PaySend vs OFX: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-10 10:51:05.0 8

International money transfers have become essential for millions of users worldwide, from overseas workers supporting their families to students paying tuition abroad. However, users often face challenges like high bank fees, slow delivery, and hidden exchange rate markups. In 2025, both PaySend and OFX stand out as leading digital transfer platforms offering more transparent and affordable services.

Still, some users prefer newer platforms like Panda Remit, known for its fast processing and user-friendly interface. To better understand how these providers differ, let’s break down their offerings. (Source: Investopedia guide on money transfers)

PaySend vs OFX – Overview

PaySend was founded in 2017 in the UK and quickly gained popularity for allowing users to send money directly to cards in over 170 countries. It offers instant transfers, transparent fees, and a strong mobile app experience, catering especially to personal remittances.

OFX, on the other hand, was founded in 1998 in Australia and has long been a leader in large international business and personal transfers. It focuses on low-cost foreign exchange services and supports high-value transactions across 50+ currencies.

Similarities:

-

Both offer global money transfers.

-

Transparent exchange rate policies.

-

User-friendly online and app platforms.

Differences:

-

PaySend targets individuals needing quick personal transfers.

-

OFX serves both individuals and businesses, often handling large transfers with better rates for higher amounts.

If you’re looking for an alternative that blends speed and affordability, Panda Remit offers competitive rates with a fully online experience.

PaySend vs OFX: Fees and Costs

PaySend charges a fixed low transfer fee (usually around $1.50 or equivalent), making it ideal for small to medium personal transfers. The total cost is displayed upfront in the app, offering full transparency.

OFX, meanwhile, does not charge fixed transfer fees but applies a small margin to exchange rates, which varies depending on currency and amount. This makes OFX better suited for large transfers, as percentage-based margins tend to result in smaller relative costs at higher volumes.

If minimizing costs is your top priority, Panda Remit may offer lower overall fees, particularly for smaller personal remittances. (See fee comparison insights from NerdWallet)

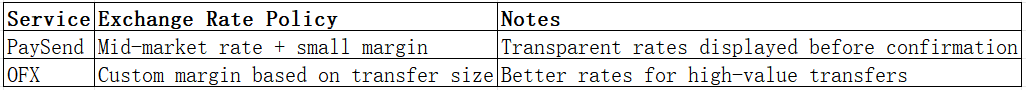

PaySend vs OFX: Exchange Rates

Both providers offer competitive exchange rates, though their models differ.

While both platforms avoid hidden markups, PaySend is better for small, fast transfers, whereas OFX benefits users transferring thousands of dollars.

For those seeking a balance between affordability and speed, Panda Remit offers consistently competitive rates on everyday remittances.

PaySend vs OFX: Speed and Convenience

PaySend specializes in instant or same-day transfers, especially for card-to-card payments. Its mobile app is intuitive, and users can track payments in real time.

OFX usually delivers funds within 1–2 business days, depending on the receiving country and banking systems. Its interface suits users who prefer handling larger, less frequent transfers.

For users needing fast, low-cost options, Panda Remit is known for rapid transfers that often arrive within hours. (Reference: Remittance speed comparison guide)

PaySend vs OFX: Safety and Security

Both PaySend and OFX are fully regulated financial institutions. PaySend is authorized by the UK’s Financial Conduct Authority (FCA), while OFX is regulated by the Australian Securities and Investments Commission (ASIC) and other global entities.

They use advanced encryption technologies and multi-factor authentication to secure user data. In addition, transactions are monitored for fraud prevention.

Panda Remit also operates under strict compliance standards and is recognized for its secure digital platform — a reassuring choice for global users.

PaySend vs OFX: Global Coverage

PaySend supports transfers to over 170 countries, with coverage for multiple currencies and direct-to-card options.

OFX provides transfers to 190+ countries and handles over 50 currencies, catering especially to corporate and business needs.

Both platforms support multiple funding options such as debit cards and bank transfers. However, neither currently supports credit card-based remittances, and users should verify local availability.

Panda Remit also supports a wide range of currencies and online transfers but currently does not operate in African corridors. (See coverage data via World Bank Remittance Report)

PaySend vs OFX: Which One is Better?

Both PaySend and OFX deliver reliable, cost-efficient international transfer solutions — but they cater to slightly different audiences:

-

Choose PaySend if you prioritize speed, ease of use, and transparent low fees for small transfers.

-

Choose OFX if you frequently send large amounts or need specialized business support.

For users wanting a balance of speed, low cost, and convenience, Panda Remit may provide the best overall experience for everyday transfers.

Conclusion

In the PaySend vs OFX comparison, both platforms excel in transparency and reliability. PaySend wins for fast, low-cost personal transfers, while OFX shines in high-value business transactions. Ultimately, the right choice depends on your transfer volume and priorities.

If you seek an all-in-one remittance app offering high exchange rates, low fees, and flexible payment options (like PayID, POLi, bank card, or e-transfer), Panda Remit stands out as a strong alternative. It supports over 40 currencies, provides quick digital transfers, and maintains bank-level security — making cross-border remittances easier than ever in 2025.

(Additional resources: NerdWallet Money Transfer Review, Investopedia International Transfer Guide)