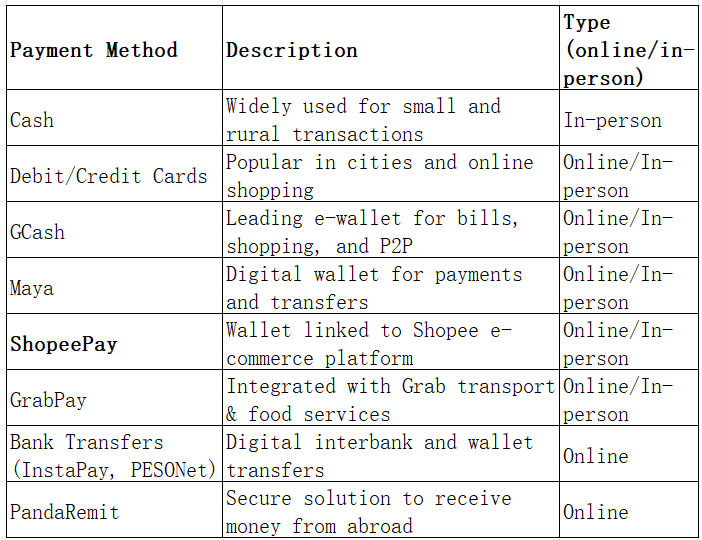

Main Local Payment Methods in the Philippines

The Philippines offers a mix of traditional and modern payment solutions:

-

Cash

Still dominant in rural areas and small businesses. Around 70% of retail transactions involve cash. -

Bank Cards (Debit and Credit)

Debit cards are commonly linked to payroll accounts, while credit cards are popular in urban areas and online shopping, though penetration remains relatively low. -

Mobile Wallets (GCash, Maya, ShopeePay, GrabPay)

Extremely popular for bills, shopping, and peer-to-peer transfers. GCash leads with millions of active users. -

Bank Transfers (InstaPay, PESONet)

Widely used for domestic transfers between banks and digital wallets.

Receiving International Transfers in the Philippines

Filipinos commonly receive money from overseas through:

-

Bank Wire Transfers – Reliable but often slow and with high fees.

-

Money Transfer Operators (Western Union, Cebuana Lhuillier, Palawan Express) – Allow cash pickup, but require in-person visits.

-

Digital Transfer Platforms – Faster and cheaper, allowing direct bank or wallet credits.

PandaRemit is an excellent solution for receiving international remittances. With competitive exchange rates, low fees, and quick processing, PandaRemit enables Filipinos to receive money securely into their bank accounts or wallets without hassle.

How to Pay and Receive in the Philippines (Table)

FAQ

1. Is PayPal available in the Philippines?

Yes, PayPal is available and widely used for online purchases and international freelancing payments.

2. Are credit cards widely accepted in the Philippines?

Yes, especially in urban areas and large retail stores, but many smaller merchants still prefer cash.

3. Do people still use cash in the Philippines?

Yes, cash is still heavily used, especially in rural areas and small transactions, though wallets like GCash are rapidly growing.

4. How can foreigners or family abroad send money to the Philippines?

They can use banks, money transfer operators, or digital platforms like PandaRemit for faster, lower-cost options.

5. How can I receive money via PandaRemit in the Philippines?

Simply create a PandaRemit account, link your local bank or wallet, share details with the sender, and receive funds securely.

Conclusion

The Philippines has a diverse payment landscape, with cash still common but digital wallets and bank transfers quickly growing.

For receiving international transfers, PandaRemit is one of the most reliable and affordable options, ensuring secure, fast, and low-cost transactions directly to your preferred account or wallet.

👉 Start using PandaRemit today and experience stress-free international money transfers in the Philippines!