PaySend vs Payoneer: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-10 11:33:46.0 17

Introduction

International money transfers are essential for freelancers, expats, and global businesses. Yet, users often face high fees, hidden charges, slow processing times, and confusing platforms. Choosing the right provider can save both money and time.

In this comparison, we explore PaySend vs Payoneer, highlighting their features, costs, and usability. For those seeking alternatives, PandaRemit offers competitive solutions for cross-border transfers. For further guidance on remittance options, see Investopedia's guide on international money transfers.

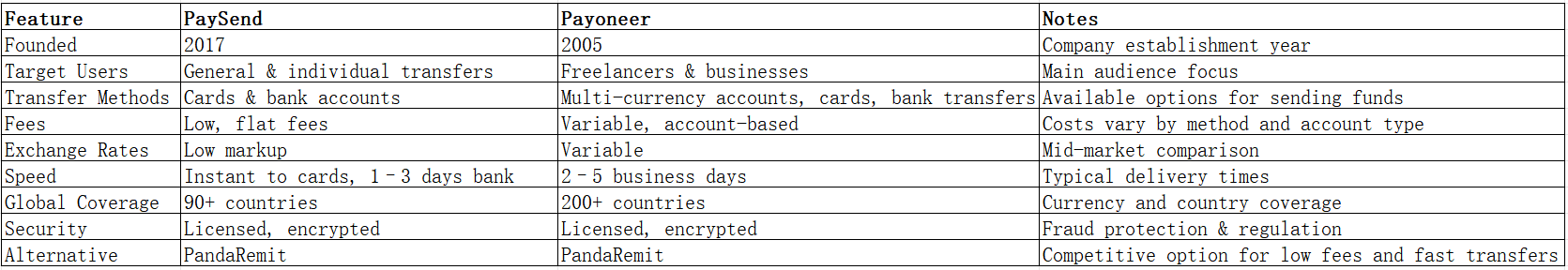

PaySend vs Payoneer – Overview

PaySend, founded in 2017, focuses on low-cost international money transfers using cards and bank accounts, serving millions of users globally.

Payoneer, established in 2005, caters mainly to freelancers, online sellers, and businesses, providing cross-border payments, multi-currency accounts, and debit card support.

Both platforms offer international transfers, mobile apps, and card support, but they differ in target audience and fee structure. PaySend emphasizes straightforward, low-fee transfers, while Payoneer is more tailored for business and freelance payments with multi-currency management. PandaRemit is another option offering competitive transfers and flexible payment methods.

PaySend vs Payoneer: Fees and Costs

PaySend charges low, flat fees for most international transfers, while Payoneer's fees vary depending on transfer method, currency, and account type. Domestic transfers are minimal for both, but Payoneer’s account-based fees may be higher for certain cross-border transactions.

Users seeking lower overall costs may consider PandaRemit. For a detailed fee breakdown, see NerdWallet's money transfer fee comparison.

PaySend vs Payoneer: Exchange Rates

PaySend generally applies small markups over the mid-market rate, ensuring predictable costs.

Payoneer may offer slightly less favorable rates depending on currency pairs and transfer methods. PandaRemit is often noted for competitive exchange rates.

PaySend vs Payoneer: Speed and Convenience

PaySend transfers are often instantaneous to card accounts and take 1–3 business days to bank accounts.

Payoneer transfers may vary, typically 2–5 business days. Both platforms have mobile apps, while Payoneer integrates additional business tools. PandaRemit offers fast, fully online transfers.

For insights on remittance speed, see WorldRemit’s guide to transfer times.

PaySend vs Payoneer: Safety and Security

Both PaySend and Payoneer operate under strict financial regulations, using encryption, fraud detection, and buyer protection measures.

PandaRemit is also a licensed, secure service.

PaySend vs Payoneer: Global Coverage

PaySend supports transfers to over 90 countries, focusing on major currencies and card-to-card or bank transfers.

Payoneer covers 200+ countries and multiple currencies, with emphasis on business payments. PandaRemit provides extensive coverage but excludes African regions and does not support credit card funding.

For more information, see the World Bank remittance coverage report.

PaySend vs Payoneer: Which One is Better?

For individuals prioritizing low fees and simplicity, PaySend is often the better choice.

For freelancers and businesses needing multi-currency accounts and integration tools, Payoneer provides greater flexibility. Users looking for a fast, low-cost alternative with diverse payment options might find PandaRemit advantageous.

Conclusion

In summary, the PaySend vs Payoneer comparison highlights distinct advantages: PaySend offers straightforward, low-cost transfers, while Payoneer provides multi-currency solutions for business needs.

PandaRemit serves as a strong alternative, delivering high exchange rates, low fees, flexible payment methods like POLi, PayID, bank card, and e-transfer, coverage for 40+ currencies, and fast, fully online transfers.

For further guidance, check Investopedia on cross-border transfers and NerdWallet's remittance comparison. Learn more about PandaRemit at pandaremit official site. Choosing the right platform depends on your priorities, whether cost, speed, or convenience, making PandaRemit an appealing option alongside PaySend and Payoneer.