PaySend vs N26: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-10 10:23:31.0 7

Introduction

As global lifestyles become increasingly connected, international money transfers have become part of daily life for students, freelancers, and expatriates. Yet, users still face pain points like high fees, slow transactions, and hidden costs. This is where fintech services like PaySend and N26 step in. Both platforms aim to simplify cross-border transfers and digital payments. But which is better in 2025?

In this detailed comparison of PaySend vs N26, we’ll explore key differences in pricing, exchange rates, and convenience. For users seeking a trusted and low-cost alternative, Panda Remit also offers fast and affordable transfers across multiple regions. For a general guide on how international remittances work, see Investopedia’s overview.

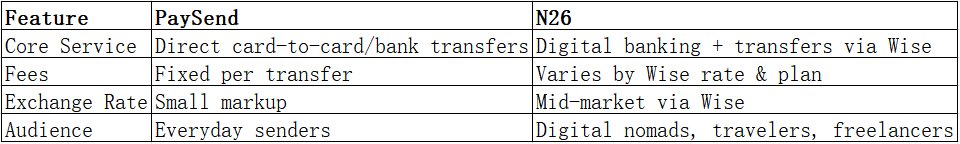

PaySend vs N26 – Overview

PaySend was launched in 2017 in the UK and quickly became known for its fixed-fee card-to-card international transfers. With coverage in 170+ countries, PaySend focuses on convenience and transparency, allowing users to send money directly to cards or bank accounts worldwide.

N26, founded in 2013 in Germany, is a fully digital bank offering financial services such as personal banking, debit cards, and international money transfers through partnerships like Wise. N26 users benefit from a seamless in-app experience and a multi-currency approach suited for travelers and professionals abroad.

Similarities

-

Both provide mobile-first platforms.

-

Offer international transfers and currency support.

-

Focus on simplicity and modern UX design.

Key Differences

Panda Remit stands as another solid choice, providing a specialized remittance solution with a focus on low fees and fast digital processing.

PaySend vs N26: Fees and Costs

PaySend is known for its transparent pricing — a fixed fee (around $2 per transaction), regardless of transfer amount or destination. This makes it ideal for predictable transfers and smaller amounts.

N26, through its Wise integration, calculates fees based on destination, currency, and transfer amount. While this model offers flexibility and transparency, the total cost may vary depending on exchange fluctuations and subscription level.

For budget-conscious users, Panda Remit tends to offer lower fees overall, especially for transfers between Asia-Pacific and Europe.

For additional insights into typical transfer fees, refer to NerdWallet’s comparison guide.

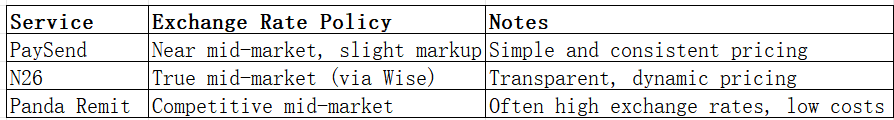

PaySend vs N26: Exchange Rates

Exchange rates can make a big difference in how much your recipient receives. PaySend generally provides rates close to the mid-market with a minimal markup. N26, by using Wise’s infrastructure, delivers true mid-market exchange rates with a transparent fee structure.

In practice, Panda Remit often offers favorable exchange rates, maximizing the recipient’s amount with clear cost visibility.

PaySend vs N26: Speed and Convenience

Speed and usability are crucial when sending money internationally. PaySend transfers are typically instant or completed within minutes, depending on the recipient’s country and payment method. Its straightforward app interface makes sending funds simple, even for first-time users.

N26, as a full-service digital bank, offers broader functionality, including savings, budgeting tools, and spending analytics. However, since it relies on Wise for transfers, delivery times can vary between minutes and 2 business days.

If your top priority is speed and simplicity, Panda Remit provides fast, all-digital transfers that are often completed within hours for supported corridors.

For context on transfer time variability, review this remittance speed report.

PaySend vs N26: Safety and Security

Both PaySend and N26 are regulated by reputable financial authorities in Europe. PaySend is authorized by the UK Financial Conduct Authority (FCA), while N26 operates under a full European banking license from BaFin in Germany. Both employ advanced security features, including 3D Secure authentication, encryption, and anti-fraud monitoring.

Likewise, Panda Remit is a licensed and compliant platform that uses advanced encryption and secure verification measures to protect users and ensure compliance with international transfer regulations.

PaySend vs N26: Global Coverage

PaySend supports transfers to over 170 countries across Europe, Asia, and the Americas, providing solid global coverage. N26, while limited to countries where it operates banking services (primarily in Europe), allows international transfers worldwide through Wise.

Panda Remit, by comparison, supports over 40 currencies and multiple payout methods, including local bank transfers, PayID, and POLi. While it does not operate in Africa or accept credit card remittances, it offers wide coverage across key global regions.

For additional context, see the World Bank’s remittance coverage report.

PaySend vs N26: Which One is Better?

Ultimately, the choice between PaySend vs N26 depends on your priorities:

-

Choose PaySend for simple, low-cost, and fast international transfers.

-

Choose N26 if you want a comprehensive digital banking experience with integrated transfer options via Wise.

Both services are reliable, transparent, and secure. However, if you’re focused on minimizing costs and maximizing speed, Panda Remit may be the better fit.

Conclusion

In the PaySend vs N26 comparison, both platforms shine in different areas. PaySend stands out for its fixed fees and rapid card-to-card transfers, while N26 excels with its digital banking ecosystem and Wise-powered exchange rates.

However, for users seeking a streamlined, cost-effective, and fast money transfer experience, Panda Remit remains an outstanding alternative. It offers:

-

Competitive exchange rates with low fees

-

Fast, fully online transfers

-

Support for 40+ currencies

-

Multiple payment options like POLi, PayID, bank cards, and e-transfer

For more insights into digital remittance trends, explore Forbes’ international money transfer guide and Remitly’s online remittance overview.

By understanding the strengths and differences between PaySend, N26, and Panda Remit, you can confidently choose the most efficient way to send money internationally in 2025.