PaySend vs Skrill Money Transfer: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-10 15:31:37.0 15

Introduction

Cross-border money transfers are essential for families, freelancers, and businesses alike. However, users often face challenges like high fees, hidden exchange rate markups, and delayed delivery. PaySend and Skrill Money Transfer have emerged as two leading digital platforms that aim to simplify this process. Still, choosing the right one depends on cost, convenience, and trust.

According to Investopedia, factors like exchange rate transparency and transfer speed play a key role when comparing services. In this article, we’ll explore both brands in depth—and briefly introduce PandaRemit, a secure and competitive alternative in the digital remittance space.

PaySend vs Skrill Money Transfer – Overview

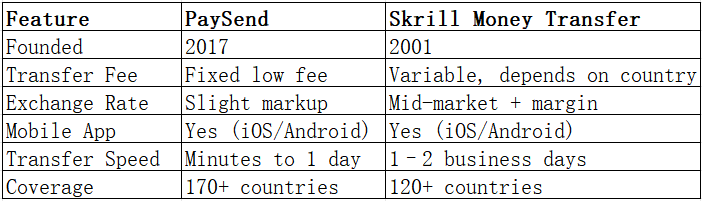

PaySend, founded in 2017 in the UK, is known for fixed-fee transfers and card-to-card payments. It supports more than 170 countries and offers an intuitive mobile app for quick transfers.

Skrill Money Transfer, launched in 2001 as part of Paysafe Group, allows users to send funds internationally via bank deposits, mobile wallets, and more. It’s recognized for its integration with online merchants and gaming platforms.

Similarities

-

Both support international transfers and have easy-to-use apps.

-

Offer debit/credit card and bank transfer funding options.

-

Provide multi-currency wallet features for users dealing in global markets.

Differences

-

PaySend focuses on simplicity with flat fees.

-

Skrill offers wider merchant integration but has variable fees and exchange rate margins.

-

PaySend targets casual users; Skrill appeals to traders and online business users.

PandaRemit is another reputable choice for users who value speed and transparent rates without complicated pricing.

Quick Comparison Table

PaySend vs Skrill Money Transfer: Fees and Costs

When sending money abroad, transaction fees can make a big difference. PaySend is known for its flat, transparent fee structure, usually around $1–$2 per transfer. Skrill, on the other hand, varies its fees depending on payment method, currency, and country—some transfers may appear fee-free but include an exchange rate markup.

For accurate cost comparisons, check resources like NerdWallet’s transfer fee guide. If you want predictable pricing, PaySend offers more transparency, while PandaRemit often provides competitive pricing with no hidden costs.

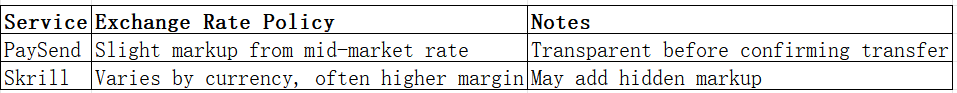

PaySend vs Skrill Money Transfer: Exchange Rates

Exchange rate margins directly affect the amount your recipient receives. PaySend typically applies a small markup on the mid-market rate, while Skrill may add a larger margin (sometimes up to 3.99%).

If you prioritize transparency and better rates, PandaRemit could be a worthwhile alternative.

PaySend vs Skrill Money Transfer: Speed and Convenience

PaySend’s biggest advantage is speed—many transactions arrive within minutes, especially card-to-card. Skrill generally delivers within 1–2 business days, depending on country and bank processing times.

Both offer user-friendly mobile apps, notifications, and tracking tools. For those seeking faster transfers, PandaRemit also focuses on rapid, real-time delivery supported by efficient processing systems.

External speed comparison studies such as Remitly’s transfer time guide confirm that digital-first remittance apps outperform traditional banks.

PaySend vs Skrill Money Transfer: Safety and Security

Security is paramount for international transfers. PaySend is regulated by the UK’s Financial Conduct Authority (FCA) and uses advanced encryption. Skrill, also regulated by the FCA, offers two-factor authentication and fraud monitoring.

Both are safe for cross-border transactions. PandaRemit is another licensed provider that emphasizes user protection through encryption and regulatory compliance.

PaySend vs Skrill Money Transfer: Global Coverage

PaySend supports over 170 countries, while Skrill covers around 120+. Both allow transfers to Asia, Europe, and Latin America. However, neither focuses heavily on Africa for outbound remittances.

For a broader perspective, the World Bank Remittance Data Portal provides insights into global coverage and remittance corridors.

PandaRemit also offers wide regional support, covering key Asian and global corridors, though it does not currently support credit card funding.

PaySend vs Skrill Money Transfer: Which One is Better?

Choosing between PaySend and Skrill depends on your needs. If you value simple fees and fast card-to-card transfers, PaySend is an excellent option. If you prioritize multi-purpose use, including online purchases and global wallet access, Skrill offers more versatility.

However, for users who want a balance of low fees, high transparency, and fast processing, PandaRemit is worth considering as an alternative digital remittance provider.

Conclusion

Both PaySend and Skrill Money Transfer deliver strong performance for international remittances in 2025. PaySend excels in simplicity and speed, while Skrill’s strength lies in its extensive integrations and wallet functions.

For users seeking a modern, user-friendly, and low-cost remittance service, PandaRemit stands out as a smart alternative. It offers:

-

Competitive exchange rates and low transfer fees

-

Flexible payment methods like PayID, POLi, bank card, and e-transfer

-

Coverage of over 40 global currencies

-

Quick, fully digital processing for faster delivery

Learn more at PandaRemit’s official site, and explore the latest remittance trends for 2025 before deciding which service fits your transfer needs best.