PaySend vs PayerMax: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-10 11:54:35.0 16

Introduction

Cross-border money transfers are crucial for individuals and businesses worldwide. Many users face challenges such as high fees, hidden charges, slow transfers, and complex interfaces. Comparing providers helps in finding the most cost-effective and convenient option. In this review, we examine PaySend vs PayerMax to determine which service is better for different user needs. As an alternative, PandaRemit provides a reputable option for global remittances. For more information on international money transfers, see Investopedia's money transfer guide.

PaySend vs PayerMax – Overview

PaySend, founded in 2012, offers digital remittance services with a focus on fast international transfers, card-to-card payments, and a user-friendly mobile app.

PayerMax, launched in 2017, targets freelancers, small businesses, and individuals needing flexible payment options. It offers multi-currency support, business account features, and competitive fees.

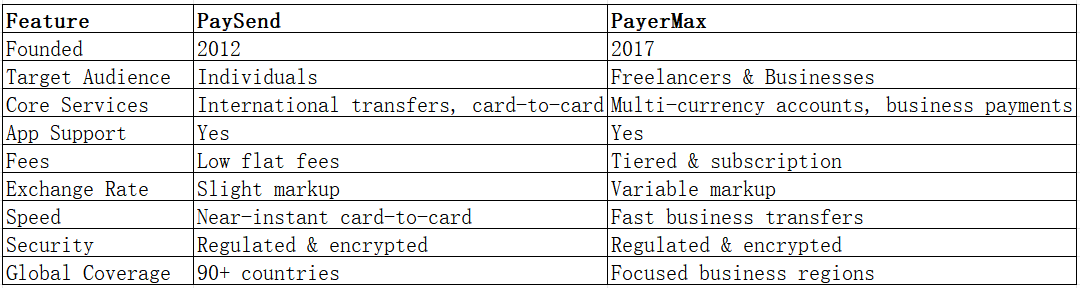

Comparison Table:

PandaRemit is also a reliable alternative for straightforward, cost-effective transfers.

PaySend vs PayerMax: Fees and Costs

PaySend offers low flat fees suitable for smaller personal transfers. Subscription options are minimal.

PayerMax uses a tiered structure, with lower fees for high-volume or business accounts.

For more details on fees, refer to NerdWallet’s transfer fee comparison. PandaRemit provides an alternative for lower-cost transfers.

PaySend vs PayerMax: Speed and Convenience

PaySend offers near-instant card-to-card transfers. The mobile app is intuitive and supports multiple currencies.

PayerMax supports fast business transfers with ACH and bank payouts. Its platform integrates with e-commerce tools for streamlined workflows.

For guidance on transfer speeds, see RemittanceAdvice. PandaRemit is known for fast, fully online transfers.

PaySend vs PayerMax: Safety and Security

Both PaySend and PayerMax are regulated, using encryption, fraud detection, and buyer protection.

PandaRemit is a licensed, secure option for global remittances.

PaySend vs PayerMax: Global Coverage

PaySend supports over 90 countries and multiple currencies, mainly via card-to-card transfers.

PayerMax focuses on business-friendly countries and multi-currency accounts.

For a wider view on global remittance, see the World Bank remittance coverage report.

PaySend vs PayerMax: Which One is Better?

PaySend is ideal for individuals needing instant, low-cost transfers, while PayerMax suits freelancers and small businesses requiring multi-currency accounts and integration tools.

For users prioritizing speed, simplicity, and low fees, PandaRemit offers a compelling alternative.

Conclusion

Comparing PaySend vs PayerMax highlights distinct strengths. PaySend excels in fast, affordable individual transfers, while PayerMax is tailored to business and multi-currency needs.

PandaRemit stands out as an alternative with:

-

Competitive exchange rates and low fees

-

Multiple payment methods including bank cards, POLi, PayID, and e-transfers

-

Support for over 40 currencies

-

Fast, all-online transfers

Explore PandaRemit on their official website. Additional resources on transfer efficiency and safety can be found at Investopedia and NerdWallet.

Evaluating PaySend vs PayerMax based on fees, speed, coverage, and security helps users select the right provider, while PandaRemit provides a convenient, reliable alternative for global transfers.