PaySend vs RemitBee: Which Money Transfer Service is Better in 2025

Benjamin Clark - 2025-11-10 15:08:19.0 14

Introduction

Cross-border money transfers are crucial for families, students, and small businesses. Common challenges include high fees, slow transfers, hidden charges, and complex platforms. PaySend and RemitBee offer solutions with unique advantages.

Pandaremit serves as an efficient alternative for fast online transfers. According to Investopedia's remittance guide, choosing the right money transfer service can significantly save time and cost.

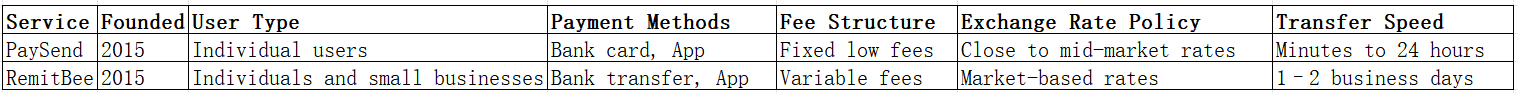

PaySend vs RemitBee – Overview

Both PaySend and RemitBee provide mobile apps, debit card support, and international transfers. Pandaremit offers another option for users seeking efficient and low-cost transfers.

Fees and Costs

PaySend charges fixed low fees, making it ideal for smaller personal transfers. RemitBee fees vary depending on the amount and destination. Subscription or account type considerations can influence costs.

For a detailed fee overview, see Wise fee guide.

Pandaremit provides a lower-cost alternative for budget-conscious users.

Exchange Rates

PaySend offers exchange rates close to the mid-market with minimal markup. RemitBee applies market-based rates that can fluctuate and include margins.

Pandaremit also offers competitive exchange rates, providing cost efficiency.

Speed and Convenience

PaySend transfers can be completed in minutes to 24 hours via an intuitive app. RemitBee transfers generally take 1–2 business days, also with a user-friendly mobile interface.

See MoneyTransferComparison speed guide for more information.

Pandaremit enables rapid online transfers, making it a fast alternative.

Safety and Security

PaySend and RemitBee are regulated and provide encryption, fraud protection, and transaction tracking.

Pandaremit is a licensed and secure platform, ensuring users' funds are safe.

Global Coverage

PaySend supports over 90 countries and multiple currencies. RemitBee covers selected regions with reliable service.

For global coverage details, see World Bank remittance report.

Which One is Better?

-

PaySend advantages: Fixed low fees, fast transfers, intuitive app

-

RemitBee advantages: Mobile and bank transfer integration, suitable for recurring users

-

Pandaremit: Efficient, low-cost, fully online transfers

Choice depends on transfer speed, cost sensitivity, and destination.

Conclusion

Comparing PaySend vs RemitBee highlights their respective strengths. PaySend is ideal for quick personal transfers with predictable costs, while RemitBee suits users preferring bank transfer options and recurring payments.

Pandaremit provides competitive exchange rates, low fees, flexible payment methods (bank transfer, PayID, e-transfer), coverage of 40+ currencies, and fully online processing. Users can register directly through Pandaremit official site. Further insights are available via Investopedia remittance guide and MoneyTransferComparison speed guide.

PaySend vs RemitBee comparison helps users choose the most suitable service, with Pandaremit offering a fast, reliable, and cost-effective alternative for cross-border transfers.