Payment methods in Thailand: How to receive money in Thailand

Benjamin Clark - 2025-09-26 09:37:44.0 19

Introduction

Thailand is one of Southeast Asia’s most dynamic economies and a popular hub for tourism, business, and migration. For locals, expatriates, and families, having reliable payment methods is essential not only for daily life but also for receiving international remittances.

This article explores the most common payment methods in Thailand and highlights PandaRemit as a secure and convenient way to receive money from abroad.

Why Payment Methods Matter in Thailand

Thailand is in the middle of a digital transformation. While cash is still widely used, mobile wallets and bank cards are gaining strong traction. Efficient payment methods ensure smooth daily transactions, while reliable international transfer solutions make it easier for families to stay financially connected across borders.

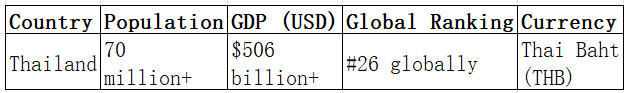

Country Overview

Main Local Payment Methods in Thailand

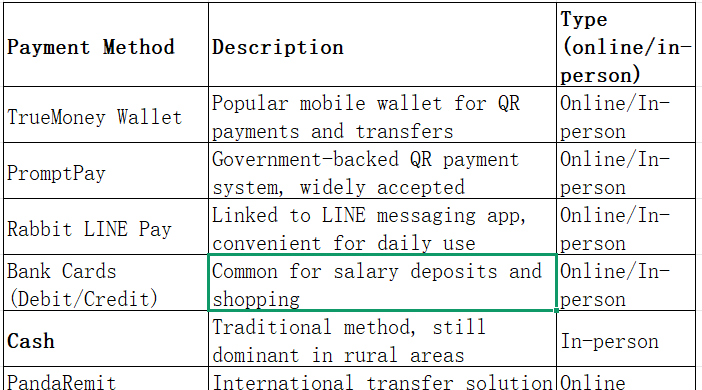

Thailand’s payment ecosystem is diverse, combining traditional cash with modern digital methods:

-

Mobile Wallets (TrueMoney Wallet, PromptPay, Rabbit LINE Pay)

Extremely popular among younger generations and urban residents. These wallets allow QR code payments, online purchases, and peer-to-peer transfers. -

Bank Cards (Debit and Credit Cards)

Debit cards are common for salary payments and shopping. Credit cards are widely used in large cities and tourist areas, though mobile wallets are overtaking them in popularity. -

Cash

Still the dominant payment method, especially in rural regions and for small transactions.

Receiving International Transfers in Thailand

Common ways to receive money from abroad include:

-

Bank Wire Transfers: Reliable but often slow and expensive.

-

Money Transfer Companies (e.g., Western Union, MoneyGram): Require recipients to collect cash at physical locations, which is not always convenient.

-

Digital Money Transfer Platforms: Offer faster, cheaper, and more transparent transfers.

Among these, PandaRemit stands out as a trusted choice for people in Thailand. With low fees, fast transfers, and Thai language support, PandaRemit makes it easy to securely receive funds directly from overseas.

How to Pay and Receive in Thailand (Table)

FAQ

1. Is PayPal available in Thailand?

Yes, PayPal is available but limited in scope, mainly used for cross-border e-commerce.

2. Are credit cards widely accepted in Thailand?

Yes, especially in urban centers and tourist areas, but mobile wallets are more commonly used for everyday transactions.

3. Do people in Thailand still use cash?

Yes, cash is still widely used, particularly in rural areas and for small payments.

4. How can foreigners or family abroad send money to Thailand?

They can use traditional bank transfers, money transfer companies, or faster and cheaper digital platforms like PandaRemit.

5. How can I receive money via PandaRemit in Thailand?

Simply register with PandaRemit, link your Thai bank account, share the details with the sender, and receive funds quickly and securely.

Conclusion

Thailand’s payment ecosystem is evolving rapidly. While cash remains prevalent, mobile wallets and cards are becoming the standard for urban and digital-savvy users.

For those needing to receive money from abroad, PandaRemit provides a secure, fast, and low-cost solution—making it one of the best ways to handle international remittances in Thailand.

👉 Try PandaRemit today and experience seamless money transfers in Thailand!