PaySend vs Revolut: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-10 10:14:31.0 22

Introduction

International money transfers are an essential part of global life—whether it’s sending money to family overseas, paying tuition fees, or managing expenses abroad. However, users often face high fees, slow delivery times, and hidden costs. That’s why choosing the right provider matters. In this comparison of PaySend vs Revolut, we’ll explore how these two fintech giants stack up in 2025 across key factors like fees, rates, and global reach.

For those seeking an even simpler and more cost-efficient option, Panda Remit is also gaining recognition for its transparent pricing and fast service. For a better understanding of how money transfers work, check out this guide on Investopedia.

PaySend vs Revolut – Overview

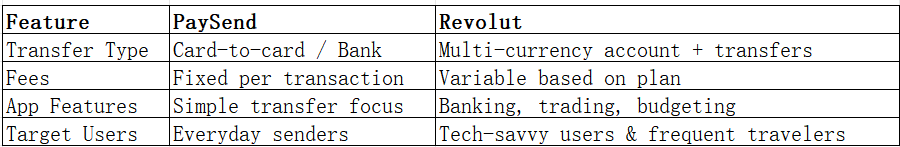

PaySend was founded in 2017 in the UK and focuses primarily on low-cost international card-to-card and account transfers. With millions of users across 170+ countries, it’s known for fixed-fee pricing and direct-to-card delivery.

Revolut, launched in 2015, began as a multi-currency banking app offering digital payments, currency exchange, and investment services. It now supports money transfers to 200+ countries, with both personal and business accounts.

Similarities

-

Both offer international money transfers.

-

Mobile apps available for iOS and Android.

-

Support for multiple currencies.

-

Real-time tracking and exchange rate transparency.

Key Differences

Panda Remit also competes in this space, offering fast, all-online transfers with a focus on simplicity and affordability.

PaySend vs Revolut: Fees and Costs

When comparing fees, PaySend is widely recognized for its transparent fixed fee (often around £1 or $2 per transaction), regardless of destination. This appeals to users who value predictability.

Revolut, on the other hand, has tiered pricing. Standard users may face small markups or transfer fees depending on the region, while Premium or Metal plan members often enjoy free or discounted transfers. However, hidden FX markups can apply outside standard currency pairs.

If minimizing costs is your top priority, Panda Remit typically provides lower overall fees and better rates for Asia-Pacific and Europe-bound remittances.

For more details on typical money transfer fees, refer to NerdWallet’s comparison guide.

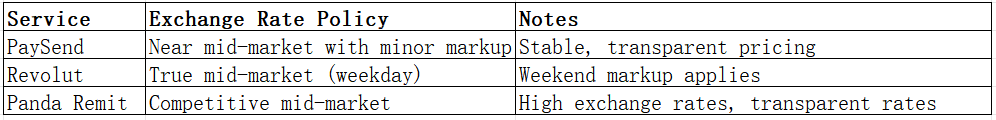

PaySend vs Revolut: Exchange Rates

Exchange rates can significantly affect how much your recipient actually gets. PaySend usually offers near mid-market rates but applies a small markup to cover operational costs. Revolut advertises mid-market rates during weekdays but applies weekend markups (often around 1%).

In many cases, Panda Remit provides consistently favorable rates, helping users maximize the amount received.

PaySend vs Revolut: Speed and Convenience

Transfer speed is crucial when you need to send money urgently. PaySend often delivers transfers within minutes—especially for card-to-card transactions. Revolut transfer times vary based on destination and receiving bank, ranging from a few hours to two business days.

Both platforms feature user-friendly mobile apps, transaction tracking, and instant notifications. Revolut’s app, however, is more feature-rich, with investment tools, crypto trading, and budgeting functions that may feel overwhelming for those focused solely on transfers.

If speed and simplicity are your priorities, Panda Remit offers quick online transfers with fast processing for many destinations.

For a general overview of remittance speed factors, you can check this remittance speed guide.

PaySend vs Revolut: Safety and Security

Both PaySend and Revolut are regulated by top-tier financial authorities in the UK and EU. PaySend is FCA-regulated, while Revolut holds banking licenses in several European countries. Both use advanced encryption, two-factor authentication, and fraud monitoring.

Users can generally trust both platforms for secure transactions. Likewise, Panda Remit is also a fully licensed and compliant service, using high-level encryption and anti-fraud systems to protect customer funds.

PaySend vs Revolut: Global Coverage

Coverage is a major deciding factor for users sending money abroad. PaySend supports over 170 countries, with strong networks in Europe, Asia, and the Americas. Revolut supports 200+ destinations and offers accounts in multiple currencies, making it ideal for global travelers.

However, both services have certain restrictions depending on local regulations and payment methods.

Panda Remit, meanwhile, offers coverage for over 40 currencies across Asia, Europe, North America, and Oceania. While it doesn’t yet operate in Africa and doesn’t support credit card remittances, it excels in the markets it serves.

You can explore broader remittance trends in the World Bank’s remittance coverage report.

PaySend vs Revolut: Which One is Better?

When choosing between PaySend vs Revolut, the answer depends on your needs:

-

Choose PaySend if you want predictable fees, simple transfers, and fast delivery.

-

Choose Revolut if you prefer an all-in-one financial app with spending analytics, savings, and investments.

Both are reliable, secure, and widely trusted. However, for users who prioritize low costs, high exchange rates, and ease of use, Panda Remit stands out as an attractive third option.

Conclusion

In summary, PaySend vs Revolut each have unique strengths. PaySend wins on fixed-fee simplicity and speed, while Revolut shines as a versatile digital banking platform. Yet, both can be outperformed by specialized money transfer services like Panda Remit for users seeking the best combination of affordability and efficiency.

Panda Remit offers:

-

Competitive exchange rates and low fees

-

Fast, online transfers

-

40+ supported currencies

-

Multiple payment options such as POLi, PayID, bank cards, and e-transfers

For a detailed look at how digital remittance platforms are reshaping the global money transfer market, check this overview on Forbes and Remitly’s guide to online transfers.

Ultimately, whether you choose PaySend, Revolut, or Panda Remit, understanding their fees, rates, and coverage ensures your money reaches its destination safely, quickly, and at the best possible value.