Paysend vs Starling Bank: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-10 10:41:23.0 15

Introduction

Cross-border money transfers have become essential for international students, remote workers, and families sending money abroad. However, users often face challenges such as high fees, slow delivery times, and confusing exchange rate markups. In 2025, digital platforms like Paysend and Starling Bank continue to simplify international remittances through user-friendly apps and transparent pricing. For users seeking low-cost, fast, and secure transfers, Panda Remit also emerges as a reputable alternative. According to Investopedia, comparing transfer fees and rates is key to saving money when sending funds overseas.

Paysend vs Starling Bank – Overview

Paysend, founded in 2017 in the UK, focuses primarily on global money transfers and card-to-card payments. It supports over 170 countries and emphasizes fixed low fees with instant delivery options.

Starling Bank, launched in 2014, is a UK-based digital challenger bank offering full banking services, including international transfers through partnerships. It’s popular among freelancers, travelers, and SMEs for its multi-currency accounts and app-based financial management.

Similarities: Both platforms provide mobile-first services, transparent interfaces, and debit card integrations. Users can send money abroad and manage their finances online without visiting physical branches.

Differences: Paysend targets users who primarily send funds overseas, while Starling focuses on broader banking solutions with built-in transfer capabilities. Paysend is generally cheaper for small, one-time transfers, whereas Starling offers more account features for daily financial use.

For users looking for an affordable alternative specialized in global remittances, Panda Remit provides another modern and efficient option in the market.

Paysend vs Starling Bank: Fees and Costs

Fees are one of the biggest deciding factors for international transfers. Paysend typically charges a fixed, low transfer fee (around £1 or €1.5) for many routes, making it predictable and cost-efficient. Starling Bank, on the other hand, doesn’t charge its own markup but passes on Wise’s fees for foreign transfers, which vary depending on destination and amount.

For domestic transactions, both offer free or low-cost options. However, international transfers through Starling can be more expensive if Wise’s fees and exchange rate margins are included.

According to NerdWallet, comparing total cost (fees + exchange rate margin) gives a clearer picture of what users actually pay. Panda Remit, often known for its low fees, can be a cheaper option in many corridors for overseas remittances.

Paysend vs Starling Bank: Exchange Rates

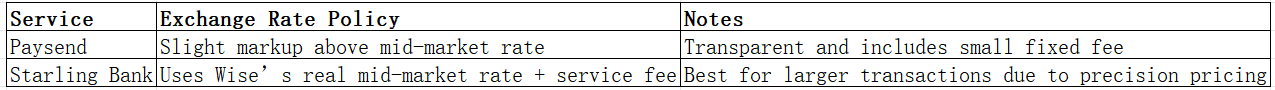

Exchange rate transparency is vital when transferring money abroad. Paysend generally offers competitive rates with small markups over the mid-market rate, while Starling relies on Wise’s real-time mid-market rates with a small service fee.

Below is a comparison table summarizing how Paysend and Starling Bank handle exchange rates:

Panda Remit also provides favorable rates close to the mid-market rate, helping users maximize the value of their remittances without hidden charges.

Paysend vs Starling Bank: Speed and Convenience

Transfer speed and usability are crucial for modern users. Paysend offers near-instant transfers for card-to-card transactions, especially within Europe and Asia. Starling Bank’s transfer times depend on Wise’s processing network—usually taking from a few minutes to one business day.

In terms of app usability, both Paysend and Starling provide intuitive mobile interfaces. Starling’s app includes additional banking tools like savings spaces and spending insights, while Paysend focuses on simplicity and fast transactions.

For users valuing both speed and convenience, Panda Remit provides an app-based experience with efficient processing and a simple transfer flow. See Remittance Speed Guide for benchmarks on typical delivery times across providers.

Paysend vs Starling Bank: Safety and Security

Both Paysend and Starling Bank are fully licensed and regulated in the UK by the Financial Conduct Authority (FCA). Paysend uses encryption and strong verification measures to safeguard transactions, while Starling, as a licensed bank, ensures funds are protected under the Financial Services Compensation Scheme (FSCS).

Panda Remit is also a licensed remittance platform, applying robust security and data protection standards to ensure safe and reliable international transfers.

Paysend vs Starling Bank: Global Coverage

Paysend supports over 170 countries and 40+ currencies, making it one of the most globally accessible fintech transfer services. Starling Bank, though primarily UK-based, enables transfers to more than 35 currencies via its Wise integration.

Both platforms are best suited for users sending money to Europe, Asia, and the Americas. Neither focuses heavily on African corridors, which aligns with Panda Remit’s supported regions as well.

For a global overview of remittance coverage, the World Bank Remittance Report provides useful insights.

Paysend vs Starling Bank: Which One is Better?

When comparing Paysend vs Starling Bank, the decision depends on the user’s priorities:

-

Paysend is ideal for individuals sending small, frequent international transfers who value low fixed fees and speed.

-

Starling Bank suits users seeking a full-service digital bank with integrated transfer options, better for managing finances and saving.

For users focused on pure remittance needs, Panda Remit often delivers greater value through competitive rates, fast delivery, and a dedicated transfer ecosystem.

Conclusion

In conclusion, both Paysend and Starling Bank offer excellent digital experiences for cross-border payments in 2025. Paysend stands out for its simplicity, speed, and predictable low fees, while Starling Bank appeals to users wanting a comprehensive mobile banking solution with integrated transfers.

However, for those seeking a specialized, affordable, and secure international money transfer option, Panda Remit deserves attention. With high exchange rates, low fees, flexible payment options such as POLi, PayID, bank card, and e-transfer, and support for 40+ currencies, Panda Remit provides fast and reliable transfers entirely online.

To learn more about global remittance trends and cost-saving options, refer to NerdWallet’s money transfer guide and Investopedia’s remittance overview.