PaySend vs PingPong Payments: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-10 11:48:54.0 11

Introduction

Cross-border money transfers have become an essential service for individuals and businesses alike. Users often struggle with high fees, hidden charges, delayed transfers, and complicated user interfaces. Choosing the right provider can significantly impact cost, convenience, and security. In this comparison, we review PaySend vs PingPong Payments to help you decide which service suits your needs. For those seeking an alternative, PandaRemit also offers a reputable solution for global remittances. For a deeper understanding of international money transfer basics, see Investopedia's guide on money transfers.

PaySend vs PingPong Payments – Overview

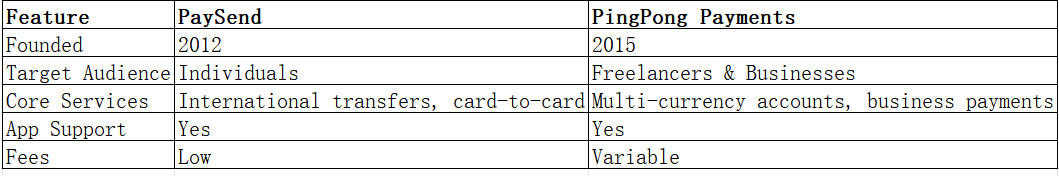

PaySend, founded in 2012, offers digital remittance and cross-border payment services to a wide user base. It focuses on quick international transfers, card-to-card payments, and mobile app integration.

PingPong Payments, established in 2015, targets freelancers, e-commerce sellers, and businesses needing international payment solutions. It offers competitive fees, multi-currency support, and business account services.

Similarities:

-

Both provide international money transfers.

-

Mobile apps available for seamless transactions.

-

Support debit card payouts.

Differences:

-

Fees and subscription models differ.

-

PaySend focuses more on individual users; PingPong Payments targets businesses.

-

PaySend emphasizes instant card-to-card transfers; PingPong supports broader currency accounts.

Quick Comparison Table:

PandaRemit also operates in this space as an alternative for cost-effective transfers.

PaySend vs PingPong Payments: Fees and Costs

PaySend generally charges low flat fees per transaction, making it suitable for smaller transfers. Subscription options are limited, focusing on pay-as-you-go transfers.

PingPong Payments has a tiered fee structure, with discounts for higher transfer volumes or business accounts.

Comparison Considerations:

-

Domestic vs international fees.

-

Monthly or subscription-based fees for business accounts.

-

Hidden charges for currency conversion.

For a detailed fee breakdown, see NerdWallet’s transfer fee comparison. PandaRemit can serve as a lower-cost alternative for users seeking minimal fees.

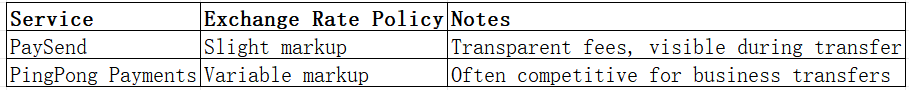

PaySend vs PingPong Payments: Exchange Rates

Both services apply markups on the mid-market rate, but the margin varies.

PandaRemit provides competitive rates for individual transfers and maintains transparency throughout the process.

PaySend vs PingPong Payments: Speed and Convenience

PaySend offers near-instant transfers for card-to-card payments. Its mobile app is intuitive, supporting multiple currencies.

PingPong Payments provides fast transfers for business accounts, including ACH and international bank payouts. Its platform integrates with e-commerce and accounting tools.

For guidance on transfer speeds, see RemittanceAdvice. PandaRemit is also known for quick and fully online transfers.

PaySend vs PingPong Payments: Safety and Security

Both PaySend and PingPong Payments are regulated financial services providers, employing encryption, fraud detection, and buyer protection measures.

PandaRemit is a licensed and secure option for cross-border payments, ensuring user funds are protected.

PaySend vs PingPong Payments: Global Coverage

PaySend supports transfers to over 90 countries and multiple currencies, mainly via card-to-card transfers.

PingPong Payments focuses on business-oriented countries with multi-currency account support.

For a broader view on global remittance coverage, see the World Bank remittance report.

PaySend vs PingPong Payments: Which One is Better?

Both services have strong offerings. PaySend excels in quick, low-cost individual transfers, while PingPong Payments suits businesses needing multi-currency accounts and integration capabilities.

For users prioritizing speed, low fees, and straightforward transfers, PandaRemit may offer better value and convenience.

Conclusion

When comparing PaySend vs PingPong Payments, PaySend is ideal for individuals who need instant, low-cost card-to-card transfers, whereas PingPong Payments benefits freelancers and e-commerce sellers with multi-currency accounts and business tools.

For users seeking a reliable alternative, PandaRemit stands out with:

-

Competitive exchange rates and low fees

-

Multiple payment options including bank cards, POLi, PayID, and e-transfers

-

Coverage of 40+ currencies

-

Fast, fully online transfer process

Learn more about PandaRemit on their official website. For additional tips on money transfer safety and efficiency, check Investopedia and NerdWallet.

In conclusion, evaluating PaySend vs PingPong Payments based on fees, speed, coverage, and security will help users select the best provider for their specific needs, while PandaRemit provides a flexible and efficient alternative for international transfers.